Information technology stocks functions in the technology space, and mostly trade on high earnings multiples. They often demonstrate above average potential in terms of headway. The technology space comprises of businesses engaged with production of electronic goods, designing of software, offering services related to IT sector.

The Australian benchmark index S&P/ASX200 last traded on 24 February 2020, at 6,978.3 points, moving down by 2.3 percent from its last close. While S&P/ASX200 Information Technology (Sector) index settled the day’s trading session at 1,436.5 points, slipping by 4.07 percent from its previous close.

In this article, we would be discussing three ASX listed stocks and their recent updates in detail:

Simble Solutions Ltd (ASX: SIS)

Immense Opportunity due to agreement with Sylvania Lighting & Raising of fund through SPP:

Simble Solutions Ltd (ASX: SIS) is an Australian IT company that is into the development of resource management solutions as it focuses on energy management and Internet of Things solutions in order to save energy & reduce their energy bill. The company offer services to various sectors like government, building and construction, agriculture, healthcare, education, and real estate all through the globe. The company has operations in SME and residential market & has offices in London (UK) and Da Nang (Vietnam), apart from Australia.

SIS stock surged 33.33% on February 21st, 2020 after the company signed an agreement with Sylvania Lighting ( having its presence in 25 countries) for three-years in which latter will integrate the SimbleSense Platform into lighting projects for Commercial and Industrial (C&I) and small and medium-sized enterprise (SME) customers. SimbleSense platform will offer “energy intelligence” to the customers, validate the energy savings via “Measure and Verification” and will provide real-time engagement to the end customers showing interest in the financial and environmental effects on their investments in lighting projects.

The agreement will enable Sylvania to white-label software products to enhance its sales conversion internationally, engaging with consumers and placing the entity as an advanced leader in lighting technology space. Moreover, Sylvania is anticipated to take up a transformational role in expanding the sales network across Europe. The company’s initial target markets are UK, France Germany, Spain and Italy and there is potential for SSI to expand in all the markets that Sylvania is operating in.

The company has plan to start sales and marketing initiatives in the first quarter of 2020 after formal market launch at Light + Building, which is the world’s leading trade fair for lighting and building services technology at Frankfurt, Germany, that is planned to take place from 8 to 13 March 2020.

Overall, the formation of partnership with Sylvania, is a great opportunity for significant growth for SIS. Further, every installation completed under this partnership will provide SIS both recurring Software-as-a-Service (SaaS) revenues and one-off energy meter hardware revenue together.

Moreover, the company is raising through Share Purchase Plan (SPP) a maximum amount of $812,853 between 13 February 2020 & 6 March 2020, through the issue of 50,803,325 shares (30% of issued share capital) at the issue price $0.016 per share. The proceeds from SPP will be used to retire legacy liabilities by June 2020 for reduction of operating cash burn, to accelerate sales activities and for increasing the revenue.

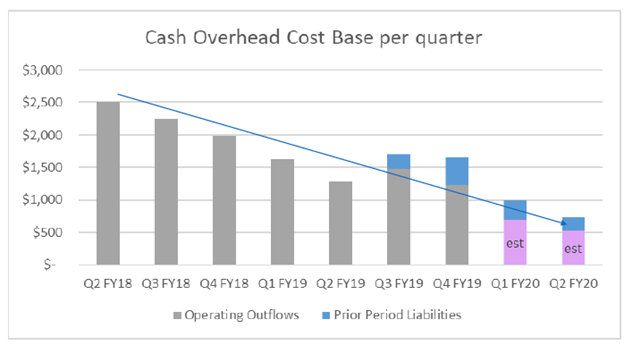

The SPP is being offered to the shareholders in Australia, New Zealand, Hong Kong, United Kingdom and USA. Additionally, as part of turnaround plan of the company intends the reduction of cash overhead cost base of company (incl R&D) significantly to $0.5m per quarter from mid - 2020. The company is on track to attain cashflow break even.

Turnaround Plan Objective: Cashflow Break-even (Source: Company’s Report)

On 24 February 2020, SIS settled the day’s trading session flat at $0.016. Meanwhile, SIS stock has fallen 52.94% in three months as on February 21st, 2020.

Crowd Media Holdings Ltd (ASX: CM8)

On verge of financial turnaround:

Crowd Media Holdings Ltd (ASX: CM8) is technology based involved in social media & marketing company, having presence in over 50 countries that is into the development of application and other software products. The company operates through two broad segments, Mobile division & Digital Marketing division.

As per an announcement dated 6 February 2020, CM8 for the first half of 2020 has reported the revenue of $8.5m and a small loss of $36k in underlying EBITDA (unaudited) compared to the loss of $1.3m in the 1H 2019 in underlying EBITDA. This reflects that the company is on the verge of financial turnaround as it will reach a near-breakeven position.

CM8 had been facing significant losses from the past 2 years. The company is taking various steps to attain this like discontinued the business in certain unprofitable markets, increasing the efficiency, as well and rebalancing of the service in subscription verticals. The steps enabled to make revenues stable for the final 4 months of 1H 2020. The company had restructured the costs substantially and personnel overheads earlier in the June 2019. The company had planned to sell products of London Labs and I am Kamu brands, both of which were expected to begin in February. LOI with Pluto Travel are on track to commercialisation on time. The company has planned to launch conversational ‘voice-and-visual’ interactive digital media product.

On 24 February 2020, CM8 ended the trading session flat at $0.023. Meanwhile, CM8 stock has fallen 23.33% in three months as on February 21st, 2020.

Appsvillage Australia Ltd (ASX: APV)

New AI platform update will increase SMB customer retention:

Appsvillage Australia Ltd (ASX: APV) offers solution to businesses & helps them in the development of their own mobile apps, which leads to saving of time signification and also reduction of price compared to those businesses who outsource or develop internally.

APV stock rose 2.50% on February 21st, 2020 after the company updated the market on the integration of an artificial intelligence (AI) algorithm into the company’s app development software for increasing the retention of its SMB customers, through increasing the development customisability of app and the user experience. The AI algorithm will enable the users to make unlimited personalised graphic design, promote campaigns and pre and post campaign analytics.

With this upgradation, SMBs can build fully customisable advertising campaigns that can be used within APV’s Facebook advertising feature which enables AI to suggest the best placement, budget and target audience in meeting the SMBs marketing objectives, within a few minutes.

On 24 February 2020, APV ended the trading session flat at $0.205. Meanwhile, APV stock has fallen 54.44% in three months as on February 21st, 2020.