The Cure may be worse than the disease in the economic context. Major financial stock markets have plunged to alarming levels amidst the growing COVID-19 scare.

The recent coronavirus-invoked financial market havoc has brought many listed tech companies into limelight which in turn has trapped the investor’s decisions between a rock and a hard place.

Technology Stocks Sanguine On Index

With dejection enduring and the world in chaos, had it not been for convincing and progressive technology solutions, we would have been staring at an unmanageable crisis.

March was a historic month across all the sectors. Australia’s tech sector stumbled along, damaged by a crashed market in mid march. The S&P/ASX 200 Information Technology (AXIJ) touched the bottom of 818.90 on 23 March 2020. With these horror stories of the pandemic, tech index after hitting the lowest eventually rebounded, weathering the storm and closed at the price of 1406.20 on 13th May 2020. The V shape recovery has shown the probable path of uptick off late post business scenarios picking up the positive momentum.

Various technology ASX stocks also illustrated a U-turn amid these crises such as Xero Limited (XRO), Afterpay Touch Group Limited (APT), WiseTech Global Limited (WTC), Altium Limited (ALU) hit the lowest price of A$64.050, A$8.90, A$10.48, A$24.67 respectively during the last two weeks of March and eventually rebounded and closed on 13th May 2020 at A$83.770, A$43.460, A$19.730, A$35.03 respectively.

The fall in stock prices may be attributed to the interruption of economic activity in order to battle against the virus. And the moment of truth is coming for various technology companies as they are starting to report their business updates during COVID-19 or their quarterly results. The results seem to be reassuring and boosting their performance as well as psychological booster for investors.

Moving forth, let’s have a snap at few attractive technology stocks that are coming out stronger in the current maelstrom.

Did you read; 10 ASX stocks that have geared up in May till date

Wisetech Global (ASX: WTC) Beats Strong Business Performance

WTC is a 1994 established Australian company engaged globally in the development and provider of cloud-based software solutions to the logistics industry. The company has logistics clients inclusive of MNCs, small and medium-sized businesses.

WTC recently released its business update for the quarter ending 31st March 2020. The update reflects strong financial position, substantial liquidity with A$230 million of net cash at the end of 31st March 2020 and undrawn debt facility of A$190 million.

WTC also reaffirmed its guidance with subject to currency movements for FY’20 with the following:

- Reaffirmation of revenue range of A$420 - A$450million with growth ranging 21% - 29%

- Reaffirmation of EBITDA within range of A$114 - A$132million and EBITDA growth range of 5% - 22%.

Stock performance: On 14 May 2020 (1:10 PM AEST), WTC stock traded at A$19.040 with a market capitalization of A$6.31 billion and ~ 319 million shares outstanding.

Afterpay Touch Group (ASX: APT) – Attractive BNPL Player

APT is an Australian listed buy now and pay later firm that offers technology driven payments.

APT made a significant announcement on 1st May 2020 wherein it apprised that APT’s 5% stake is bought by Tencent which in turn will seek learning and explore vast experience and network from Tencent.

APT published a business update on 14th April 2020 in response to COVID-19 for the quarter ending 31 March 2020 along with its response plan. Following are the highlights:

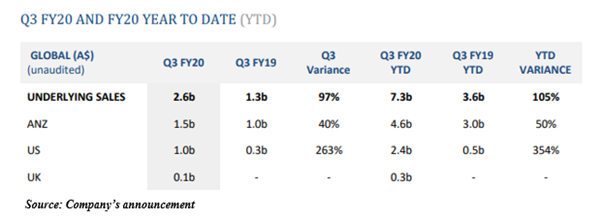

- Reported underlying sales at A$7.3 billion YTD which grew 105 per cent in comparison to the previous corresponding period (or pcp) and also noted that the growth rate remained in line with H1 FY20 as compared to H1 FY19.

- March was reported as the third-largest underlying sales month on record, with up surge of 97 per cent against pcp during Q3 FY’20.

- At the end of March 2020, Total cash reported was A$541.1million inclusive of A$515.0 million cash and $26.0million restricted cash with total liquidity of A$719.2 million.

- Debt facilities accounted for $355.7million in the balance sheet.

Stock performance: On 14th May 2020 (1:10 PM AEST), APT stock traded at A$42.640 with a market capitalization of A$11.61 billion and ~267 million shares outstanding.

Did you read; Tech Players Atlassian, Afterpay and NEXTDC in Action

Altium Limited (ASX: ALU) Working to Beat the COVID Related Headwinds

Provider of the PCB design software, PCB parts as well as data management software, Altium recently announced on 8th April 2020 appraising the strong operational and market position of the company. However, due to upsurge in COVID-19 cases, ALU withdrew its earnings guidance for FY2020.

ALU expects some headwinds driven by prolonged lockdown restrictions with SMEs’ cash management priorities likely to impact the company in its strong May and June months.

However, ALU believes to be well-positioned with strong financial performance and an existing cash balance of over US$77 million. Also, the company boosted its transactional sales capacity with the introduction of its new digital online sales capability. The model is expected to take some time to ramp up fully but shall play a support role in reaching the 100,000 subscriber target by 2025.

On 14th May 2020 (1:10 PM AEST), ALU stock traded at A$35.370 with a market capitalization of A$4.59 billion and ~ 131 million shares outstanding.

Computershare Limited (ASX: CPU) : Revision of FY’20 Earnings Guidance

CPU is a global market leader in transfer agency and provides software for share registration and shareholder communications.

On 7 April 2020t, he company announced following revised FY2020 earnings guidance:

- Decline in Management EPS is expected by ~ 20% on a constant currency basis in comparison to FY’19 wherein they had anticipated a decline of 15%

- Margin income for FY’20 is expected to be nearly A$180 million whereas, FY’21 value is expected to be~ A$100 million

- Assumption of average client balances in the range of A $13 billion to A$14 billion for Q4 2020

- Average cash balance in between A $14 billion and A$15 billion in FY2021.

- The positive sides are embarked with highlight that the Company’s recurring operating revenue is resilient, Expectations of a sharp rise in the Bankruptcy Administration pre filing work along with equity capital raisings activity ramp up.

On 14th May 2020 (1:10 PM AEST), CPU stock traded at A$11.770 with a market capitalization of A$6.43 billion and ~ 540.88 million shares outstanding.

While work from home, online learning, e-commerce, digital payments and tech transition of businesses have become new normal amidst lockdown and social distancing norms, tech players are getting immense boost to tap the burgeoning market opportunities. Market players may keep a watch on tech companies with competitve offerings, liquidity position and strong outlook.

_06_13_2025_00_59_44_862321.jpg)

_06_13_2025_00_34_45_117286.jpg)