Due to the roll-out of NBN in Australia, investors are keeping a close eye on telecommunication stocks trading on ASX. In the past six months, the below-mentioned communication stocks have provided positive returns. Letâs take a closer look at these stocks and their recent updates.

Spark New Zealand (ASX:SPK)

Spark New Zealand Appointed Former Telstra CFO to its Board

New Zealandâs leading digital services company, Spark New Zealand (ASX: SPK) has appointed two new directors to its Board. The company has appointed former Chief Financial Officer (CFO) of Telstra Warwick Bray, as a non-executive director to the Board. Plus, the Board has also appointed highly experienced Chief Executive Jolie Hodson, as an executive director.

Who is Warwick Bray?

- Warwick Bray has more than 40 years of experience in the international telecommunications, technology and media sectors, most recently in senior executive roles at Telstra;

- He has extensive finance and strategy expertise combined with deep telecommunications industry experience;

- Warwick worked with Telstra for 9 years until 2018;

- At Telstra, Mr. Warwickâs executive roles comprised Chief Financial Officer, Group Managing Director Product, Executive Director Mobile and Head of Corporate Strategy;

- Warwick has been managing director at JP Morgan (London) and Dresdner Kleinwort Wasserstein (London) in telecommunications equity research;

- On Educational front, he holds a Bachelor of Science (Hons) and a Masters in Business Administration (MBA) from the University of Melbourne.

While announcing the new appointments, Spark New Zealand Chair Justine Smyth highlighted that the company was looking for a new Director with strong financial expertise to join the Board.

SPK Board

Justine Smyth (Chair)

- Justine Smyth has extensive experience in governance, mergers and acquisitions, taxation and financial performance of large corporate enterprises, as well as actively investing in small and medium enterprises;

- Her background is in finance and business management, having been a Partner with Deloitte and Group Finance Director at Lion Nathan;

- She is currently a director of Auckland International Airport Limited and Chair of The Breast Cancer Foundation New Zealand;

- Education: Bachelor of Commerce from the University of Auckland, Fellow of the New Zealand Institute of Chartered Accountants and a Chartered Fellow of the Institute of Directors

Alison Barrass (Non-executive Director)

- Alison Barrass has a broad range of skills, including knowledge and expertise in the fast-moving consumer goods (FMCG) sector and in governance, leadership and marketing-led innovation;

- She has 30 yearsâ experience of working in major international FMCG companies, including PepsiCo, Kimberley-Clark, Goodman Fielder and Griffins Foods;

- Education: Bachelor of Science from the University of Southampton, Business Diploma in Marketing from the University of Auckland.

Pip Greenwood (Non-executive Director)

- Pip Greenwood has significant experience in capital markets, mergers and acquisitions, telecommunications and governance;

- She was formerly interim CEO of Russell McVeagh and a senior partner at the firm, with over ten yearsâ experience on the firmâs Board, including time as its Chair;

- Education: Bachelor of Laws from the University of Canterbury.

Ido Leffler (Non-executive Director)

- Ido Leffler has a significant experience in developing digital brands and extensive networks in the start-up communities of Silicon Valley and Australasia;

- He co-founded Yoobi, Yes To Inc, Brandless and Beach House Group;

- Education: Bachelor of Business from the University of Technology in Sydney

Charles Sitch (Non-executive Director)

- Charles Sitch has 20 yearsâ experience in driving business strategy;

- He has worked for McKinsey & Company from 1987, where he became senior director in 2010, primarily working with CEOs and Boards on strategy and operations turnarounds, before retiring in 2010;

- He has been involved in various new business ventures and is Chairman of the Board of Trinity College at the University of Melbourne

- Education: MBA from Columbia Business School, Bachelor of Laws and a Bachelor of Commerce from Melbourne University.

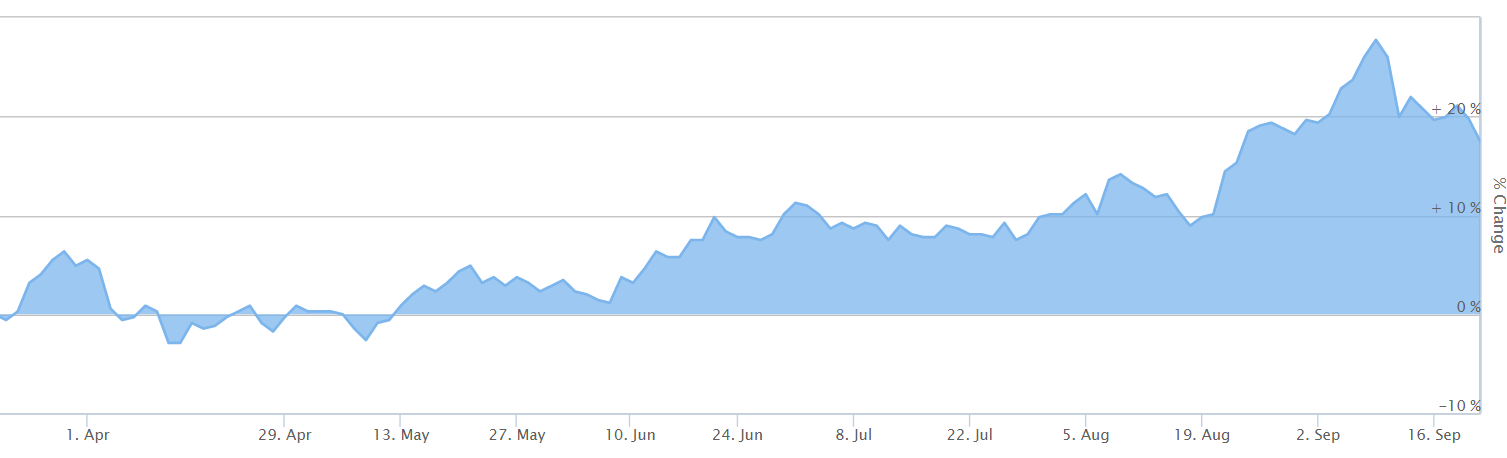

Stock Performance: At market close on 23 September 2019, SPKâs stock was trading at a price of $4.080 with a market capitalisation of $7.44 billion. In the past six months, SPKâs stock has provided a return of 17.44% as on 20 September 2019.

SPK six months Share Performance (Source: ASX)

Telstra Corporation Limited

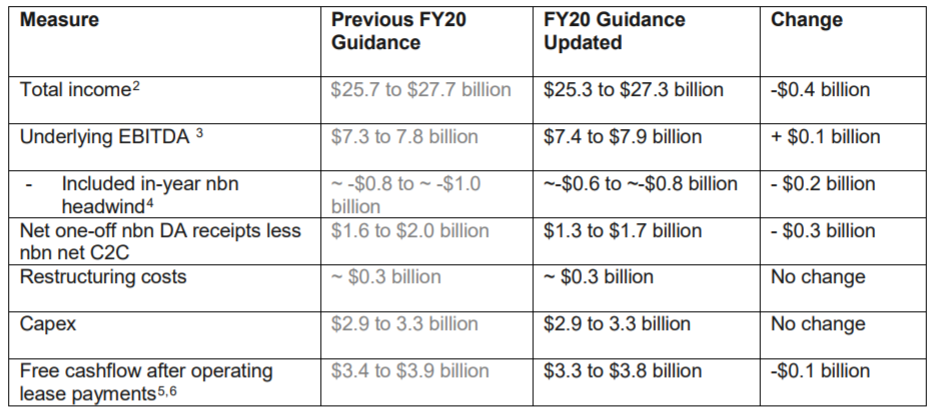

Australiaâs leading telecommunication services provider, Telstra Corporation Limited (ASX: TLS) recently updated its FY20 guidance after the release of NBN Coâs Corporate Plan 2020. Telstra no longer is expecting FY20 as the year of peak NBN headwind and now expects that its total income in FY20 will be in the range of $25.7 billion to $27.7 billion.

Telstra FY2020 Updated Guidance (Source: Company Reports)

Via its T22, Telstra has radically simplified its products and services by reducing over 1,800 Consumer and Small Business plans to just 20 in-market core fixed and mobile plans. Last year, this telecom giant launched its customer loyalty program, Telstra Plus, which rewards members with points that can be put towards the latest devices, accessories and entertainment.

In the financial year 2019 (FY19), the company successfully absorbed the intense competition and the challenging structural dynamics of the telecom industry. Further, it also completed the strategic investment program that it announced in 2016 to create the networks for the future and to digitise its business while making significant investment and progress in relation to T22 strategy. The estimated nbn headwind that Telstra absorbed in 2019 was around $600 million.

Telstraâs financial results for FY2019 were in line with guidance and market expectations. Further, the results demonstrated the companyâs strong progress against the T22 strategy.

2019 was also the year in which Telstra demonstrated its clear network leadership by being the first operator in Australia and among the first in the world to launch 5G technology, putting the company well-placed for future growth.

Stock Performance: At market close on 23 September 2019, TLSâs stock was trading at a price of $3.650 with a market capitalisation of $43.41 billion. In the past six months, TLSâs stock has provided a return of 12.87% as on 20 September 2019.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.