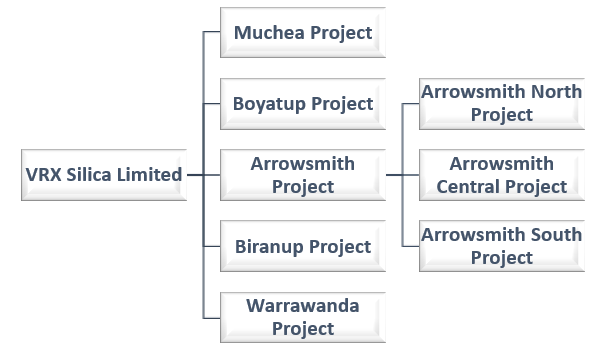

Silica sand explorer, VRX Silica Limited (ASX:VRX), formerly known as Ventnor Resources Limited, aims to become a global supplier of high-grade silica sand. The companyâs activities are targeted at the expansion of silica sand assets in Western Australia.

It holds five significant projects in Western Australia, including

- Arrowsmith, Muchea,

- Boyatup,

- Warrawanda and

- Biranup projects.

The companyâs Muchea and Arrowsmith projects are the most advanced ones and hold substantial potential for high-grade silica sand.

VRX Silica has recently released its annual report for the year ended 30th June 2019. The company achieved many milestones during the financial year, primarily focussing on its Arrowsmith North, Arrowsmith Central and Muchea projects.

The Arrowsmith Project is located at 270km to the north of Perth and comprises of five granted exploration licences and two pending mining leases and the Muchea Project is situated fifty kilometers to the northern side of Perth and comprises of an exploration licence, 1 granted exploration licence, and a mining lease pending.

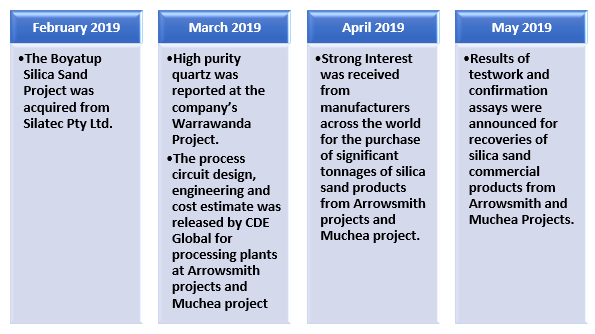

Let us take a look at the major developments observed by the company in FY19 at its Arrowsmith and Muchea Projects below:

Key Developments at Muchea Project

During the financial year, the company witnessed the following developments at its Muchea project:

- The Muchea Silica Sand Project was acquired by the company in late July 2018. The company entered into new agreements with Wisecat Pty Ltd and Australian Silica Pty Ltd to acquire 100 per cent of the Muchea project. (July 2018)

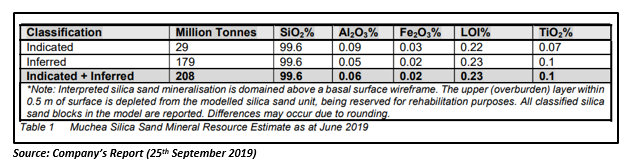

- A maiden Mineral Resource Estimate (MRE) was reported for the Muchea project, that comprised of a total Mineral Resource of 191 Mt @ 99.6% SiO2, including an Indicated component of 19 Mt @ 99.7% SiO2 and the Inferred component of 172 Mt @ 99.6% SiO2. (November 2018)

- A silica sand Mining Lease application (MLA) (M70/1390) was lodged for the Muchea project, that covers a part of the Exploration Licence E70/4886 and has an area of 2,918Ha. (January 2019)

- On a small portion of the 2,900ha MLA area (217ha area), a 57-hole aircore drill program for a total of 887m was conducted. (March 2019)

- A new JORC compliant MRE was determined after the receipt of results from the aircore drill program, that added significant value to the companyâs inventory while confirming the extent and quality of its silica sand projects.

The new MRE increased the total Mineral Resource by 9% to 208 Mt @ 99.6% SiO2. (June 2019)

Subsequent to the balance sheet date, the company entered into an MOU with CSG Holding Co Ltd to establish a strategic alliance with regard to the Muchea Silica Sand Project.

Key Developments at Arrowsmith Project

The companyâs Arrowsmith project progressed substantially during the reported financial year. The company saw the following significant developments at its Arrowsmith project:

- A development program was announced for the Arrowsmith projects, comprising Arrowsmith North and Arrowsmith Central on 2nd August 2018.

- The Department of Mines, Industry and Safety granted a POW for exploration on both the Arrowsmith Central (E70/4987) and Arrowsmith North (E70/5076) prospects. (August 2018)

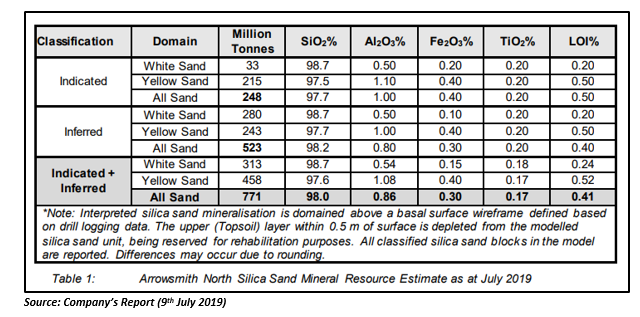

- The MRE announced for the Arrowsmith North project, comprised an Inferred Resource of 193.6 Mt @ 98% SiO2. It surpassed the earlier Exploration Target of 100 to 140 million tonnes at 95% to 98% SiO2. (October 2018)

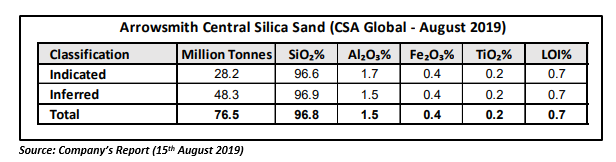

- Based on hand auger drilling, a maiden MRE was reported for the Arrowsmith Central project, that comprised of an Inferred Mineral Resource of 28 Mt @ 97.7% SiO2. (October 2018)

- The first silica sand MLA (M70/1389) was lodged by the company at its Arrowsmith North prospect, that covers part of Exploration Licences E70/5027 and E70/5109, and has an area of 1,728Ha. (December 2018)

- An MLA (M70/1392) was lodged at Arrowsmith Central prospect, that covers a part of Exploration Licence E70/4987 and has an area of 1,900Ha. (February 2019)

Subsequent to the financial year 2019, the following developments were noted by the company at its Arrowsmith project:

- A new MRE was reported for the Arrowsmith North project after the receipt of the aircore drill program results. The upgrade was to a JORC compliant total MRE of 771 Mt @ 98.0% SiO2, an overall increase of 398% on the maiden estimate. (July 2019)

- A new MRE was reported by the company for the Arrowsmith Central project. The upgrade was to a JORC compliant total MRE of 76.5 Mt @ 96.8% SiO2, an overall increase of 273% on the maiden estimate. (August 2019)

- The details of Bankable Feasibility Study (BFS) and maiden Probable Ore Reserve at Arrowsmith North were announced, demonstrating exceptional financial metrics and a world-class project;

The Probable Ore Reserve amounting to 223 Mt @ 99.7% SiO2 was announced in line with the JORC Code with 204 Mt @ 99.7% SiO2 included within the MLA area. (August 2019);

- The details of Arrowsmith Central BFS were announced, demonstrating compelling financial metrics and complementing Arrowsmith North;

The Probable Ore Reserve amounting to 18.9 Mt @ 99.6% SiO2 was announced in line with the JORC Code with 18.7 Mt @ 99.6% SiO2 included within the MLA area. (September 2019)

Other Developments in FY19

The company also witnessed some other significant developments during the period, which are as follows:

Financial Highlights

VRX Silica reported a rise of 27.6 per cent in its revenue from continuing operations during the period, to $96,228. The company also recorded a substantial increase in its cash balance at the end of the financial year 2019, from $276,936 in FY18 to $1,545,418.

The company also received firm commitments for raising a total capital of $4.66 million during the year, via a share placement to professional and sophisticated investors.

VRX Silicaâs performance during the reported financial year clearly indicates that it has so far made considerable progress in its Arrowsmith and Muchea projects. Continuing with its growth trajectory, the company is likely to flourish further in the mining space.

Stock Performance

VRX closed the trading session at $0.150 on 1st October 2019. The stock has delivered an exceptional return of 108.33 per cent in the last six months.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. The above article is sponsored but NOT a solicitation or recommendation to buy, sell or hold the stock of the company (or companies) under discussion. We are neither licensed nor qualified to provide investment advice through this platform.