About Dividend Yield:

Dividend Yield of a stock is obtained by dividing the total annual dividend paid per share by the current market price of the stock. Dividend Yield is a calculation of the return from the stock only due to dividends received. If the amount of dividend per share remains the same, the dividend yield is inversely proportion to the market price of the share. If the market price increases, dividend yield decreases and if the market price decreases, dividend yield increases. Generally, mature companies that are not growing at a very fast pace have the highest dividend yields.

Below is a list of stocks with high dividend yields on the ASX:

BHP Group Limited

About the Company: BHP Group Limited (ASX: BHP) is into minerals exploration, processing and production of coal, iron ore, copper and manganese ore and also hydrocarbon exploration, refining and production. The company has a market capitalisation of A$108.17 billion as on 1st October 2019.

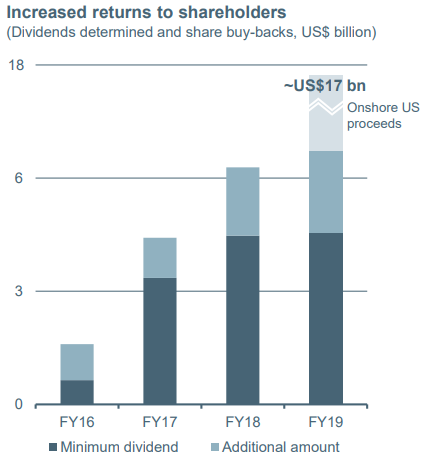

Dividends: The company decided to pay a dividend of 78 US cents per share as fully franked final dividend, taking the whole year dividend to US$1.33 per share which is equivalent to approximately 73% payout ratio. The annual dividend yield of the stock is 5.22% as per ASX.

Source: Companyâs Presentation

Stock Performance: The stock produced returns of -11.90% and -5.97% in the time period of three months and six months, respectively. The stock closed at $37.000 on 1st October 2019 with a P/E multiple of 16.060X.

Rio Tinto Limited

About the Company: Rio Tinto Limited (ASX: RIO) is into the business of exploration, development, production, processing and marketing of minerals and metals. The company has a market capitalisation of A$34.40 billion as on 1st October 2019.

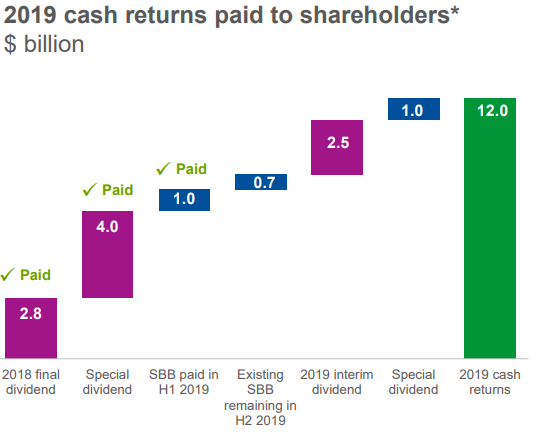

Interim Dividend Announced: The company announced an interim dividend of 151 US cents per share. In addition, it also declared a special dividend of 61 US cents per share for the half year ended 30 June 2019. The Rio Tinto Limited shareholders will be paid an interim dividend of 219.08 Australian cents per ordinary share and a special dividend of 88.50 Australian cents per ordinary share while Rio Tinto Plc shareholders will be paid an interim dividend of 123.32 British pence per ordinary share and a special dividend of 49.82 British pence per ordinary share. The annual dividend yield of the stock is 5.07% as per ASX.

Source: Companyâs Presentation

Stock performance: On the stockâs performance front, it produced returns of 5.81% and -10.65% on one month and three months, respectively, with the stock has a P/E multiple of 8.100X.

Washington H. Soul Pattinson and Company Limited

About the Company: Washington H. Soul Pattinson and Company Limited (ASX: SOL) is into the business of gold and copper mining and refining and ownership of shares. The company also engages in coal mining, property investment and consulting. The company has a market capitalisation of A$5.03 billion as on 1st October 2019.

Final Dividends: For the full year ended 31 July 2019, the company has declared a fully franked final dividend of 34 cents per share which is an increase of 3% from the last yearâs final dividend of 33 cents per share. The total dividend for the year stood at 58 cents per share, up by 3.6% over the prior year. The reason to pay dividends is the regular cash generated from the portfolio. In FY19, the net regular cash from operations increased by 18.1% from the previous year. The dividend yield of the stock stood at 2.76%.

Increasing Dividends since 2000 Source: Companyâs Presentations

Stock performance: On the stockâs performance front, it produced returns of 0.67% and -6.03% on one month and three months, respectively. The stock has a P/E multiple of 20.310X.

WAM Capital Limited

About the Company: WAM Capital Limited (ASX: WAM) is Australiaâs Listed Investment Company, which provides investors with exposure to an actively managed diversified portfolio of undervalued growth companies. The company has a market capitalisation of A$1.64 billion as on 1st October 2019.

Dividends for the full year ended 30 June 2019: The company declared a fully franked full year 2019 dividend of 15.5 cents per share, with a final dividend of 7.75 cents per share. The dividend yield of the stock stood at 6.8% as per ASX.

Stock performance: On the stockâs performance front, it produced returns of 8.06% and 12.32% on one month and three months, respectively.

Magellan Financial Group Limited

About the Company: Magellan Financial Group Limited (ASX: MFG) manages funds, offering international investment funds to high net worth and retail customers in Australia and New Zealand. It also offers its services to institutional investors globally. The company has a market capitalisation of A$9.37 billion as on 1st October 2019.

Dividends: MFG had a positive financial year 2019 with the average FUM increasing by 28% to $75.8 billion and adjusted NPAT increasing by 35% to $364.2 million. For six months ended 30 June 2019, the company declared a total dividend of 111.4 cents per share, franked at 75%. The dividend payment comprises of a final dividend of 78 cents per share and a performance fee dividend of 33.4 cents per share. The dividend yield of the company stood at 3.6% as per ASX.

Source: Companyâs Presentation

Stock performance: On the stockâs performance front, it produced returns of 1.38% and -3.31% on one month and three months, respectively. The stock has a P/E multiple of 24.140X.

Telstra Corporation Limited

About the company: Telstra Corporation Limited (ASX: TLS) is Australiaâs technology and telecommunication company, which also offers a wide range of communication services. The company majorly operates in Australia and has more than 350 retail stores. It delivers 3.7 million retail fixed bundles, 18.3 million retail mobile services and 1.4 million retail voice services. The company has a market capitalisation of A$41.75 billion as on 1st October 2019.

Dividends: The company has announced to pay a total fully franked final dividend of 8 cents per share. These 8 cents per share comprise of 5 cents per share of ordinary dividend and 3 cents per share of special dividend. If we combine the dividends, the shareholders will receive total dividend of 16 cents per share for FY19.

The annual dividend yield of the stock stood at 2.85% on 1st October 2019 as per ASX.

Stock Performance: In the last six months period, the stock has generated a positive return of 7.22 percent and currently the stock is trading at a PE multiple of 19.390x.

National Australia Bank Limited

About the company: National Australian Bank Limited (ASX: NAB) was formed in 1858 and currently has over 33,000 people who serves nine million customers in more than 900 locations across New Zealand and Australia. The company has following segments:

- Corporate and Institutional banking (CIB): This segment delivers a variety of lending and transactional products and services linked to financial and debt capital market;

- Consumer Banking and Wealth (CBW): This segment supports millions of consumer banking relationships in Australia by providing a comprehensive range of financial services and products;

- Business and Private banking (BPB): This segment focuses on serving three main aspects- small businesses, medium businesses and investors;

- New Zealand Banking: The New Zealand banking consists of Consumer Banking, Corporate and Insurance franchises, Agribusiness, Wealth and Markets sales operations in New Zealand. It excludes the bank of New Zealandâs Markets Trading operations.

The company has a market capitalisation of A$85.63 billion as on 1st October 2019.

Dividend: The bank has declared a total dividend of 83 cents in the first half of 2019 and the annual dividend yield stood at 6.13% as per ASX.

Source: Companyâs Report

Stock Performance: In the last six months period, the stock has generated a positive return of 17.16 percent. Currently, the stock is trading at a PE multiple of 14.480x.

Westpac Banking Corporation

About the Bank: Westpac Banking Corporation (ASX: WBC) is one of the major bank in Australia and it delivers broad range of financial, banking and other related services. The Group has four customer facing divisions:

- Consumer- This division is responsible for sales and services to consumer customers in Australia under the BankSA, BT, Westpac, St.George, RAMS and Bank of Melbourne brands;

- Westpac Institutional Bank (WIB)- This division is responsible in delivering a broad range of financial products and services to commercial, corporate, institutional and government customers with connections to Australia and New Zealand;

- Business- This division is responsible for sales and service to micro, small-to-medium enterprises, commercial business and Private Wealth clients;

- Westpac New Zealand- This division is responsible for sales and services of banking, wealth and insurance products for consumer, business and institutional customers in New Zealand.

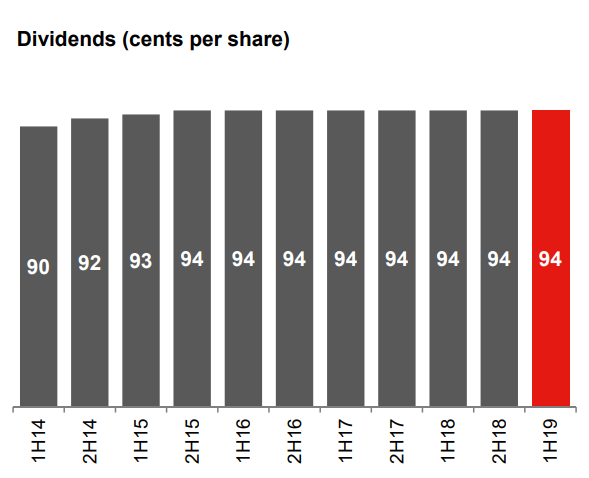

Dividends: WBC has declared an interim dividend of 94 cents per share for 1H FY 19 which is fully franked. This makes the payout ratio at 98% with an annual dividend yield of 6.34%.

Source: Companyâs Report

Stock Performance: In the last six months period, the stock has generated a positive return of 13.22 percent. Currently, the stock is trading at a PE multiple of 14.380x.

Planning to invest in Dividends? Have a look at Upcoming Dividends for ASX CompaniesDisclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.