Penny stocks, also called micro-cap stocks (as they have a very low market capitalisation) are traded at a very low price. These stocks generally have poor liquidity, so they are considered risky for investment. Generally, the beginners prefer to invest in these stocks as they can start investment with low capital, can buy significant number of shares and can get good profits. Further, the manipulators and scammers are also after the penny-stocks. If the investor has already made a profit of 20% to 30% in just a few days, he should immediately sell the stocks quickly. The investors while investing in stocks in 2020 should see guidance for FY 20, their track record in attaining the target, the economic cycle, demand of the sectors/segments etc.

Let us now have a look at the recent updates from a few ASX listed penny stocks.

Warrego Energy Ltd (ASX: WGO)

Acquired a minimum 50.1% indirect interest in El Romeral:

Warrego Energy Ltd (ASX: WGO) formerly Petrel Energy Limited, an oil & gas company that is into upstream operation. The company has recently acquired a minimum 50.1% indirect interest in El Romeral, which is an integrated gas production and power station situated in southern Spain that has 3 producing wells and 13 prospects. This acquisition will be done by WGO’s 85 percent owned JV or Joint Venture vehicle - Tarba Energia SL. The initial consideration for this acquisition is €750,000. WGO had generated cash & cash equivalents of $13,476,000 at the end of September, which includes $12,520,000 raised from the SPP and placement of shares.

On 6 January 2020, WGO last traded at $0.200, slipping by 4.762 percent compared to its prior closing price. Meanwhile, WGO stock has risen 10.53% in one month.

Integrated Green Energy Solutions Ltd (ASX: IGE)

24 modules being constructed by IGE & will receive payment by IGP:

Integrated Green Energy Solutions Ltd (ASX: IGE) generates renewable energy as it converts and processes waste plastics and biomass for generating fuel and energy. Integrated Green Partners LLC, (“IGP”) was formed with the partnership of IGE & GEP Fuel and Energy Indiana, LLC (“GEP”) in USA. IGE & GEP had planned to build sites in the USA, starting in Camden Indiana in which there will be construction of twenty-four 50 tonne per day (“TPD”) modules that are capable of processing 1200 TPD of ASR derived plastics into 420 million litres of fuel per annum.

As per the plan, IGE would be paid a down-payment for initial module construction costs. The upfront payment agreed is USD$39,600,000.00 and will form part of the USD $70,000,000.00 that has to be paid to IGE for the 24 modules. Now IGP has to make the upfront payment before 31 January 2020 based on the funding secured by GEP as part of their partnership terms.

On 6 January 2020, IGE last traded at $0.240, falling by 2.041 percent from its earlier closing price. Also, IGE stock has risen 122.73% in the past three months.

Alt Resources Ltd (ASX: ARS)

Acquisition of 100% interest in tenement E29/991:

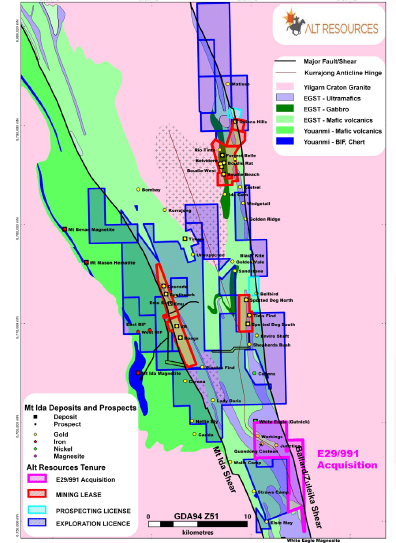

Alt Resources Ltd (ASX: ARS), that operates in the exploration of gold, has gold assets in the Mt Ida Gold Belt, situated in the South-Central region of Western Australia, known as Bottle Creek, Quinn's and Mt Ida gold projects. The company has signed Binding Terms Sheet for the acquisition of 100% interest in tenement E29/991 from Mr Bruce Legendre and will consolidates the company’s holdings in the southern end of the Mt Ida South project area.

E29/991 location and regional geology, Source: Company’s Report

On 6 January 2020, ARS last traded flat at $0.020. Meanwhile, ARS stock has risen 5.26% in one month, while in the past 6 months period, it gave a return of 11.11 percent.

Andromeda Metals Ltd (ASX: ADN)

Significant Increase in the Measured Resource:

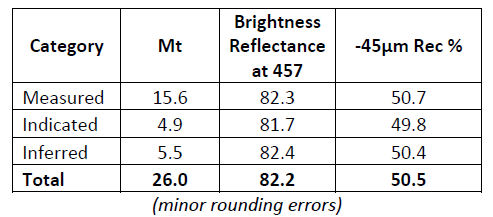

Andromeda Metals Ltd (ASX: ADN), formerly known as Adelaide Resources Limited, is into exploration of gold, lithium & copper. ADN has posted 80% increase in the Measured Resource for the Poochera Kaolin Project from the 2019 infill drilling assumed between April to May at Carey’s Well. There has been more than 28% increase in the “bright white” kaolinised granite Mineral Resource to 26 million tonnes. These increases will be included in the Pre-Feasibility Study that is expected to be concluded by initial part of June quarter this year.

New Mineral Resource (source: Company’s Report)

On 6 January 2020, ADN last traded at $0.044, slipping by 2.222 percent from its previous close. Meanwhile, ADN stock has fallen 18.18% in the past three months.

Lithium Australia NL (ASX: LIT)

Received Rebates for FY 19 & Grants:

Lithium Australia NL (ASX: LIT) is into the exploration & development of lithium assets, and produces battery-grade lithium carbonate. The company has received $3 million (net of costs), as per the $6.3 million funding agreement with New York based institutional fund manager - The Lind Global Macro Fund, LP, which is an entity managed by The Lind Partners. LIT has also received $1.23 million as R&D rebate from Australian Tax Office for FY 19 and LIT’s 100%-owned subsidiary VSPC Ltd has received an ATO R&D rebate of $876,095 for FY 19. LIT’s subsidiary Envirostream Australia Pty Ltd secured a grant amounting to $110k from Sustainability Victoria with respect to its Melbourne battery recycling facility. LIT and its subsidiary companies are expecting the result from two more grant applications, whose decisions are anticipated in initial 2020.

On 6 January 2020, LIT last traded at $0.061, slipping by 1.613 percent from its previous close. Also, LIT stock has risen 34.78% in the last three months.

Kalium Lakes Ltd (ASX: KLL)

Outlook for 2020:

Kalium Lakes Ltd (ASX: KLL) is in the production of sulphate of potash products from brine deposits in Western Australia meant for the domestic and international markets. The company in FY 20, expects the commissioning to start at the end of the year. The company expects an updated Mineral Resources and Ore Reserves, to follow on from the recent drilling results at 10 Mile West and Sunshine Lake. The company has got positive update as Magnesium by-product is expected to add to the overall economics of the BSOPP and plans to conduct various studies during 2020.

On 6 January 2020, KLL last traded at $0.495, rising up by 1.02 percent from its previous close. Meanwhile, KLL stock has fallen 14.50% in the past three months timeframe.

Cronos Australia Ltd (ASX:CAU)

Forms Joint Venture to develop CBD Products for Australia and New Zealand:

Cronos Australia Ltd (ASX:CAU) caters to the Healthcare sector, offering highest quality medicinal cannabis products. CAU through its wholly owned subsidiary, Cronos Australia Group Pty Ltd, has formed a 50:50 joint venture with A&S Branding Pty Ltd, for the development of cannabidiol (CBD) based products, that include the skincare products, for Australia and New Zealand.

On 6 January 2020, CAU last traded at $0.210, falling down by 2.326 percent from its previous close. Meanwhile, CAU stock has fallen down 15.69% in one month.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.