In this article, we would be discussing four stocks with exposure to infant food products. On 20 June 2019, the Australian Bureau of Statistics (ABS) released the Australian Demographic Statistics, which enumerated that between December 2017 to December 2018, the population rose by 404,800 people. Further, it depicted a growth rate of 1.6% y-o-y. Importantly, it was preliminary estimated resident population (ERP) on 31 December 2018. Therefore, the growing population could prove to be an upside in revenue streams.

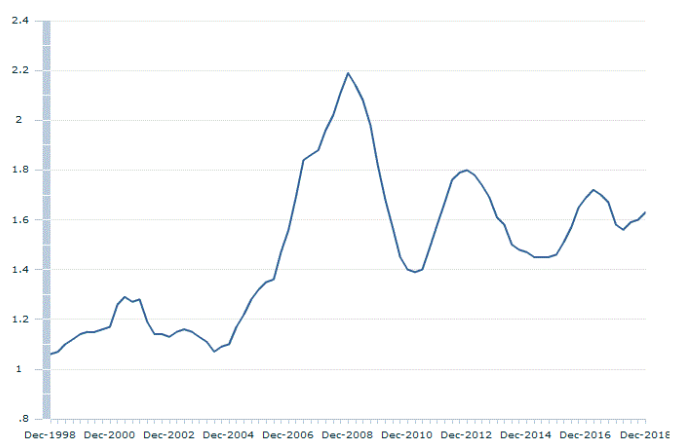

Annual Population Growth Rate (Source: ABS)

While we discuss the stocks with exposure to infant products, it would be worth having a look at the birth of the new-borns in the country. According to ERP, these births in the country witnessed an increase of 10,600 between December 2017 to December 2018 period. Also, the major rise in the percentage - 9.8% was witnessed in the NSW region. Generally, infant products are fed to the babies for a few years after their birth; this means a consistent source of revenue for the manufacturers from the sale of such products.

Importantly, the births are not the only component that may impact the revenues of companies with exposure to infant products. In this article, as per the reports, the four stocks had been engaged in raising capital, acquiring businesses and expanding markets. Letâs now have a look at them:

Keytone Dairy Corporation Limited (ASX: KTD)

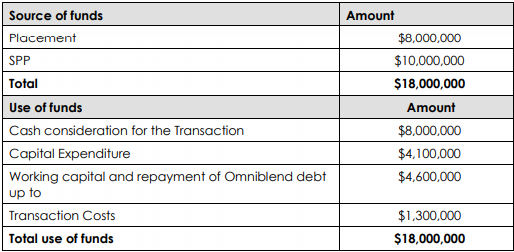

On 26 June 2019, Keytone Dairy Corporation Limited (ASX: KTD) announced a Share Purchase Plan. Accordingly, the company had recently on 17 June 2019, entered into a conditional share sale agreement to acquire 100% of the fully paid ordinary shares in the capital of Omniblend Pty Ltd (Omniblend). Also, the purchase consideration was of $8,000,000, and KTD intends to fund the acquisition through the capital raising. Further, the capital raising activity includes placement to sophisticated, institutional and professional investors (Placement) and a Share Purchase Plan to Eligible Shareholders (Plan).

Under the placement, the issue of 18,604,65 fully paid ordinary shares at $0.43 per share would be carried out to raise up to $8,000,000 excluding costs. Under the plan, Eligible Shareholders would be provided with an opportunity to acquire shares worth up to $15,000 at $0.43 per share, along with a minimum investment of $2k. Moreover, the eligibility criteria enlisted that registered shareholders as on 14 June 2019 (Record Date) could apply; additionally, shareholders must fall under the jurisdiction of ANZ.

Application of Funds (Source: Company Announcement, in June 2019)

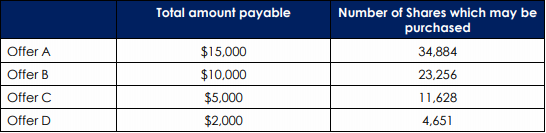

Reportedly, Share Purchase Plan would close by 15 July 2019, and eligible shareholders can choose from one of the offers as listed below, to buy the shares falling under the plan:

Plan Offering (Source: Company Announcement, in June 2019)

It should be noted that the company intends to host AGM on 26 July 2019, (as per the announcement). Further, the AGM would include a voting procedure to approve the issue of shares to shareholders of Omniblend under the transaction and the placement. Importantly, if the approval fails, application monies would be refunded to the shareholders.

On 05 July 2019, KTDâs stock last traded at A$0.460, down by 2.128% from the previous close. In the past six months, its return has been of +23.68%.

Australian Dairy Nutritionals Group (ASX: AHF)

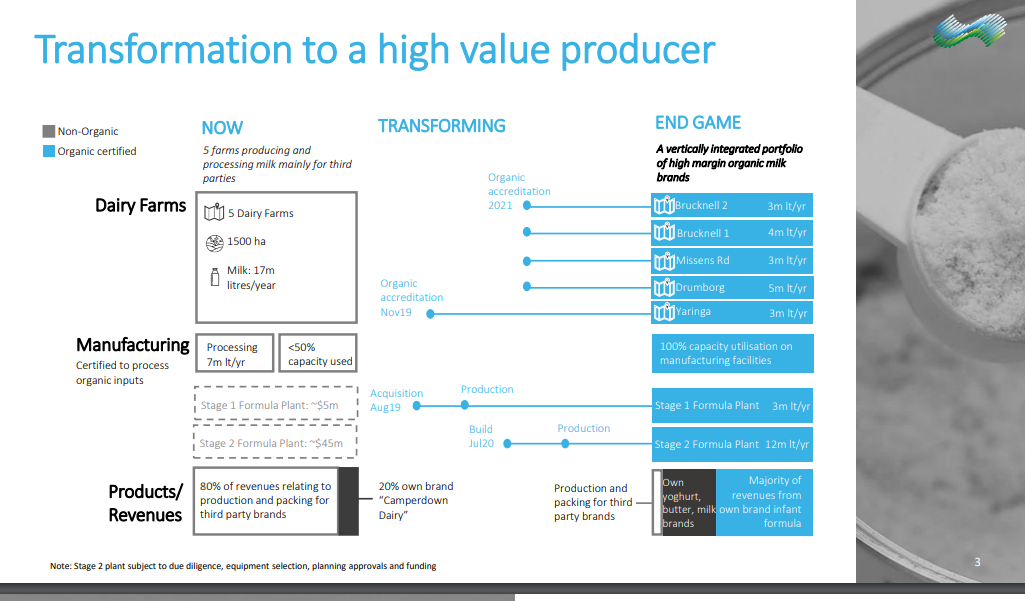

Dairy farmer, Australian Dairy Nutritionals Group (ASX: AHF), on 28 June 2019, reported that Tranche 1 of the Placement had been completed (announced on 21 June 2019). It had been settled with the issue of 32,657,851 stapled securities, which was consequential to ~$3.92 million of fresh capital excluding costs. Further, the remaining part of the placement pegged to raise ~8.1 million excluding costs is subject to shareholder approval, at the general meeting scheduled on 8 August 2019.

Issue of Securities to Ultima Capital Partners

Reportedly, AHF also issued 150,031 stapled securities to Ultima Capital Partners Pty Ltd ACN 151 293 140 (UCP). Further, the issue was in relation to the consultancy services from UCP pertaining to two-stage infant formula project along with the purchase of the infant formula plant (announced on 4 April 2019).

Strategy (Source: Companyâs Investor Presentation, June 2019)

On 05 July 2019, AHFâs stock closed the trading session, flat at A$0.140. In the past six months, its return has been of 16.67%. Currently, the market capitalisation of the company stands at ~A$42.01 million.

Wattle Health Australia Limited (ASX: WHA)

On 25 June 2019, Wattle Health Australia Limited (ASX: WHA) requested to place its securities on a trading halt on ASX. Further, the securities were suspended from quotation on 27 June 2019, as per the request of Wattle Health. It was reported that due to the pending release of an announcement with regards to acquisition and financing, the company followed this course. Post the companyâs releases on 02 July 2019, the securities of Wattle Health started trading on ASX.

Also, on 02 July 2019, WHA announced that an Extraordinary General Meeting would be held on 31 July 2019. Concurrently, it was also announced that the company had signed a New Debt Term Sheet pertaining to the Blend & Packâs acquisition.

Extraordinary General Meeting

According to the release, the meeting is scheduled to approve the proposed acquisition of Blend & Pack. Currently, GL Food Pte Ltd (a subsidiary of Mason Group) holds the interest of 75% of the issued share capital of Blend & Pack. Earlier, in February this year, WHA reported that a conditional agreement (Share Purchase Agreement) was signed with GL Food Pte Ltd (GL Food) to acquire an additional 46% of the total issued share capital for the purchase consideration of ~A$47.7 million.

Subsequently, in May this year, the company announced that a non-binding term sheet was signed with a third party (Gramercy) to raise capital through debt up to US$75 million. In addition to this, the company also revised the Share Purchase Agreement (SPA) to purchase the whole interest of GL Food (75%) in the Blend & Pack. Concurrently, the new fixed purchase consideration had been reported as US$55 million.

The announcement made by the company also enlisted that the completion date of amended Share Purchase Agreement with G L Food was extended to 31 July 2019. Accordingly, the shareholders of WHA would vote on the transaction with GL Food for the interest of 75% in Blend & Pack (Proposed Transaction). Also, WHA already holds 5% interest in Blend & Pack, and completion of the SPA would take the interest of Wattle Health in Blend & Pack to 80%.

Meanwhile, the company is presently negotiating with all Blend & Pack Founding Shareholders for an additional ~8% of the total issued share capital of Blend & Pack (Founders Transaction) excluding from Mr Andrew Grant. In addition to this, WHA is negotiating with Mr Andrew Grant for an additional 5.5% of the total issued share capital of Blend & Pack (AG Transaction).

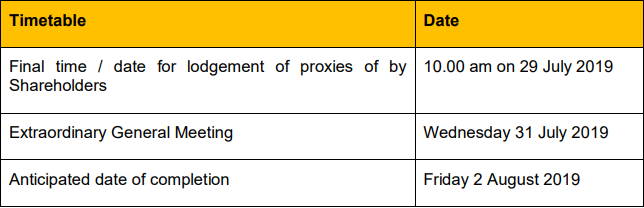

It was also reported that binding agreements for Founders Transaction & AG Transaction were not finalised as of 2 July 2019. Further, Mason Group holds a 4.1% stake in Wattle Health; therefore, it is excluded from the voting list to approve the resolution. An indicative timeline for the Proposed Transaction is below:

Indicative Timeline (source: Companyâs Announcement, July 2019)

New Debt Term Sheet

According to the release, the company had revised the debt facility term sheet to improve the proposed net cash funding of up to US$85 million with Gramercy Funds Management LLC (Gramercy). Further, as mentioned above, the company have been negotiating to improve the proposed stake in Blend & Pack to 93.5%. Earlier, the initial debt term sheet with Gramercy proposed the funding of up to US$75 million. Moreover, the revised debt term sheet enumerates that the debt facility will have a term of four years with a 9% coupon rate p.a. and an original issue discount of 13% (previously 15%).

Corio Bay Dairy Group

Previously, on 09 May 2019, the company announced that the undrawn Prospere Advisors Ltd Loan would be terminated, which was initiated to fund the construction of the organic spray drying facility by Corio Bay Dairy Group Ltd (CBDG). Further, CBDG is a JV among WHA, Organic Dairy Famers of Australia and Niche Dairy for creating the foremost dedicated organic nutritional spray dryer in Australia. In addition to this, WHA expects the commissioning of plant by the first half of 2020.

Uganic

It was also reported that Uganic would begin production in August 2019. Further, Uganic is a true Australian Organic range of nutritional dairy, which would be marketed through retail and online channels in Australia and China along with major SE Asia market through Cross Border E-Commerce.

On 05 July 2019, WHA last traded at A$0.575, up by 5.505% from the previous close. In the past three months and one month, the return of the stock has been -30/57% and -0.91%, respectively.

Bioxyne Limited (ASX:BXN)

On 29 April 2019, in the quarterly report, Bioxyne Limited (ASX:BXN) mentioned that the sales revenues in Q3 FY2019 were of $103,438 along with timing delay in PCC®. Further, new orders obtained in April were of ~A$600,000, which would match the prior yearâs annual result. Accordingly, in Vietnam, order from the wholesale channel for US$176,000 was received, which would be delivered by July 2019. Also, BXNâs cash in hand was $2.48 million as on 31 March 2019, and New Image legal matter was settled for approximately A$0.48 million in early April 2019.

Also, in early April, Bioxyne provided an update on its operations. Besides, the company reported updates pertaining to business in other jurisdictions and on litigation.

Products (Source: Companyâs Appendix 4C- Quarterly)

Indonesia

Reportedly, since the acquisition of P T Gamata Utama (PTG) â a direct sales company, BXN has trained distributors on extensive products. Also, the company introduced a product range to distributors and product registration was pending. Further, Q1 2019 had sales of ~$50,000 from PTG products, and products by BXN were expected in Q2.

Malaysia

It was reported that direct sales were impacted due to the 2018 federal general election, which had been consequential to change of government. Additionally, online product ordering had begun from mid-April 2019.

China and other parts of Asia

As per the release in April 2019, the company witnessed constrained sales due to the regulatory requirement for direct sales in China, Vietnam and Taiwan. Also, negotiations were underway with local wholesale partners for sales.

Litigation

The company had agreed to pay NZ$500,000 to New Image Group in F&F settlement pertaining to all issues in the dispute. The litigation was brought against the CEO of Bioxyne Limited. Now, it would enable BXN to prosper the business in the country.

BXNâs stock last traded on ASX at A$0.02 (on 4 July 2019). In the past six months, the return of the stock stands at -33.33%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.