The first online cyber security exchange across the world, WhiteHawk Limited (ASX:WHK) is an Australian-headquartered firm allowing SMEs to take smart measures against fraud and cybercrime. It is a cloud-based cyber security exchange platform that offers virtual consultations, AI Cyber Risk Profiles that instantly match SME customers to customised solutions on demand. The platform permits firms to satisfy their requirements on a continuing basis with proven time and cost savings.

WhiteHawk has recently released two updates related to its 360 Cyber Risk Framework on the Australian Stock Exchange (ASX). The companyâs extensive 360 Cyber Risk Framework comprises continuous monitoring, mitigation and alerting of cyber and business risks for vendor companies and supply chain in real-time. The company has also announced an update related to the Defense Industrial Base outreach challenge.

Let us discuss all the three updates in some detail below:

Issue of USD 360,0000 Invoices

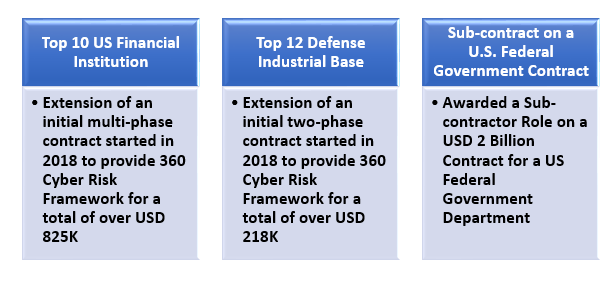

The company informed that it has invoiced a total of USD 360,000 in initial revenues from three contracts to provide WhiteHawkâs 360 Cyber Risk Framework. The three contracts include:

Now, let us discuss each one of them in some detail below:

Contract Extension with a Top 10 US Financial Institution

The company notified in August this year about a contract extension with a Top 10 U.S. Financial Institution to provide 360 Cyber Risk Framework. This customer contracted with WhiteHawk to apply 360 Cyber Risk Framework, which incorporated delivery of an online SaaS (Software as a Service) subscription developed by consulting services engaged in cyber risk management. Under the contract, the customer was to receive WhiteHawk Risk Portfolio Reports and Cyber Risk Scorecards for fifty suppliers.

Contract Extension with a Top 12 Defense Industrial Base Company

In June 2019, the company announced the contract extension with a Top 12 Defense Industrial Base company signed to provide 360 Cyber Risk Framework for supply chain risk management. The company entered into a contract with this customer in December 2018, under which the customer was to receive Risk Portfolio Reports for the top five suppliers and quarterly Cyber Risk Scorecards for 30 additional suppliers. The contract also enabled the customer to apply 360 Cyber Risk Framework, which incorporated delivery of an online SaaS subscription developed by consulting services. The contract extension proved the companyâs ability to extend prevailing contracts and produce recurring SaaS revenue from its technology.

Sub-Contract on US Governmentâs Project

WhiteHawk recently notified about being awarded a sub-contractor role for five years (one year with four option years) on a newly assigned USD 2 billion US Federal Government Department Chief Information Office contract. Under the contract, the company was to work under a Virginia based company (primary contractor) and provide cyber intelligence and transition and innovation introduction, a comprehensive Cyber Risk Management Framework, as well as customised cyber subject matter expertise within the framework of the primeâs team.

The company also mentioned that it is expected to earn revenue between USD 300K to USD 600K in the first year, and contingent upon the final scoping by the customer and Prime, revenue is likely to grow between USD 1 million to USD 3 million per year in subsequent years.

Engagement in a "proofs of value"

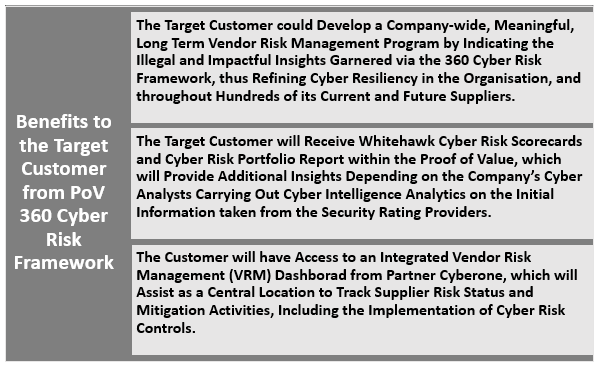

WhiteHawk has recently informed about the engagement with a renowned global insurance leader in a "proofs of value" (PoV) agreement, which has the potential to generate major long-term opportunities. The company has been working with this multibillion-dollar international insurance group to undertake a PoV 360 Cyber Risk Framework for up to ten of their existing suppliers, which provide a various range of products and services, including software, industrial consulting, banking, finance, cloud, technology, and professional services.

The PoV includes the newly automated WhiteHawk Cyber Risk Scorecards, the Interos business risk platform, and the advanced CyberOne Vendor Risk Module.

Mr Terry Roberts, Executive Chair of WhiteHawk, believes that the companyâs integrated, scalable and automated approach has the potential to enable Insurance Groups to mitigate and identify business and cyber risks in near real-time.

WhiteHawk in Top Five Submissions in U.S. Cyber Command

The companyâs proposal was chosen and recognised as one of the top five submissions in the U.S. Cyber Commandâs recently announced Other Transaction Authority request for proposal via its accelerator counterpart, DreamPort. Under the proposal, the authorities are required to determine innovative commercial solutions with automated cyber risk collection and analysis approaches, where human intervention is not required for determining the cyber security posture of at least twenty DIB (Defense Industrial Base) companies. The winner of this DIB outreach challenge is likely to receive a prize money of USD 25,000.

With the selection, WhiteHawk has got a chance to a face-to-face demonstration with DOD (Department of Defense) cyber procurement heads. Through this opportunity, the company will be easily accessible to authorities that wish to speed up the typical government RFP process and cyber risk mitigation service contracting.

The significant developments discussed in this article showcase WhiteHawkâs strength and growth trajectory, backed by customersâ reliability on this cyber security exchange platform. The company has witnessed substantial growth so far and is expanding at an accelerated pace.

Stock Performance: WHKâs stock was trading higher at AUD 0.087 with a rise of 2.35 per cent by the close of trading session on 4 September 2019. The stock has generated a YTD return of 26.87 per cent.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. The above article is sponsored but NOT a solicitation or recommendation to buy, sell or hold the stock of the company (or companies) under discussion. We are neither licensed nor qualified to provide investment advice through this platform.