Crude Oil Spot prices soared from the level of US$64.36 (Dayâs low on 25th June) to the level of US$66.94 (Dayâs high on 26th June 2019), which marked a rise of more than 4 per cent in a single trading session amid a drastic fall in the United States Crude Oil Inventory. The spot prices are currently recorded at US$66.66 (as on 28th June 5:16 PM AEST).

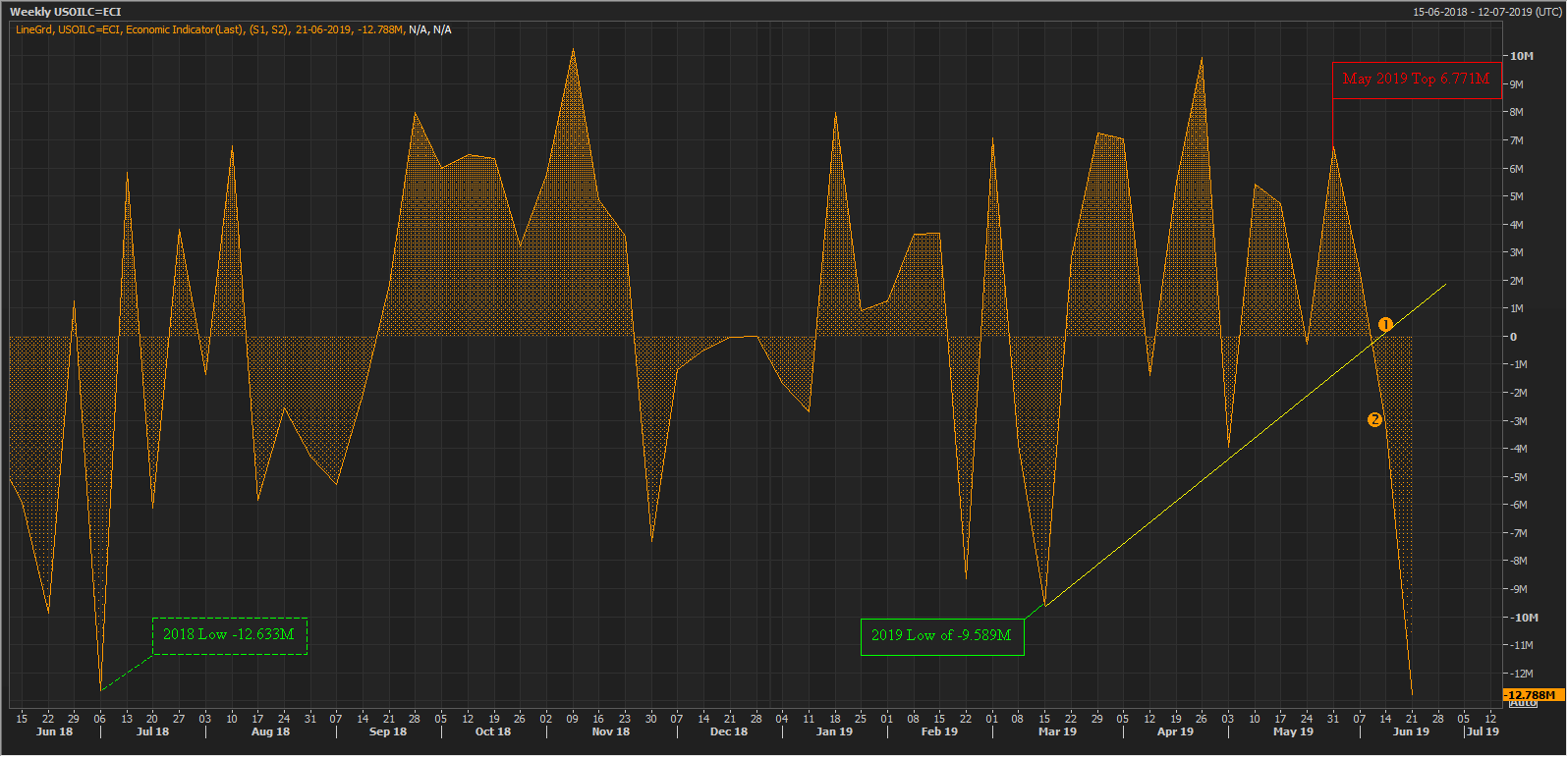

The United States Weekly Crude Oil Inventory plunged by -12.8 million (as on 21st June) post a previous decline of -3.1 million, which in turn, fanned the crude oil prices in the international market.

Inventory Analysis:

The United States Crude Oil Inventory plunged below the 2018 low of -12.633M on 21st June 2019. The restriction on imports along with a second consecutive decline in import volumes could explain the downfall in the crude oil inventory; however, the productivity of the rigs in the United States is improving, which in turn, could provide some respite to the U.S. domestic market.

For now, the crude inventory in the United States is moderate, and the recent drop has added a third consecutive fall in the crude stockpiles post a peak of 6.771M in May.

The factor which is contributing more towards the inventory fall in the United States is higher refinery inputs, which in turn, suggest that the domestic demand of oil is high, which could be further supportive for the crude oil prices.

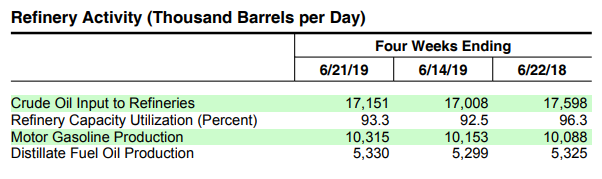

Petroleum Activities:

The refinery inputs in the United States inched up further by 73,000 barrels per day (for the week ended 21st June) post an increase of 200,000 barrels a day in the previous week. However, the refinery average inputs remained unchanged and stood at 17.3 million barrels per day (as on 21st June).

The refineriesâ operating capacity increased to stand at 94.2 per cent of the operable capacity against the previous level of 93.9 per cent, which in turn, could justify the fall in the inventory level along with the lesser imports.

Source: EIA

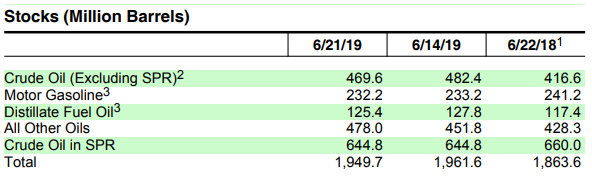

The tension between the United States and Iran along with the sanctions on Venezuela is witnessing a fall in crude imports from both the nations, which in turn, is further exerting pressure on the United States crude oil stockpiles.

The United States Crude Oil Inventory stands at 469.6 million barrels (as on 21st June), excluding those in the Strategic Petroleum Reserve, down by 12.8 million from its previous week level of 482.4 million barrels.

Source: EIA

Despite the drop, the inventory levels in the United States are about 5 per cent higher than the five-year average levels. However, there may be a further reduction in the United States inventory, if the nation sticks to its import restrictions.

The United States Crude import for the week ended 21st June 2019 averaged at 6.7 million barrels per day, down by 812,000 barrels per day from the previous week import average of 7.5 million barrels per day.

The average imports also marked a decline, and as per the data, the imports over the past four weeks averaged at 7.4 million barrels per day, which in turn, marks a decrease of 10.2 per cent from the same corresponding period for the week ended 21st June, and previously the import averaged at 7.5 million barrels a day.

On the supply side, the overall petroleum-based products supplied by the United States over the past four-week averaged at 20.6 million barrels a day (as on 21st June), which in turn, marks an increase of 1.8 per cent as compared to the same corresponding period in the year 2018.

In a nutshell, the lesser imports and higher refinery inputs exerted pressure on the crude oil inventory levels in the United States, which in turn, supported the crude oil prices; however, the investors should remain cautious as the inventory is still 5 per cent above the 5-year average inventory levels.

Crude Oil on Charts:

On a daily chart, the crude oil prices are trading above its previous resistance level of approx. US$63.77. The same level is now acting as the support for the prices, and investors should keep a close eye around the level, as a break below or sustain above would decide further action in it.

In the chart shown above, it can be seen that the prices are currently trading above the 7 and 20-days exponential moving averages, which are currently at US$64.86 and US$65.22 respectively. However, the prices are below its 200-day exponential moving average, which is at US$67.47.

The 200-days exponential moving average could further act as a hurdle for the crude oil prices, and after considering the trend of declining volume, it can be estimated that the 200-days EMA could post a strong resistance, as bullsâ strength is losing the momentum.

The global events and speculative buys support the current rally in the market, and investors should remain cautious around the current levels.

Future Outlook and Explorers Stance:

Behemoth independent oil traders such as BP, Vitol, etc., have forecasted the oil prices to experience a boom before stabilising around the level of US$55 to US$60 per barrel over the long-term, and as per the market consensus, the price anywhere around US$60 is sufficient enough for oil producers to operate comfortably.

The price boom is expected by many independent energy market experts as well before the crude oil finally reduces its share in the energy generation. The thought which shapes the bullish outlook for oil is the fact that crude oil has a restricted supply as it is a non-renewable energy resource.

Over the expected price boom, oil explorers and producers are brewing their production capabilities and building partnership.

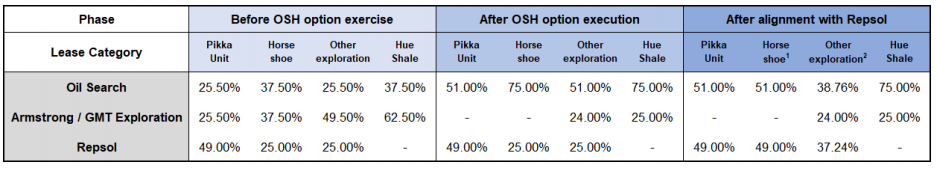

One such example is the Australian Securities Exchange-listed oil explorer- Oil Search Limited (ASX: OSH), when the company decided to double its stake in the Pikka Unit, Horseshoe Block and other exploration leases in Alaska by exercising the Armstrong/GMT option for US$450 million.

OSH decided to inch up the stake post analysing the data, which the company acquired over the last 18 months since the company made the original acquisition. As per the company, the assets in Alaska marked a gain in material value through drilling and testing over time, and now, the project development options have been matured.

OSH exercised its option to acquire a 25.5 per cent stake of Armstrong Energy LLC and 37.5 per cent interest of GMT Exploration Company LLC respectively, in the Pikka Unit and Horseshoe area. Apart from the stake in Pikka Unit and Horseshoe, the exercised option would further acquire 37.5 per cent interest in the Hue Shale leases and a 25.5 per cent stake in other exploration areas for a consideration of US$450 million.

Funding and Further Plans:

OSH would fund the acquisition from existing corporate facilities and from a US$300 million additional bank credit lines, which will be finalised shortly. The credit lines have a term of one year, which as per the company, is the maximum anticipated period to complete the sell-down of a portion of interest in the Alaska unit.

Apart from the bank lines of credit, OSH would use its existing US$900 million of corporate debt facilities to exercise the US$450 million option scheduled for late August.

On the sell-down of a portion, OSH would recommence a partial formal divestment process in the Alaskan portfolio, and the company scheduled a sale in the first half of 2020 ahead of FID (Final Investment Decision) for the Pikka Unit Nanushuk development. The scheduled tenure would provide the company with time to reassess the resource upgrade potential, which in turn, could maximise the sale value of the assets.

The company intends to hold 35.5 per cent of its core assets and in further response to the planned stake sale and to build a further relationship with the key operators in the North Slope, OSH entered an agreement with the Spanish mammoth- Repsol to sell a stake for a net payment of US$64.3 million.

The respective stakes, post the acquisition and completion all processes would be as follows:

Source: Companyâs Report

OSH settled the dayâs session at A$7.070, down by 1.81% as on 28 June 2019.

Other Energy Players on ASX:

Likewise, other energy players in the Australian market such as AGL Energy Limited (ASX: AGL) and Kalium Lakes Limited (ASX:KLL) are making sales and development progress.

AGL Energy is expecting first gas sale in the second half of the financial year 2022 from its proposed AGL Gas Import Jetty at Crib Point in Victoria. AGL settled the dayâs session at A$20.010, down by 0.55% as on 28 June 2019.

And, Kalium Lakes secured key gas supply and transport contracts with various reputable organisations to meet the requirements of its Beyondie Sulphate of Potash Project. As per the company, these contracts would provide 1 Terajoule of gas per day to produce 90ktpa of SOP a year. KLL settled the dayâs session at A$0.585, down by 0.86% as on 28 June 2019.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.