The below mentioned stocks have witnessed significant improvement in their share price during todayâs trade session. Letâs take a closer look at these stocks-

Imagion Biosystems Limited (ASX:IBX)

Imagion Biosystems Limited (ASX: IBX) helps in early detection of cancer by using the combination of biotechnology and nanotechnology. The company has a technology that can be used to improve diagnosis for many common cancers.

Today, the company has announced that it has completed toxicology safety study of its lead MagSenseTM nanoparticle formulation, results of which will be used to support filings with regulatory and clinical authorities to proceed to first-in-human testing. The company believes that it will be breaking new ground in medical imaging bringing a targeted bio-safe iron oxide nanoparticle to first-in-human studies.

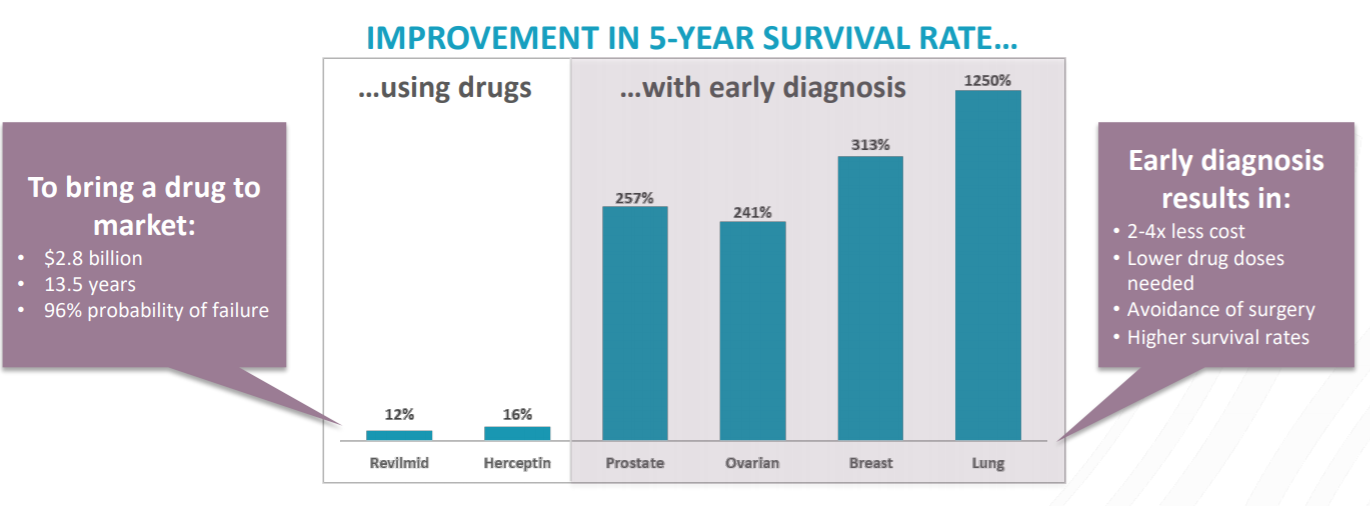

Benefits of Early Detection (Source: Company Reports)

Benefits of Early Detection (Source: Company Reports)

Following the release of this news, the share price of the company increased substantially by 12.5% during the intraday trade.

In the last six months, the share price of the company decreased by 50% as on 22 May 2019. IBXâs shares closed the dayâs trade at $0.027 with a market capitalisation of $7.75 million as on 23 May 2019.

Farm Pride Foods Limited (ASX:FRM)

The shares of Farm Pride Foods Limitedâs (ASX: FRM) are up by 45.455% in todayâs trade session. Due to the significant rise in the share price, ASX has raised a price query in which it has noted the change in the price of FRMâs securities from a low of $0.22 at the close of trading yesterday, to a high of $0.30.

In reply to this query, the company has advised that it is not aware of any information could explain the recent trading in its securities. For the half- year ended 31 December 2018, the company announced revenues from ordinary activities of $44.636 million.

In the last six months, the share price of Farm Pride Foods Limited decreased by 71.79% as on 22 May 2019. FRMâs shares closed the dayâs trade at $0.320 with a market capitalisation of $12.14 million as on 23 May 2019.

Simble Solutions Limited (ASX:SIS)

The shares of Simble Solutions Limited (ASX: SIS) are up by 66.667% in todayâs trade session, despite of not releasing any price sensitive information.

In an update provided on 13 May 2019, the company had announced that the accelerating sales activity in the Simble Energy division, stable revenues from the Mobility division and a reduction in gross costs of the business overall has resulted in a significant reduction in the net burn rate which is forecasted to continue to decline gradually over time.

Further, the company is confident that it will continue to deliver further improvements in cash flow over time which will gradually reduce the Companyâs reliance on external capital. The company is also confident that it will meet its business objectives as its business continues to grow and has a significant customer pipeline of opportunities.

SISâs shares closed the dayâs trade at $0.050 with a market capitalisation of $3.1 million as on 23 May 2019.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.