Fixed income exchange-traded funds (ETFs) are popular among investors who seek slightly riskier products with a more reliable income stream. In fact, factoring in the June interest rate cut and further expected rate cuts by the end of the year by the Reserve Bank of Australia, more investors are considering shifting to fixed income ETFs, recognising their benefits like liquidity, diversification, transparency and low cost.

According to data from the ASX, the Australian FUM (funds under management) in fixed-income ETFs inched over 30% to reach $ 10.4 billion in the five months as on 31 May 2019. Moreover, several market reports suggest that in 2019 so far, fixed income ETFs have received significantly more attention than ever before. It is also the number one category for flows in the industry, so far in the year.

In this piece of article, we will understand what exactly fixed income ETFs are, in addition to their advantages and disadvantages and a shed some light on some of the fixed income ETFs listed on the Australian Securities Exchange (ASX).

What is a fixed income ETF (Exchange-Traded Fund)?

As a special type of ETF, fixed income ETFs (exchange-traded funds) seek to track the performance of a specific bond market index. Fixed Income ETFs, which are traded on major stock exchanges just like regular stocks all day during trading hours, invest in the portfolio of fixed-income securities such as bonds and preferred stocks. They give access to a basket of government and higher-yielding corporate bonds. They are a very good investment option for those who seek an income stream from a diversified set of fixed-income securities. Moreover, fixed income exchange-traded funds generally trade on organised exchanges.

Fixed income ETFs generally distribute the dividends and income earned by the portfolio to the investors in the fund at a quarterly, half-yearly or annually basis.

Who invests in fixed income ETFs?

Institutional buyers such as insurance companies, asset managers, hedge funds, sovereign wealth funds and pensions are the major users of fixed income ETFs. Investors with long-term goals and who seek equity without taking too much risk generally prefer fixed income exchange-traded funds. Thus, investing in this asset class is often considered as defensive.

Fixed Income ETFs â Pros and Cons

Advantages: There are number of advantages associated with fixed income exchange-traded funds. The main benefit is that they have lower risk than stocks, as a result they are less volatile. Moreover, they are easy to track and trade. Below are some of the major factors owing to which income-hungry investors turn to fixed income ETFs.

- Low Cost: As a major portion of the investment in this ETF is directed towards income generation, they have low-cost of investment.

- Greater Diversification: Fixed income ETFs are generally designed to track the performance of a portfolio of bonds that means they offer diversified exposure to various sectors, thereby reducing the risk associated with an exposure to the performance of a single bond.

- Flexibility: They can be bought or sold any time during the trading hours on the Australian Securities Exchange unlike term deposits, which are also referred to as fixed-terms deposits, as in the latter type of investment, funds can also be withdrawn once the investment matures in order to avoid a penalty.

- They offer tax efficiency:

- Fixed income ETFs give the transparency of pricing and holdings.

Disadvantages: With pros, comes cons. Following are some of the factors that make fixed income ETFs less attractive, as they may lead to a loss of income or give different returns.

- Default risk: Bonds that are issued by the Australian government and state governments have a low credit risk than other fixed income securities. Credit risk is defined as the risk of non-payment of principal and interest by the bond issuer. Generally, fixed income ETFs with lower credit ratings give higher interest rates to cover the additional risk.

- Interest rate changes: Any change in interest rates can impact the income generated by the fixed income ETFs. While an increase in interest rate can pull down the bond price, a decline in interest rate can result in a fall in the income for the fund.

- Liquidity risk: This kind of the risk refers to a situation under which an investor is compelled to sell a security at a loss or buy at higher price, as he/she fails to find a buyer or seller, respectively.

- Distribution risk: There is no guarantee that an exchange traded fund will make a distribution payment.

- Inflation risk: There are chances that the value of principal and interest payments get reduced, if inflation is higher than expected if an investor has to wait for a longer period to receive the principal amount.

Some of the common brand names under which fixed income ETFs are listed on the ASX include iShares, Vanguard International and SPDR S&P/ASX. Let us now have a look at some of the fixed income ETFs that are listed on the Australian Securities Exchange (ASX).

- SPDR S&P/ASX Australian Bond Fund (ASX:BOND)

A Brief Look: Listed on ASX in July 2012 under the symbol âBONDâ, SPDR S&P/ASX Australian Bond Fund offers investment returns by closely tracking the performance of the S&P/ASX Australian Fixed Interest Index. It has a management cost of 0.24%, with a quarterly distribution frequency. The ETF is designed to provide portfolios with correct tracking, low portfolio turnover and lower cost. Its investment manager is State Street Global Advisors, Australia, Limited. As of 01 July 2019, it has $ 50.11 million in funds under management and NAV is $ 27.56.

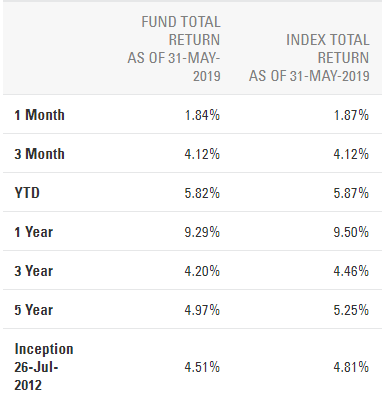

Fund Performance (Source: Companyâs Website)

ETF Performance: On 2 July 2019, the BOND was priced at $ 27.630 on ASX and trading down by 0.036% (AEST: 2:37 PM). The 52-week high and low of the ETF is $ 27.800 and $ 25.570, respectively. It has provided a YTD return of 5.70%.

- iShares Core Composite Bond ETF (ASX: IAF)

A Brief Look: An exchange-traded fund with focus on fixed income asset class, iShares CORE Composite Bond ETF was officially listed on ASX in March 2012 and trading under the symbol IAF. Located in Melbourne, the ETF invests primarily in investment grade fixed income securities that are issued by the government of Australia, state governments, corporate entities, and supranational and sovereign agencies.

ETF Performance: On 2 July 2019, the IAF was priced at $ 113.710 on ASX and trading up by 0.053% (AEST: 2:37 PM). The 52-week high and low of the ETF is $ 114.700 and $ 105.800, respectively. It has provided a YTD return of 4.31%.

- Vanguard Australian Government Bond Index ETF (ASX:VGB)

A Brief Look: Founded in April 2012, Vanguard Australian Government Bond Index ETF aims to match the returns of the Bloomberg AusBond Govt 0+ Yr Index before tax, expenses and fees. The returns include income and capital appreciation. It invests in a diversified portfolio of securities including high-quality, income-generating securities that are issued by the Australian government, state governments and treasury corporations. VGB has an annual management fee of 0.20% and an AUM of $ 265.57 million as at 31 May 2019.

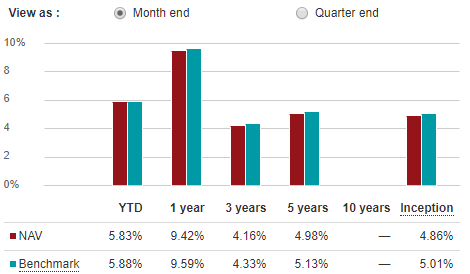

The below image depicts the ETFâs NAV and benchmark, as of 31 May 2019:

Source: ETF Website

ETF Performance: On 2 July 2019, the VGB was priced at $ 52.740 on ASX and trading up by 0.038%. The 52-week high and low of the ETF is $ 53.300 and $ 48.700, respectively. It has provided a YTD return of 5.57%.

- Russell Investments Australian Select Corporate Bond ETF (ASX:RCB)

A Brief Look: Russell Investments Australian Select Corporate Bond ETF, listed on ASX on 13 March 2012, is focused on providing total return consistent with the DBIQ 0-4 year Investment Grade Australian Corporate Bond Index over the long term, before costs and tax. Russell Investment Management Ltd. manages the ETF, which invests in the fixed-rate, corporate bonds dominated by the Australian dollar.

ETF Performance: On 2 July 2019, the RCB was priced at $ 20.540 on ASX and is trading down by 0.194%. The 52-week high and low of the ETF is $ 21.110 and $ 19.970, respectively. It has provided a YTD return of 1.68%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.