Australiaâs banking sector constitutes a substantial part of its financial system governed by a strong regulatory regime. It is one of the largest contributors to the national GDP, contributing around $ 140 billion over the last year.

According to the World Economic Forum Financial Development Index of 2012, Australia was esteemed as one of the best performing financial centres globally, owing to sectorâs soundness and robustness of financial intermediation.

Australian banking sector has seen volatility recently amidst Haynes Royal Commission Report into Misconduct in the Banking, interest rate changes and APRAâs proposal to scrap the 7% mortgage serviceability assessment floor.

Let us take a close look at three Australian banking stock with large market capitalisations and positive return yields.

CYBG PLC

CYBG PLC (ASX:CYB), headquartered in the United Kingdom, is a banking group comprising Clydesdale Bank, Yorkshire Bank, Virgin Money and the digital banking platform B, that together offer commercial banking services like loans, insurance, financial planning, investment management, cash management accounts, credit cards, mortgage and others for retail and institutional customers.

The Groupâs market cap stands at ~ AUD 4.83 billion with 1.43 billion outstanding shares. Today, on 20 June 2019, the CYB stock settle the dayâs trading at AUD 3.610, edging up 7.122%. In addition, CYBâs YTD return also stands positive at 3.37%.

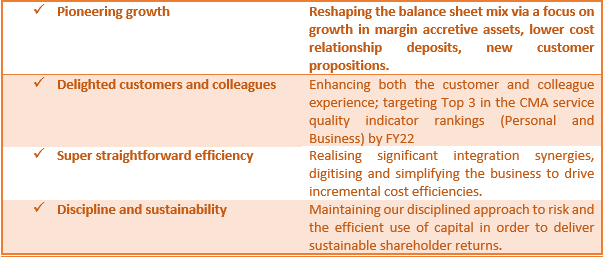

Strategy Update- Recently on 19 June 2019, CYBG released its refreshed strategy and updated medium-term strategic and financial targets that it aims to deliver to disrupt the status quo in UK banking. The strategy is built on four new strategic pillars that would be used to deliver increased shareholder value as listed below.

By mid-October 2018, the Group announced to have acquired all the equity stake in Virgin Money. The Group plans to compete the full integration of Virgin Money to build a simplified, efficient and digitised business, and offer an outstanding customer experience. This would be achieved after FSMA Part VII approval, required to enable the application of the Virgin Money brand across the Group, will be received by the end of October 2019.

The Group will be re-named Virgin Money UK PLC by the end of 2019 and begin the re-launch of the Virgin Money brand and re-branding of the business in late 2019. CYBG is also commencing a new Transformation Programme to realise significant opportunities to digitise and simplify the internal processes.

Three new business divisions have been created including Business, Personal and Mortgages.

The new Group would combine the ethos of Virgin, i.e., its distinctive and brilliant customer experience, with CYBGâs technology, product expertise and know-how.

It has set some clear medium-term financial targets listed below.

| Medium-Term Financial Targets | |

| Reaffirmed 2019 guidance of 165-170bps NIM and < GBP 950 mn underlying costs | 30 bps cost of risk through FY22 |

| GBP 200 mn of net cost savings by FY22 | Above system asset growth |

| Operating costs < GBP 780 mn by FY22 | Targeting c.13% CET1 capital ratio |

| Strong growth in relationship deposits | Statutory RoTE of > 12% by FY22 |

| Progressive and sustainable ordinary dividend with c.50% pay-out ratio over time | >100bps of excess CET1 capital generation per annum by FY22 |

Bank of Queensland Limited

Bank of Queensland Limited (ASX:BOQ), based in Brisbane, Australia, is a full-stack financial services provider which operates business banking centers, retail branches, and also equipment finance centers across various locations in New Zealand and Australia. The Bank also operates an ATM network throughout Australia.

Bank of Queenslandâs market cap stands at around AUD 3.9 billion and it has 405.78 million shares outstanding on the ASX. Today on 20 June 2019, the BOQ stock closed the market trading session at AUD 9.580, down 0.42%, by AUD 0.208 with a total of ~1.8 million shares traded until the end.

Besides, BOQ has delivered positive return yields of 4.28% for the last one month and 2.92% over the past three months. The Bank also an annual dividend yield of 7.5% to date (as per ASX).

Leadership changes- Today (20 June 2019), Bank of Queensland has announced the stakeholders about the resignation of its Chief Financial Officer, Matt Baxby who would work with the Bank until the full year results are released in October 2019. The remaining tenure would ensure that the transition is smooth following the commencement of Managing Director & CEO, George Frazis due to occur in September 2019. A comprehensive search for Mr Baxbyâs replacement will be conducted. Mr Baxbyâs notice period ends 31 December 2019.

Previously on 29 May 2019, the Group also announced that Roger Davis had retired as the Chairman and would also stay until October 2019. Patrick Allaway has been appointed as Chairman Elect. Patrick Allaway joined the Board on 1 May 2019 with an extensive prior experience in the financial, real estate, media and retail sectors.

Financial Performance- BOQ recently paid an ordinary fully paid dividend (fully franked) of AUD 0.34 to its shareholders with respect to the six months for the period ended 28 February 2019, with a DRP price of A$8.77730.

The financial results for the first half-year to 28 February 2019 were released in April 2019. Th Group reported cash earnings after tax of around $ 167 million, down 8% and the statutory net profit after tax also decreased by 10 % to $ 156 million.

Source: 2019 Half-Year Results Presentation

Basic cash earnings per share was also down 10 % to 41.8 cents per share. The dividend of AUD 0.34 pertaining to the first half of 2019 depicts a decline of 4 cents per share and essentially reflects the challenging revenue and cost environment that the Bank and the whole industry is currently facing.

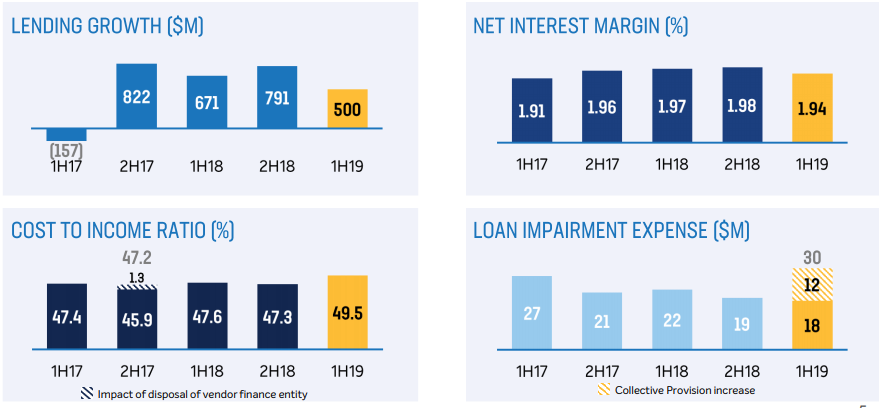

The Net Interest Margin recorded a dip of 3 basis points to 1.94% while the Cost to Income ratio edged up 190 bps to 49.5%.

There was a 2% increase in the Operating Expenses and the Loan Impairment Expense amounted to $ 30 million or 13 basis points of gross loans. The Common Equity Tier 1 (CET1) capital ratio was posted at 9.26%.

Source: 2019 Half-Year Results Presentation

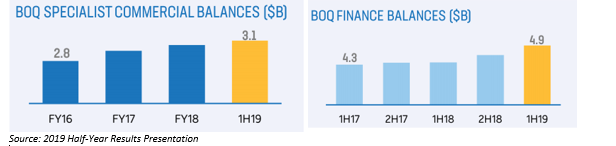

Overall, the BOQ business delivered solid growth including the Total Loan growth of $ 756 million or 8% annualised, growth in BOQ Specialist & BOQ Finance demonstrating working of niche strategy and a focus on quality and return for risk.

Source: 2019 Half-Year Results Presentation

MyState Limited

MyState Limited (ASX:MYS) is a non-operating holding company of the diversified financial services Group, established in 2009 and based in Hobart, Australia, consisting of MyState Bank and Tasmanian Perpetual Trustees, an asset management and trustee services company. MyState Bank is regulated by the Australian Prudential Regulatory Authority.

With a market capitalisation of ~ AUD 409.68 million and around 91.04 million shares outstanding, the MYS stock is trading today (20 June 2019) at AUD 4.470, down 0.67%.

In addition, the MYS stock has delivered a three-month return of 3.69% and a one-month return of 6.13%. MyState Bank also has an annual dividend yield of 6.39% to date (As per ASX).

Acquisition update- Fiducian Group Limited (ASX:FID) is seeking to acquire MyStateâs retail financial planning business in Tasmania for $ 3.5 million.My State financial planning client book has $ 340 million in funds under advice. The company is expecting NPAT neutral deal to be competed before the month end.

Fiducian is a leading national financial services company with more than $ 2.7 billion funds under advice and 40 practices nationally.

According to Melos Sulicich, MyState Limited Managing Director and CEO, the above strategic move would allow for the Group to simplify its business and focus on investments for growth in the areas where it has a competitive advantage.

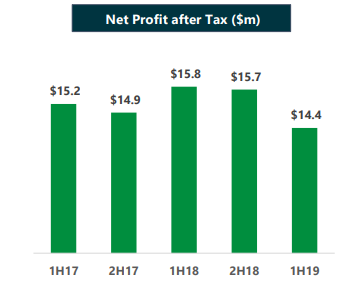

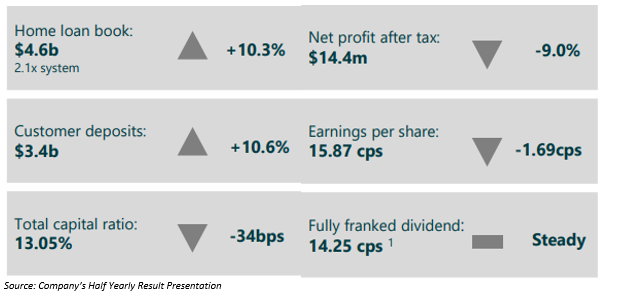

Financial Results- The Group released its results for the half-year ended 31 December 2018 (1H FY19), reporting that the net profit after tax for 1H FY19 was $ 14.4 million compared with $ 15.8 million in the prior corresponding period (pcp). Also, the half year result for the Group was largely driven by a decreasing net interest margin (NIM), which declined 21bps on the pcp.

Source: Companyâs Half Yearly Report and Accounts

Although NIM experienced a decline, the banking business achieved a loan book growth of around 2 times system (10.3%), i.e., the loan book grew $ 189.261 million during 1H19 compared with growth of $ 46.107 million in the pcp. There was also a strong customer deposit growth supported by digital platform and product innovation.

Source: Companyâs Half Yearly Result Presentation

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.