In this article, we would discuss the two stocks engaged in the exploration & production of gold in Australia. These two stocks constitute to S&P/ASX 300, S&P/ASX 300 Metals and Mining (Industry) and more indices. On 7 August 2019, the S&P/ASX 300 Metals and Mining (Industry) was trading at 4,374.6, up by 103. points or 0.24% (at 12:51 PM AEST).

10 Year Performance S&P/ASX 300 Metals and Mining (Industry)

Ramelius Resources Limited (ASX: RMS)

On 6 August 2019, the company forwarded an announcement made by Rumble Resources Ltd (ASX: RTR) with regards to acquire 100% of the Western Queen Gold Project from Ramelius. Accordingly, Rumble had executed a binding option agreement with Ramelius Resources to acquire 100% of the Western Queen Gold Project.

Key Commercial Terms: Reportedly, Rumble would pay A$50k cash for a nine month option and spend a minimum of A$200k on exploration expenditure within nine months. Besides, Rumble could choose to pay an additional A$50k for a further nine month option period, and during the extended period, it would be required to keep the project in good standing.

Further, Rumble could choose to pay A$100k in shares or cash to exercise the option to purchase 100% of the project, and this could be undertaken at any time prior to the expiry of either option. Additionally, following the completion of option periods and minimum expenditure along with the good standing position of the project, Rumble could leave the agreement without any further obligation except customary representations, warranties and indemnities.

Also, on 5 August 2019, Ramelius Resources presented at the Diggers and Dealers. Accordingly, the company had showcased its projects and key metrics. The company has five projects, Mt Magnet Gold Mine & Edna May Gold Mine are the production centres while Vivien Gold Mine, Marda Gold Project & Tampa Hill Gold are mine development projects. As on June 30, 2018, the company had mineral resources of 3.476Moz, total ore reserves of 0.698Moz, and the FY2020 guidance of producing 205-225koz at an AISC in the range of A$1,225 â 1,325/oz.

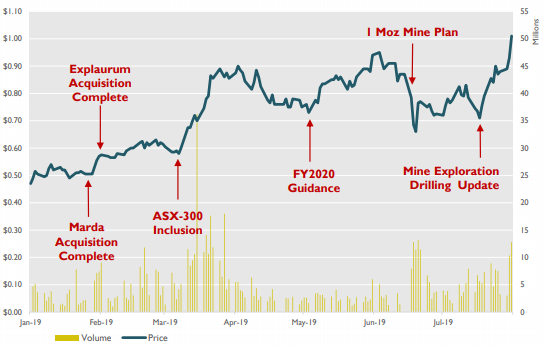

Share Price Performance (Source: Diggers and Dealers Presentation, August 2019)

2019 Outlook: In August, the company would report earnings results for FY2019, including any dividends. It also anticipated permitting & commencement of the Marda Project. In September, the company would release the Annual Resources & Reserve Statement, and Vivien extension resource modelling results. Further, in October, the company would deliver the 2019 Annual Report and September 2019 Quarterly Report. By December, the company is targeting the approval for Greenfinch project, and Tampia decision-to-mine.

Strategic Focus: On Operational Excellence front, the company would focus on achieving guidance while controlling costs. It would ensure new developments and deliver the best possible returns. On High-Impact Exploration front, Ramelius has an exploration budget of A$20 million for Mt Magnet & Edna May, and it intends to explore additional opportunities around the production centres.

On Strategic Acquisitions front, the company would assess strategic acquisition opportunities to deliver step change, and it is well placed to quickly execute the transactions. On Shareholder Returns front, the company is following a disciplined approach to capital management, and it has established a dividend policy to emphasise on the shareholder return focus.

On 7 August 2019, RMSâ stock was trading at A$1.29, up by 7.5% (at AEST 12: 39 PM).

Dacian Gold Limited (ASX: DCN)

On 5 August 2019, the company announced further strong drilling results validating a high-grade discovery below the historic Morgans North open pit at its Mount Morgans gold operation near Laverton in WA.

Reportedly, the new discovery is interpreted to be hosted by a previously unrecognised branded-iron-formation unit, which lies in the footwall of the BIF units that had been mined during the historical (1990s) Morgans North open pit.

Besides, the results have been validating the potential for significant increases in Mineral Resources and mine life, and DCN have been accelerating work to complete a maiden Mineral Resource for this new discovery by the end of September quarter.

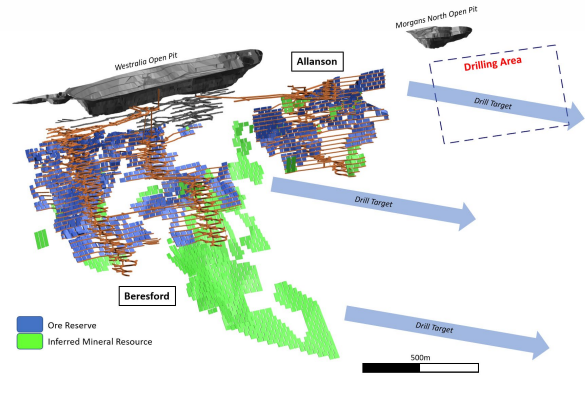

New Drill Intersections: As per the release, the company completed a total of 16 new diamond drill holes for approximately 5700m on a broadly 80m x 80m drilling grid to test the extents of the high-grade mineralisation in the previously unrecognised BIF units lying in the footwall of the BIF lode mined during 1990s. Also, the area new drilling lies approximately 500m north of the operating Westralia underground gold mine.

In the below figure, the area is labelled as Drilling Area.

New Discovery (Source: Companyâs Announcement)

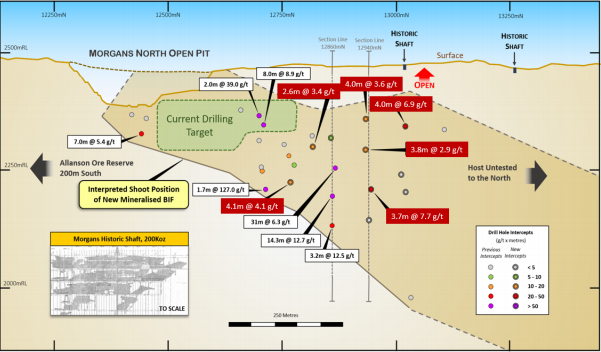

Reportedly, the new drill holes were planned to infill an interpreted high grade shoot on an approximate 80m x 80m drilling grid. Also, the company completed an 80m spaced drill section south, and two 80m-spaced drill sections north of the discovery section. Besides, the discovery section hosted the previously reported high-grade results from three 80m-spaced holes of: 31m @ 6.3g/t Au, 14.3m @ 12.7g/t Au and 3.2m @ 12.5g/t Au.

As per the release, the high-grade mineralisation has been validated over a strike length of close to 300m around the discovery section. Besides, the company is presently drilling a gap of close to 250m between the base of the Morgans North open pit, and the area of the new drill intersections.

The Below figure depicts the newly discovered high-grade units, and the new drilling results are in the red label, whereas the previous results are in white label. Besides, the area labelled as the âCurrent Drilling Targetâ is the focus of the present drilling activities.

New Discovery Intersections (Source: Companyâs Announcement)

Recently, the company presented at the Diggers and Dealers. Accordingly, it was reported that the Mt Morgans is surrounded by multi-million ounce deposits. Also, the project is capable of 170Koz average annual production from FY2020-FY2024, and 150-170Koz for FY2020. Besides, the 8-year LOM delivers discounted (5%) cash flows of over A$420 million, with a robust operating margin backed by A$1800/oz gold prices.

On 7 August 2019, DCNâs stock was trading at A$1.045, up by 6.633% (at AEST 12:46 PM). Over the year-to-date period, the stock has recorded a return of -61.42%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.