An investor invests because it serves a set of objectives, which are unique to self and heavily depend on the life stage he/she is at and the existing risk appetite. The key objectives of investment include growth, income and safety, though the degree of each differs from investor to investor. The one thing that remains common is- creation, maintenance and regular check of the investing portfolio that one customises exclusively for themselves.

In the investing portfolio, every investor aims to have one essential component- Quality Stocks. But what are quality stocks and why is it important to have them in the investing portfolio?

Read on to find out!

What are Quality Stocks?

The present global economic condition is vulnerable with protracted trade wars heating up the market, climate change triggering businesses and political upheaval taking a toll within and across borders. The uncertainty of events is bound to leave everyone baffled, and this is when owning quality stocks and bonds is considered a boon.

There is no standard dictionary definition of quality stocks. However, it is often referred to as the stocks that offer more reliability and less risk. They may not have enough and frequent share price increases (that growth stocks savor) but tend to have a comparatively more stable balance sheet and dependable earnings and tend to fare well.

The companies with quality stocks usually have less debt, stable businesses and some defensive qualities in a tougher economy. Few examples of quality stocks include Walmart, McDonaldâs, Pfizer and Procter & Gamble.

At this point, it is important to note that, quality stocks are not quite the same as value stocks, as having value is about buying the relatively cheaper stocks, whereas quality pertains to paying more for companies which have a comparatively better track record.

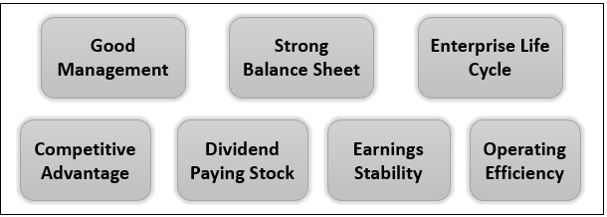

Below are the key characteristics of quality stocks:

What is Quality Investing?

Now that we understand the meaning of quality stocks, let us break down the concept of quality investing. This process involves identifying and tapping stocks of companies with the characteristics of good businesses, as quality stocks have been regarded as the key to successful value investing, by investing experts since time immemorial.

Quality investing supports best overall and not just the best-in-class approach, wherein the investing strategy is based on a set of clearly defined fundamental criteria, that identify the good quality performers (which have the features depicted above).

The current economic uncertainty has urged investors across the world to invest in quality stocks as they offer better chances of withstanding a probable downturn. Quality stocks are often looked upon as ways to reduce risk in times when stock valuations are very high.

Why Should You Have Quality Stocks in Your Portfolio?

Quality stocks are one of the most trusted tools of wealth creation. Let us understand the reasons that one should definitely bag some quality stocks in his/ her investing kitty:

- High-quality stocks have been noticeably outperforming the broad market in recent periods.

- Quality stocks always have an edge and provide a sustainable competitive advantage.

- The returns generated from quality stocks outshine most other forms of investment.

- Ideally, higher quality implies exceptional stock performance with time across economies.

- Even though quality stocks may essentially be marginally expensive when compared to other available options, their performance over time makes up for the demarcation.

- Quality stocks are prone to perform way better than other options in times of volatility, market stress, through recessions and in down markets.

Where to Find Quality Stocks?

Now that we understand the basic crux of quality stocks and quality investing, the question is - which sectors are more prone to having these lucrative options available? Letâs find out-

Banking Sector- Quality stocks are prone to be in the banking sector, as Valuations in it remain rich. Moreover, the private sector banks are likely to outperform their public sector counterparts.

Material Sector- Construction, metals and mining, capital goods and infrastructure are a lucrative sector for quality stocks as these companies, their products and services are always in demand and attain attention from the public and private eye.

Technology Sector- With abundant opportunities for growth and disruptive innovation, this sector is dynamic and competitive. Several impactful companies are born in this sector, which generate massive gains from innovation and depict a consistent profitability (leading to good returns).

Quality Stocks on ASX

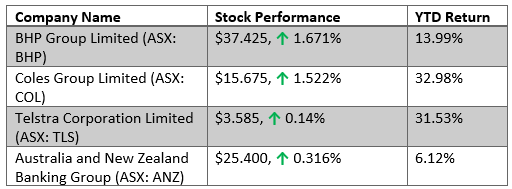

Let us look at the performance of a few quality stocks on the Australian Securities Exchange, during the trading session on 15 November 2019 (at AEST 01:56 PM):

What Do the Experts Say?

Experts from across the globe believe that quality dominates the equity markets. Reliable profitability, and a strong balance sheet, in some combination are the major lookouts for every new and experienced investor in the investing world. Experts stress on the fact that a quality company may not necessarily be a fast-growing one, and these stocks can be both cheap and expensive. The key characteristic that an investor should look out for is- if the stock is a good bet to keep making money and has negligible chances of facing adverse issues.

A section of investing experts state that the popularity of quality stocks, and the preparedness of investors to pay for it, is offset by a dominant tendency that the already cheap stocks will get even cheaper.

An investor should conclude an effective holistic picture of the company that is shortlisted to be added in the stock portfolio. Ratio analysis, annual dividend yields, earnings report, growth projections and the ability to withstand micro and macro level challenges, should be considered. Only when the complete checklist is adequately ticked-off the investors criteria, should one go ahead with the investment.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.