Summary

- Suspended and deferred dividends have raised jitters among income-savvy investors.

- Preserving cash becomes imperative amid a crisis for sustainability of the business.

- Diversified revenue streams and lower leverage may provide income amid a crisis.

As businesses have taken flight to preserve cash flows, Australian income-savvy investors have felt the rage of suspended and deferred dividends, while high-yield offering papers like the one floated by Virgin Australia Holdings Limited have lost credibility.

It is imperative for businesses to preserve cash flows, which are crucial for the going concern of the entity. Companies that are generating enough cash flows to meet their obligations, may declare dividends but lower dividends should be highly anticipated.

We shall consider these three items when looking for companies having propensity to deliver income amid a crisis. But there could be more factors that an investor may require to consider when finding companies from the income-earning perspective.

Revenue drivers and fundamentals: Businesses generate cash through sales, services, etc. It is crucial to focus on the products and services of the business, and how its offerings are generating cash. As with service-based offerings, cash flows of financial stocks are largely dependent on fees, commission, interest rates, markets, economic environment, etc. Unlike airlines and travel companies, cash flows of financial stocks appear to be relatively stable amid this crisis.

Diversification of revenue streams: A diversified revenue base enables a business to have better risk management. Just like diversification is very important in an investment portfolio, it is equally important in a business’ revenue as well. When businesses have revenue streams that are largely cyclical in nature, management often looks to acquire businesses that have sustainable revenue proposition across cycles.

Leverage in the business: A business delivers sustainable income when it has minimal debt or no debt. And, interest payable on debt could be used as dividend payments in absence of debt in the balance sheet. However, some businesses require debt funding due to relatively higher capital and asset needs, which could be extremely dilutive through equity funding.

We shall now discuss some businesses that may have a sustainable income. In fact, PDL has recently declared an interim dividend of 15 cents per share.

Steadfast Group Limited (ASX:SDF)

In May, the group provided an update on its April performance. It was noted that April EBITA was consistent with the pre-pandemic expectations with no adverse impact on working capital position of the business.

Over FYTD period ended in April, the group’s EBITA was 21.8% higher than the same period last financial year. SDF noted that premium rates continued to rise, but volumes in equity broking were lower, which was offset by expense savings.

Underwriting agencies of the business delivered strong organic growth. Broker network has seen very low acceptance of the deferred premium offer provided by few insurers.

Earlier, the group reported nine-month performance for the period ended 31 March 2020. Revenue was up 25.8% to $597.9 million over the previous corresponding period, while EBITA was $147.9 million for the period, up by 21% over the pcp.

On 2 June 2020 (AEST 11:30 AM), SDF was trading at $3.365, up by 0.749% from the previous close.

Perpetual Limited (ASX:PPT)

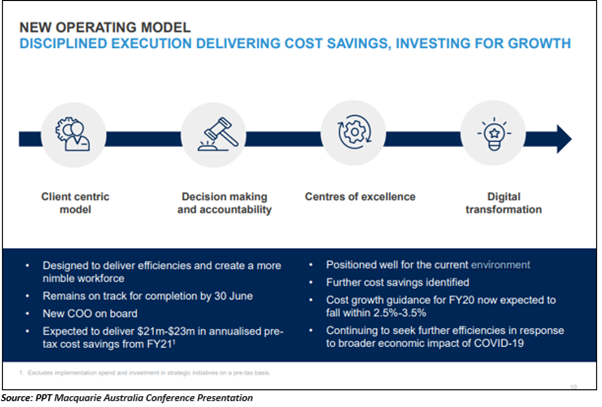

Perpetual has a diversified business model. As per the latest presentation, the company’s operating revenues for the half-year ended 31 December 2019 included 39% contribution from PI Investment fees, 25% from PP market, 12% from PP non-market, 13% from PCT Debt Market and 11% from PCT Managed Fund services.

Market revenues of Perpetual Investments and Perpetual Private were impacted due to market declines in March. Since markets rebounded in April, the company experienced a reversal in some of the declines. Other offerings that improved revenues due to non-market linkage included new clients, real asset values, credit growth system, debt markets, and investment flows into real assets.

In response to COVID-19, the company has improved client connectivity and delivery through an insights hub, webinars, client engagement and new advisors. It has a strong balance sheet, and the business has identified additional cost savings.

For FY20, expense growth was revised down to 2.5-3.5%. Acquisition of Trillium Asset Management is on track for completion during this fiscal year. The company is evaluating acquisition opportunities in the domestic as well as international markets.

Perpetual Corporate Trust has a diversified revenue base, which includes securitisation, managed fund services, data analytics solutions, trust management, accounting and agency, investor and intermediary reporting, document custody, standby servicing, etc.

On 2 June 2020 (AEST 11:43 AM), PPT was trading at $31.420, up by 2.713% from the previous close.

Pendal Group Limited (ASX:PDL)

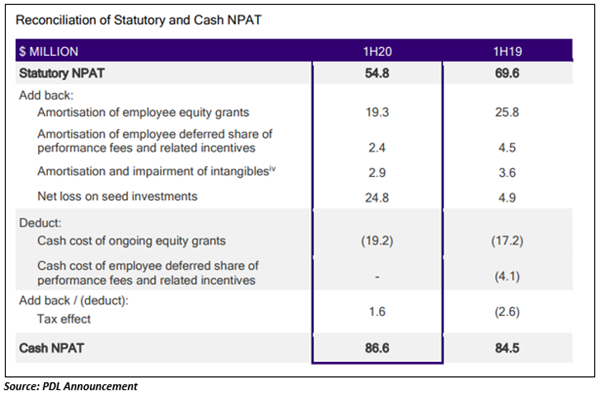

Pendal Group reported interim results last month for the period ended 31 March 2020. The group announced an interim dividend of 15 cents per share against 20 cents per share in the previous corresponding period.

Its statutory NPAT for the period was $54.8 million, down 21% from the same period last year at $69.6 million. However, cash NPAT of the business was $86.6 million, up by 2% over the pcp. Cash profit is adjusted for non-cash items and unrealised/realised gains and losses from financial assets.

It was noted that group acknowledges the importance of dividends to its shareholders, but the dividend is lower than would be in case of normal conditions due to COVID-19. Management stress tested the business with a range of scenarios. Although they are confident that the business would weather the impact of the pandemic, reduced dividend was a sensible decision.

On 2 June 2020 (AEST 12:01 PM), PDL was trading at $6.480, up by 3.846% from the previous close.

Due to cyclical business, financial stocks may provide a long-term value. Locking-in yields at lower prices of the stock will likely benefit shareholders when businesses raise their dividends over the course of future as a contraction is followed by recovery, meaning recovery for cyclical businesses as well.

Do Read: Investing During Crisis: Tips to Ride Through the Volatile Territory