Global investors are now keeping an eye on the Australian technology stocks that have remained mostly stable and have held onto their valuations despite the market volatility due to emerging trade tensions between the United States and China. The trade conflict between the two largest economies of the world has been creating huge fluctuations in the stock market in the last few days.

The trade battle started with the US President Donal Trumpâs threat to raise the tariffs on the Chinese goods worth $200 billion to 25 per cent from 10 per cent. As an answer to Mr Trumpâs warning, China announced the imposition of retaliatory tariffs on $US60 billion worth US goods on last Monday. The technology stocks plunged in the Australian share market as well, apart from Europe and Wall Street, following the announcement of retaliatory tariffs.

The market rebounded on Tuesday while the FAANG stocks (Facebook, Apple, Amazon, Netflix and Alphabetâs Google) failed to recover on Wall Street. But the tech stocks were among the dayâs best performers on the Australian share market on Wednesday.

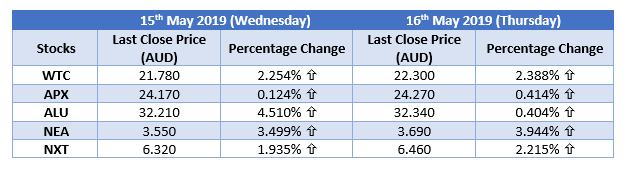

The below table highlights the performance of some major Australian tech stocks in the last two days.

As indicated in the above table, the major tech stocks â WiseTech Global Limited (WTC), Appen Limited (APX), Altium Limited (ALU), Nearmap Ltd (NEA) and NEXTDC Limited (NXT) have performed well on the Australian Securities Exchange (ASX) in the last two days. The stocks had a quick recovery from the market variations amid US-China trade war.

All these tech stocks are currently trading higher on the ASX today.

At 2:10 PM AEST on 17th May 2019, WTC is trading at AUD 23.340 (up by 4.66%), NXT at AUD 6.500 (up by 0.62%), NEA at AUD 3.830 (up by 3.79%), ALU at AUD 32.710 (up by 1.14%) and APX at AUD 25.660 (up by 5.27%).

Among the best performing names on the local market this year is Australia's WAAAX stocks (Wisetech Global, Afterpay Touch, Altium, Appen and Xero). According to market experts, the companies like Appen, Afterpay and Xero are now on overseas investorsâ radar. The experts see a rise in demand for Aussie and New Zealand tech companies from offshore buyers.

As per the market analysts, the investors investing in tech stocks in Australia would benefit from a full, drawn-out trade war as the Australian dollar would get hit hard. As many of the WAAAX stocks pay costs in Australian dollars but earn a large part of their revenue in US dollars, the investors are keenly eyeing these stocks.

However, the analysts advise investors to move cautiously in the midst of the current market situation. This is so because some of the tech stocks are trading on very high multiples and so there is a risk of the valuation returning to normal levels.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.