Introduction:

With growing dependence on information technology, the requirement of cyber protection has increased nowadays. With the evolution of artificial intelligence, individuals are dependent on technology for every common aspect of their lives. The technology, however, requires huge data related to every kind of information for individuals. Thus, the IT companies, including the artificial intelligence service provider businesses, require protecting their databases from any cyber threats. We will be discussing four businesses which work in the cyber risk advisory services.

Whitehawk Limited (ASX : WHK)

Whitehawk Limited offers solutions related to cyber risk advisory services. The company operates through internet-based cybersecurity marketplace where clients can take advice on their cybersecurity needs and be matched to vendor products.

Major Operating Highlights for Q3FY19:

- As per the latest update, the company is developing a permanent program with leading twelve defense industrial base company. This establishes an annual subscription supply chain of 150 Vendors and grosses over US$500,000. The company has landed this contract as the US Defense Department embarks upon an ambitious schedule enforcing cybersecurity within its industrial base.

- As per the market update, WHK is looking to execute the third phase of Cyber Risk Management contract collaborating with the top 10 financial institutions. The company has added 26 new vendors in the course of activity, while the Management reported that comprehensive program award has been delayed to January 2020.

- The company reported receivables collection of US$394K during the Q3FY19. The business reported a cash balance of US$1.78 million.

- The company reported cash used in operating activities at $0.177 million, net cash from investing activities at $0.155 million for the third quarter of FY19.

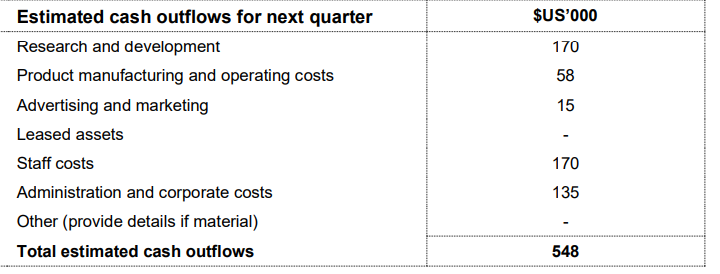

- As per the Q4FY19 cash flow guidance, the company expects a cash outflow of $0.548 million which includes $0.17 million in research and development and in staff costs each followed by $0.135 million for administrative and corporate costs.

Q4FY19 Estimated Cash Flow (Source: Company Resource)

Guidance: As per the Management guidance, the business will focus on maximizing execution on three current U.S. government CIO contracts during Q4FY19 and throughout 2020, following work initiation. The company will further look to mature current 360 Cyber Risk Framework proposal conversations with Defense Industrial Base companies and target to deliver one or two new contracts during Q42019. The company is planning to enhance its WhiteHawk 360 Cyber Risk Framework within the U.S. Defense Industrial Base. The product offers solutions for identifying, prioritizing and mitigating cyber risks across the defense industrial base.

Stock Update: The stock of WHK closed at $0.095, with no change as on 29 November 2019. On a three-months and six-months basis, the stock has given a return of 4.4% and -34.48%, respectively.

Senetas Corporation Limited (ASX : SEN)

Senetas Corporation Limited operates in development of network data encryption solutions.

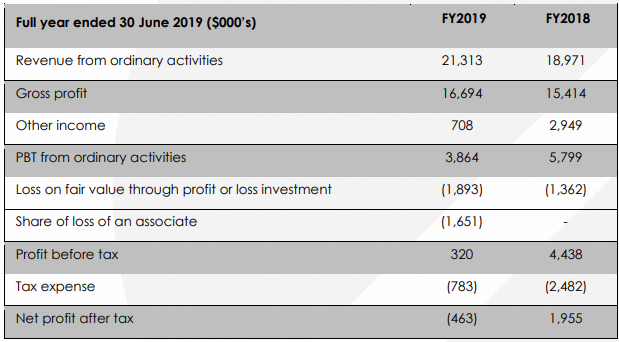

FY19 Financial Highlights for the period ended 30 June 2019: SEN declared its annual report wherein the company reported revenue of $21.3 million, up 12.3% on y-o-y basis stood better than the industry growth, aided by Increasing global awareness of cyber security concerns. The business reported growth in both sales and maintenance revenue, primarily in Europe. Revenue from Thales was up 15.8% on y-o-y basis. During the year, the company confirmed Thales as the exclusive global distribution partner after its acquisition of Gemalto.

FY19 tax expense includes a Research & Development credit of $1.40 million as compared to FY18 R&D rebate of $2.05 million. Recurring maintenance revenue represents ~40% of the total revenue. The company reported operating profit before tax of $3.86 million which excludes the impairment to the investment in Smart Antenna Technologies & share of Votiro loss.Net loss after tax during the period FY19 came in at $0.46 million as compared to a net profit of $1.955 million in FY18. SEN reported gross margin of 78% in FY19 as compared to 81% in previous financial year. The company reported decent progress in Votiro, which is in line with expectations and good progress being made in building distribution relationships and sales capability.

The business reported strong balance sheet with $17.86 million of cash in hand and zero debt.

FY19 Financial Highlights (Source: Company Reports)

Outlook: As per the management guidance, the company will be looking for innovation for their existing products suite with transport layer independence and virtual technologies and several other revenue opportunities. The Management is positive from its recent investment in Votiro and expects that the CDR technology is likely to grow at a decent pace in the future.

Stock Update: The stock of SEN was placed at $0.070 as on 29 November 2019. The stock has generated a negative return of 25.56% in the last one year.

Elsight Limited (ASX: ELS)

Elsight Limited is engaged in providing cutting-edge communications and live data transmission solutions for organizations across defense & security, IoT, large-scale Safe City projects, sensitive facilities management.

As per the recent market update, the company reported the following business highlights relating to the business expansion in the US Markets which are summed up as follows:

- The business has reported an upgraded version of Halo v1.1, which is ready for commercial deployment to strategic customers.

- ELS is ready to open its North American Office in Atlanta, GA in coming days.

- The business has started hiring of its key personnel and doing several promotions to drive Halo v1.1 sales and marketing efforts.

- ELS confirmed its first purchase order which includes ten Halo units from Airobotics, a tier one automated service provider based in US-based. As per the Management updates, Airobotics will look for industrial drone and aerial data platforms, while the company will be targeting for pilot trial in coming days.

- As per the market update, the company informed Halo is a brand-new offering from ELS. The product contains a compact form factor in respect to the physical weight and offers minimum battery consumption and heat index.

- The companyâs Airoboticsâ pilotless drone solution came up as the only regulatory compliant commercial UAV solution across the Globe. The above solution can be operated with the help of a remote. With Airoboticsâ end-to-end automated drone technology, the company intends to simplify the drone operations.

- The management intends full integration of Elsightâs Halo communication platform into Airoboticsâ range of solutions enabling Airoboticsâ standard communications system to power aerial-data collection in Smart Cities.

Stock Update: The stock of ELS closed at $0.445, up 1.136% as on 29 November 2019 with a market capitalization of $42.35 million. The stock has given returns of 12.82% and -14.56% in the last three months and six months respectively.

Prophecy International Holdings Limited (ASX : PRO)

Prophecy International Holdings Limited is engaged in designing, development and marketing of computer software applications and services aimed at the worldwide corporate marketplace.

FY19 Operational Highlights for the Period ended 30 June 2019: PRO declared its FY19 financial results, wherein the company reported revenue of $12.11 million as compared to $10.676 million in FY18. During FY19, the company reported 28.9% growth in snare sales followed by 71% growth in ARR for eMite. The company successfully added 90 new eMite customers during the financial year. The company reported EBITDA of $0.087 million during FY19 as compared to $0.517 million in FY18. The 83% decrease in EBITDA was principally caused by $703K increase in expenses. The company reported loss of $1.45 million during FY19 as compared to $0.79 million in the previous financial year. The company announced two products eMite and Snare Analytics for Amazon Connect during the financial year 2019. The company reported total current assets of $6.93 million which includes cash and cash equivalent of $4.375 million, trade receivables of $2.215 million and other assets of $0.342 million. The business reported total assets of $22.866 million, including property, plant and equipment (PPE) of $0.251 million and intangibles of $15.39 million as on 30 June 2019. PRO reported net assets of $15.787 million during the end of FY19. The business derives 73.9% of the revenue from USA, 19.7% from Australia and 6.3% from Asia. The company reported $2 million of operating cash flow during the period.

Stock Update: The stock of PRO closed at $0.52 with a market capitalization of $33.29 million on 29 November 2019. The stock has generated 42.47% and 92.59% returns in the last three months and six-months, respectively.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.