Summary

- The UK government announced to infuse £3 billion on green projects to improve energy efficiency on homes and public buildings.

- The Brexit talks set to kick-off as the UK, and European negotiators meet.

- GB Group enhanced technological capabilities in artificial intelligence, machine learning and user validation methods to enable customers to make better decisions.

- ULS Technology announced a contract renewal with Lloyds Bank for providing conveyancing solution.

- GB Group and ULS Technology suspended final dividend due to the impact of COVID-19 disruption.

Given the above market conditions and business updates, we will review two technology stocks -GB Group PLC (LON:GBG) and ULS Technology PLC (LON:ULS). The shares of both GBG and ULS were up by 1.28 percent and 0.63 percent, respectively (as on 7 July 2020, before the market close as at 1:30 PM GMT+1). Let’s walk through their financial and operational updates to understand the stocks better.

GB Group PLC (LON:GBG) – Enhanced new technologies to serve customers better

GB Group is engaged in the provision of identity data intelligence services. GB Group provides three core solutions: Location, Identity and Fraud. The Group owns proprietary software and algorithms to serve B2C customers. The Group target geographies are UK, Europe, South East Asia, China, Australia, New Zealand and North America with a team of 1,000 people. The Group has close to 20,000 customers.

FY2020 Annual results (ended 31 March 2020) as reported on 30 June 2020

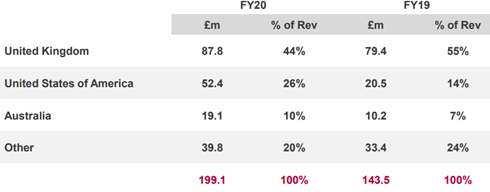

The Group revenue was up by 38.7 percent to £199.1million. The organic revenue growth with constant currency was 10.7 percent. The income from international customers was approximately 56 percent of the Group revenue. The adjusted operating profit was £47.9 million, which increased by 49.7 years on year. The profit before tax and deferred income balance was £20.6 million and £38.4 million, respectively.

Identity generated revenue of £105.4 million, Location and Fraud generated revenue of £49.8 million and £35.5 million, respectively. Identity includes the acquisition revenue from IDology and VIX Verify of £31.6 million and £9.3 million, respectively.

Operational Highlights

The Company invested in data, products and technology. Loqate a unit of Location business segment launched What3Words partnership. The Group improved capabilities in artificial intelligence, user identification and validation methods through internal development and partnerships. The Group expanded Fraud capabilities through partnerships; Cyber Fraud and Digital Credit scores. The increased capabilities and better products would enable the customer to take intelligent and risk-based decisions.

Revenue Analysis per Geography

(Source: Company Website)

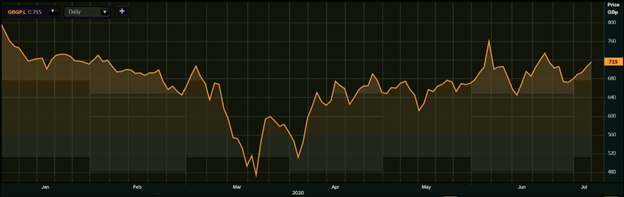

Share Price Performance

6-Month Chart as on July-7-2020, before the market close (Source: Refinitiv, Thomson Reuters)

GB Group PLC’s shares were up by 1.42 percent and trading at GBX 715.00 per share (as on 7 July 2020, before the market close at 3.32 PM GMT+1). Stock 52-week High and Low were GBX 806.00 and GBX 465.00, respectively. The Group had a market capitalization of £1.37 billion.

Business Outlook

The Group is witnessing the mixed impact of the pandemic on the business. In the current situation, consumers are making online transaction and Companies are enhancing their capabilities to provide secure digital transaction. The long-term market drivers are expected to be supportive with further improvement through the digitalization of customer businesses. The Group has withdrawn guidance and suspended the dividend for FY20 to preserve cash.

ULS Technology PLC (LON:ULS) – Housing sales recovery expected in the second half of the year

ULS Technology is a holding Company and provides management services to the subsidiary companies. The Company has digital platforms which bring together people to buy, sell and re-finance their homes. The Company provides services to mortgage brokers, banks, building societies and price comparison websites.

FY2020 Annual results (ended 31 March 2020) as reported on 24 June 2020

The Company reported revenue of £28.3 million, which was lower than £30.0 million a year ago. The gross margin was £12.4 million. The underlying EBITDA and profit before tax were £6.0 million and £4.8 million, respectively. As on 31 March 2020, ULS had cash of £2.3 million, and the net debt stood at £3.4 million. The board suspended the final dividend for FY20.

Operational Highlights in FY20

The Company invested in developing DigitalMove, a digital platform for buying and selling property. The platform had more than 3,500 intermediary advisers, and over 10,000 instructions had gone into the platform. The number of advisors increased by 18 percent year on year. The Company developed a lender proposition and attracted new introducers; the Company partnered with Principality Building Society. The Company recently launched Rapid Remortgage, a product which legally prepares the remortgage case. The Rapid Remortgage uses the functionality of DigitalMove along with the core conveyancing platform. On 6 July 2020, the Company re-contracted with the Lloyds Banking Group for two years for omnichannel conveyancing solution through DigitalMove platform.

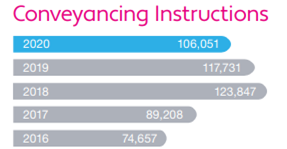

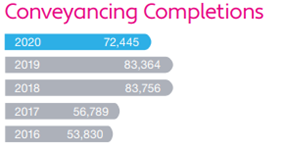

Conveyancing comparison

(Source: Company Website)

Share Price Performance

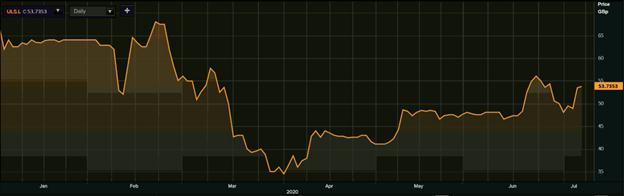

6-Month Chart as at July-7-2020, before the market close (Source: Refinitiv, Thomson Reuters)

ULS Technology PLC’s shares were up by 0.63 percent and trading at GBX 53.74 per share (as on 7 July 2020, before the market close at 2.10 PM GMT+1). Stock 52-week High and Low were GBX 74.00 and GBX 34.00, respectively. The Group had a market capitalization of £34.64 million.

Business Outlook

The Company witnessed a fall of around 90 percent in transactional conveyancing instructions due to the pandemic. The Company expects sales recovery in the second half of the year with total transactions to be close to 735,000 in FY21; however, it would decline by around 38 percent from the level seen in FY20. The Company would focus on investing in product development and acquisition to support the growth of extensive distribution network through mortgage advisers, lenders, estate agents and direct-to-consumer websites.