Marijuana stocks or pot stocks are catching investorsâ eyes these days after the legalisation of cannabis for medicinal and recreational use in many countries. According to the Australian health department, all the cannabis formulations such as tinctures, oils and some other extracts, which have therapeutic applications come under âmedicinal cannabis productsâ. In Australia, there are various companies in the cannabis space that have started the manufacturing and export of medicinal cannabis products.

The key medicinal use of cannabis is to reduce chronic pain and muscle spasm, and numerous cannabis players are conducting clinical trials to identify other treatment benefits. Tetrahydrocannabinol (THC) and cannabidiol (CBD) are the two main active components of cannabis that are currently in research, and there are some other components which could be the focus of research in upcoming years. The cannabis sector is growing enormously, and it seems that pot stocks could be an excellent future for the investors to put their money on.

Letâs zoom the lens on five ASX listed pot stocks in detail.

Althea Group Holdings Limited (ASX:AGH)

Australian headquartered pharmaceutical company Althea Group Holdings Limited (ASX:AGH), founded in 2017, is a licensed producer, supplier and exporter of medical cannabis products. The company currently exports in regulated medicinal cannabis markets which include the Australian and the United Kingdom markets. Althea has plans to expand into emerging markets by entering the Asian and European regions.

New Full-Spectrum CBD Product

In an ASX announcement on 28 October 2019, Althea unveiled the launch of its new product CBD100, a highly concentrated cannabidiol (CBD) oral oil product. AGHâs new product CBD100 is a full spectrum cannabis-derived extract oral oil, which is primarily comprised of CBD and small amounts of flavonoids, terpenoid and other cannabinoids. The new CBD oil has less than 1mg per ml of tetrahydrocannabinol (THC), and this is the most highly concentrated CBD oil provided by the company.

- Full-spectrum cannabinoid profile of Altheaâs CBD100 provides a competitive advantage in the market.

- AGH expects that the patient growth rate will increase after this launch.

- CBD100 is manufactured in Australia and is a Good Manufacturing Practice (GMP) certified product.

- The product is ready for export to international markets.

Annual General Meeting (AGM)

The companyâs 2019 AGM is scheduled on 27 November 2019 in Melbourne, Australia. The agenda of this meeting is the discussion of financial reports along with some resolutions.

Stock Performance

The companyâs stock was trading at $0.420 on 07 November 2019 (AEST 01:32 PM) with a market cap of approximately $97.99 million and approx. 233.31 million outstanding shares. The stock has delivered a positive return of 58.49% on a YTD basis.

AusCann Group Holdings Limited (ASX:AC8)

Australian headquartered leading medical cannabis company AusCann Group Holdings Limited (ASX:AC8), which was formerly known as TW Holdings Limited, is into the cultivation and distribution of medical cannabis.

New Board Appointment

The company recently announced a new appointment to the Board, with Mr Christopher Mews joining as a Non-Executive Director of AusCann from 1 December 2019. Mr Mews has more than 20 years of experience in the financial services sector.

Key Highlights FY2019 (ended on 30 June 2019)

- New in-house Product Development facility-

AusCann invested in product development capabilities by purchasing a 7,300 square metres R&D site in Perth, Australia. This facility was fully funded from the companyâs existing cash reserves and was valued at $5.25 million.

- Chilean operation-

The (50:50) joint venture DayaCann of AusCann with Fundación Daya in Chile signed a non-binding MoU with Khiron Life Sciences Corp, a Canadian-listed medical cannabis entity. This MoU led to the beginning of DayaCannâs first cannabis cultivation activity with Khiron. Under this MoU, DayaCann will supply high-quality cannabinoid medicines to Khiron, which will provide a fund amounting $1.67 million to support the development of these activities.

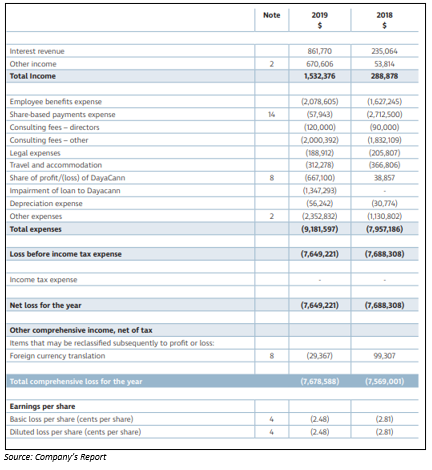

- Financial Highlights-

- In FY2019, the company generated a total income of $1,532,376.

- The interest revenue of the company for FY2019 stood at $861,770.

Stock Performance

The companyâs stock was trading at $0.270 on 07 November 2019 (AEST 01:46 PM), down 5.263%, with a market cap of nearly $90.36 million and approx. 317.05 million outstanding shares. The stock has a 52 weeks high price of $0.860 and a 52 weeks low price of $0.265. The YTD return of the stock stood at -54.76%.

Cann Group Limited (ASX:CAN)

Victoria based industry leader Cann Group Limited (ASX:CAN) is engaged in breeding and cultivation of medicinal cannabis. The company has its research and cultivation facilities in Melbourne and manufactures medicinal cannabis products for sale & use in Australia and export purpose. The company has licenses for research and cultivation of medical cannabis, which were issued in 2017. CAN is scheduled to hold 2019 AGM on Friday, 29 November 2019 in Melbourne, Australia.

NDA with Symbion

On 7 November 2019, the company rolled out a range of imported medicinal cannabis products for supply to approved Special Access Scheme (SAS) patients. CAN executed a distribution agreement with Symbion Pty Ltd, which will carry the companyâs full range of imported products for supply to the patients.

Moreover, the company has secured the first shipment of a high THC oil formulation, imported from strategic partner Aurora Cannabis in Canada.

Highlights for the quarter ended on 30 September 2019

- CAN finalised the design for a greenhouse facility in the Mildura facility, with which the facilityâs annualised production capacity will increase by 40% to 70,000kg of dry flower per annum.

- The estimated completion to occur in Q4 CY2020.

- The expected annual revenue from its new increased capacity is ~$220 million to $280 million.

- The company secured licenses for its existing facilities.

Financial highlights for Q319

- Net cash outflow in operating activities stood at $547 million.

- Net cash outflow in investing activities reached $665 million.

- The companyâs cash on hand at the end of the quarter was $261 million.

Stock Performance

The companyâs stock was trading at $1.015 on 07 November 2019 (AEST 01:59 PM), up 0.495% with a market cap of approximately $143.29 million and ~ 141.87 million outstanding shares. The YTD return of the stock stood at -49.50%.

ASX listed biotechnology company Ecofibre Limited (ASX:EOF) produces and sells products derived from hemp to both retailers and consumers in Australia and the United States. Ecofibre manufactures nutraceuticals and cannabinoid oil; nutraceutical products are for human and pet consumption. EOF, in partnership with Thomas Jefferson University (TJU), is also engaged in the development of new hemp-based products in the US.

NASDAQ International Designation

In an ASX update, Ecofibre announced that the company entered the NASDAQ International Designation program. EOFBF will be the symbol of Ecofibre in the over the counter program, which is specially designed for non-US companies to provide more visibility to the United States investors.

Financial Highlights (for year ended on 30 June 2019) - The company generated revenue of $35.6 million for FY2019, which was up 519% as compared to the last fiscal year.

Stock Performance

The companyâs stock was trading at $3.400 on 07 November 2019 (AEST 02:05 PM), with a market cap of $1.07 billion and approx. 314.96 million outstanding shares. The stock has a 52 weeks high price of $3.700 and a 52 weeks low price of $1.450. The last six-month return of the stock is 70%.

Elixinol Global Limited (ASX:EXL)

ASX listed company Elixinol Global Limited (ASX:EXL) is engaged in CBD oil manufacturing for medical cannabis industry. Elixinolâs business includes- Elixinol LLC, Hemp Foods Australia Pty Ltd and Nunyara Pharma Pty Ltd.

Key Highlights - Q3 FY2019 (ended 30 September 2019)

- In July 2019, the company unveiled about its partnership with PharmaCare for developing a CBD capsule, which will be sold under the Naturopathica brand.

- Exclusive CBD supply agreement with Pet Releaf- The company signed a manufacturing and supply agreement with Pet Releaf, which is a market-leading brand for hemp-derived CBD oils for pets.

- Distribution Agreements- Elixinol Europe signed exclusive distribution agreements for the sale of its branded products across various retail channels in Belgium, Luxembourg and Finland.

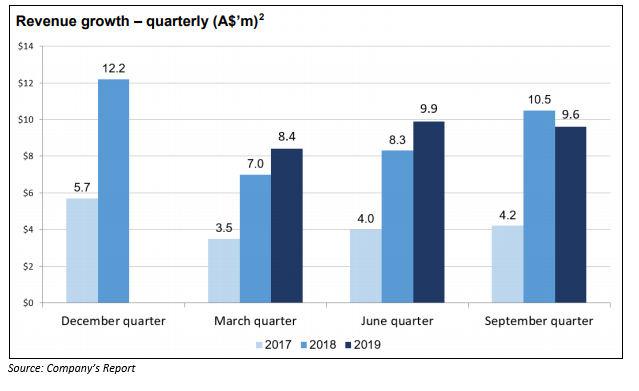

- In the third quarter of FY2019, the company generated group revenue of $9.6 million.

- A decline of 3% from the prior sequential period Q2 FY2019 ($9.9 million)

- A decline of 9% from corresponding prior period Q3 FY2018 ($10.5 million)

Stock Performance

The companyâs stock was trading at $1.485 on 07 November 2019 (AEST 02:19 PM), down 1% with a market capitalisation of nearly $206.84 million. The stock has a 52 weeks high price of $5.930 and a 52 weeks low price of $1.465. The YTD return of the stock stands at -44.24%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.