All three stocks from the technology space have come up with recent updates on ASX. Class Limited and Altium Limited released financial results for FY19 reporting robust growth across key performance measures. Zip Co. Limited highlighted on the acquisition of PartPay, which provided the company with an exposure to global geographies. FY19 results for Zip Co. Limited are still awaited.

Below are the details on the announcements made by the companies.

Class Limited

Class Limited (ASX: CL1) develops cloud-based accounting, investment reporting and administration software.

Dividend: The company recently released an announcement regarding distribution of dividend amounting to AUD 0.025 per ordinary share. The shareholders will receive the dividend on September 27, 2019.

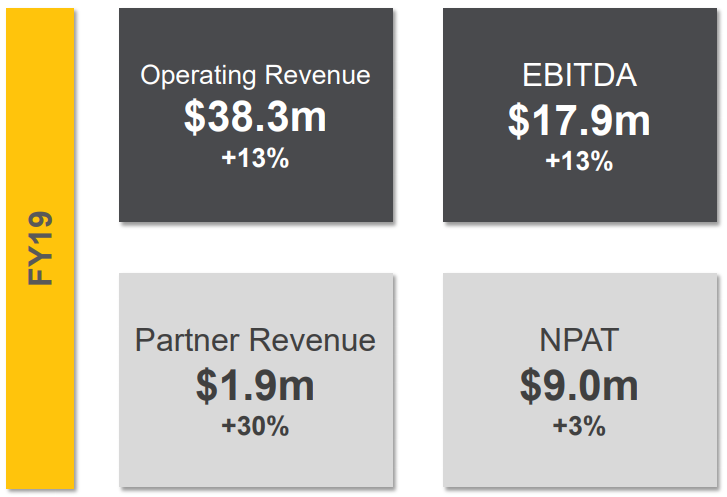

FY19 Financial Performance: During the year ended 30 June 2019, the company generated operating revenue amounting to $38.3 million, up 13% on corresponding prior-year period. Growth in revenue during the period was majorly attributable to continued account growth and partner initiatives. EBITDA for the period was reported at $17.9 million, up 13% on corresponding period in the previous year. NPAT for the year was reported at $9.0 million, increasing 3% from the year-ago period. Expenses for the year increased by an amount of $2.3 million due to continued investments and recruitment in key areas of business such as the partner program, sales and marketing & product development.

FY19 Key Metrics (Source: Company Presentation)

Remarkable Performance by Class Super: The companyâs core product, Class Super, won two awards namely Accounting Innovator of the Year and Software Services Innovator of the Year. In addition, the product, for the 5th year in a row, was rated #1 for Highest Overall Client Satisfaction. These accomplishments enable the company to maintain a high retention rate of 99%, that promises an annualised recurring revenue amounting to $38.2 million. As at 30 June 2019, the company had 179,082 accounts, as compared to 169,413 accounts as at 30 June 2018.

Product Development: The company made an investment of $9.0 million for product development, representing an increase of 48% on the previous year. Development during the period involved introduction of new product features to Class Super to drive growth. The new features comprised of (a) Tax statement automation, utilised for processing tax statements to save the time of accountants and administrators. (b) Adviser Dashboard, to provide complete visibility of all portfolios being managed by advisers helping them guide the clients on investment strategies and performance. (c) Managed accounts support, to provide improved managed account data accounting and reporting in Class.

Outlook: The company is focused on accelerating the development of the Class product suite. Owing to investments in product development & sales and marketing, the company expects the margins to reduce in FY2020. However, these initiatives once set in place, have immense potential for growth in the future. In FY20, the company is planning to increase its investment in product development and technical capability to $12 million, that represents an increase of 33% on FY19. The company does not expect any major contribution of this investment in FY 20 but is still targeting a revenue growth of 10%. Revenues and EBITDA in FY21 and beyond are expected to see a material uplift.

The stock of the company is currently trading at a market price of $1.300, down 1.515% on 20 August 2019 (AEST â 12:38 PM) and has a market capitalisation of $155.31 million.

Altium Limited

Altium Limited (ASX: ALU) is engaged in development and sale of computer software for design of electronic products.

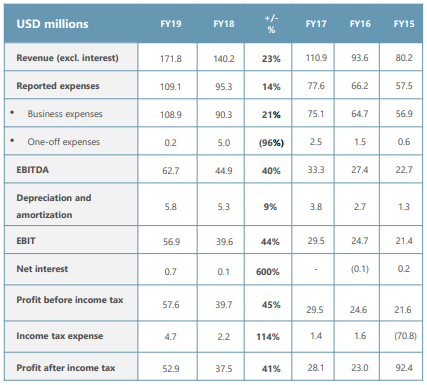

FY19 Financial Highlights: During the year, sales to customers amounted to US$177.22 million, up 23% in comparison to prior corresponding period sales of US$144.54 million. Revenue from ordinary activities for the period was reported at US$171.82 million, up 23% on corresponding period of prior year. Expenses during the period increased by 15%, from US$95.31 million in FY18 to US$109.10 million in FY19. EBITDA for the period amounted to US$62.72 million, up 40% on year-ago period EBITDA of US$44.87 million. EBITDA margin for the period stood at 36.5%, as compared to 32.0% in the corresponding prior-year period. During the year, the company generated profit after income tax amounting to US$52.89 million, up 41% on FY18 profit of US$37.49 million.

FY19 Income Statement (Source: Company Presentation)

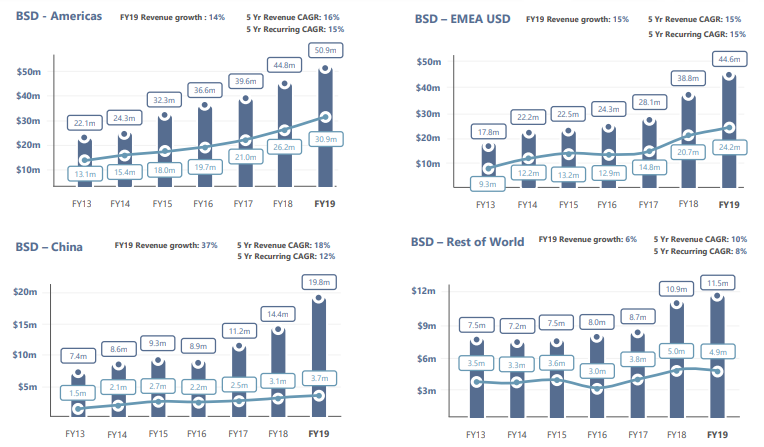

Significant Achievements: Subscriber seats for the period totalled to 43,698, representing an increase of 13%. In addition, the company sold more than 8,000 new licenses for Altium Designer seats, depicting a percentage increase of 27% in total Altium Designer seats. During the period, all the business segments delivered double-digit growth in revenue. The company witnessed record growth from China, expanding beyond Shanghai and Shenzhen to Beijing. FY19 revenue for China increase at a rate of 37% on corresponding prior-year period. The period also saw the release of Altium Designer 19 with a set of new capabilities for advanced design and complex projects.

Segment-Wise Revenue: Revenue for Board and Systems amounted to US$126.78 million, up 17% year over year. Nexus reported an increase of 38%year over year at US$6.64 million. Revenue from Tasking amounted to US$19.86 million, up 37% over the corresponding prior-year period. Octopart reported revenue of US$17.95 million, increasing 49% year over year.

Board and Systems Revenue by Region: China reported the strongest growth in revenue at US$19.81 million, up 37% on corresponding prior-year revenue of US$14.41 million. EMEA followed China with revenue amounting to US$39.20 million, up 20% on prior- year revenue of US$32.79 million. Revenue from the Americas was reported at US$50.86 million, up 14% on prior- year revenue of US$44.76 million. Board and Systems revenue from Rest of World stood at US$11.51 million, up 6% in comparison to prior-year revenue of US$10.88 million.

BSD Revenue by Region (Source: Company Presentation)

Outlook: The company is targeting a revenue of US$200 million in 2020 and is committed to a higher EBITDA margin floor of 37%, that excludes the impact of the new leasing standard. Altium is aiming to achieve 100,000 Altium Designer subscribers before 2025 and is expecting to soon achieve the target halfway, by enrolling 50,000 subscribers as early as 2020. Another target in the pipeline is a revenue goal of US$500 million in 2025.

The stock of the company is currently trading at a market price of $35.300, up 4.841% on 20 August 2019 (AEST â 1:19 PM) and has a market capitalisation of $4.39 billion.

Zip Co. Limited

Zip Co. Limited (ASX: Z1P) offers point-of-sale credit and payment solutions to consumers and integrated Retail Finance solutions to merchants.

Acquisition of PartPay: The company recently announced that it has entered into an agreement to acquire 100% shares in PartPay Limited which will provide a global exposure to United Kingdom, New Zealand, South Africa and United States. PartPay comes with an integration with New Zealandâs leading retail group, The Warehouse Group and a fully-operational, United Kingdom subsidiary supported by a scalable local team.

Consideration: Total consideration for the acquisition involves an upfront payment of NZ$50.8 million. Based on some prescribed performance targets for FY20 and FY21 financial years, there will be a further earn-out of up to NZ$15.0. Overall, Zip will pay a total maximum consideration of NZ$65.8 million through issue of new fully paid ordinary shares in the company.

With a strong customer base across multiple investment plans, PartPay aligns strongly with Zipâs core strategy. PartPay is currently integrated into over 1k retailers including New Zealandâs Telco, Spark and the leading retail group, The Warehouse Group. Following the deal, PartPayâs founder John OâSullivan will join the Zip team.

In addition, the company has also agreed on acquisition of direct strategic equity interest in buy now, pay later (BNPL) provider, QuadPay Inc. The subscription agreement with QuadPay involves a further investment of approximately US$11.4 million.

FY19 Results Release Date: The company recently updated the exchange that it will release the financial results for FY19 on 22 August 2019.

Partnership with Big W: In another recent announcement, the company notified on the partnership with Woolworths Groupâs Big W, for the purpose of offering Zip interest free payments to its customers. This partnership will provide flexibility to the consumers in terms of choosing how to pay for their everyday products.

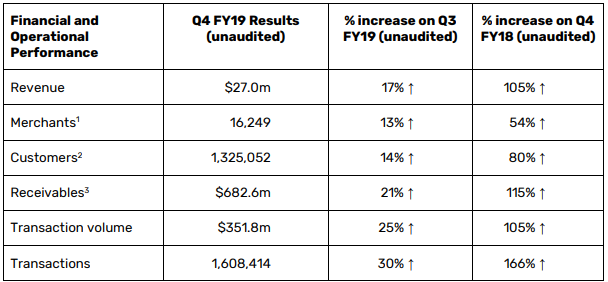

Q4FY19 Highlights: During the quarter ended 30 June 2019, the company reported record quarterly revenue amounting to $27.0 million, up 17% on the previous quarter. Quarterly transaction volume stood at $351.8 million, up 105% YoY. During the quarter, the number of customers increased to over 1.3 million, up 159,000 or 14% on the previous quarter. The company performed ahead of all financial targets set at the beginning of FY19 and improved on cash EBTDA.

Key Operational Highlights (Source: Company Reports)

Overall, with over $1.1 billion transactions processed on the companyâs platform in FY19, strong growth in merchant base and continued growth across all key operational metrics, transactions and customers, the company seems well positioned to deliver a strong financial year ahead.

Currently, the stock of the company is trading at a market price of $3.340, up 10.963% on 20 August 2019 (AEST â 2:45 PM) and has a market capitalisation of $1.06 billion.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.