In the wake of shaky world economic scenario, investors are flocking into the equity markets while looking for safe investment options. Some experts believe that investing in the equity market is one of the best ways through which one can build real wealth. One of the primary benefits offered by equities is the chance to grow your money by identifying the right stocks to invest in. Generally, a rational investor does not put all his hard-earned money into a single stock; rather diversifies its stock portfolio to mitigate the equity market risk.

Why Invest in Australian Equity Market?

As per the Reserve Bank of Australia (RBA), the equity market is one of the most high-profile and important financial market of Australia, which is a destination for a large share of households' retirement savings and an important source of funding for Australian companies. The bank mentioned that the total capitalisation of listed companies in Australia was ~$2 trillion at the end of 2018, which is approximately 100% of the GDP. Also, the share prices in Australia have risen at a geometric average of about 6% year over the past hundred years.

Advantages of Long-Term Investments

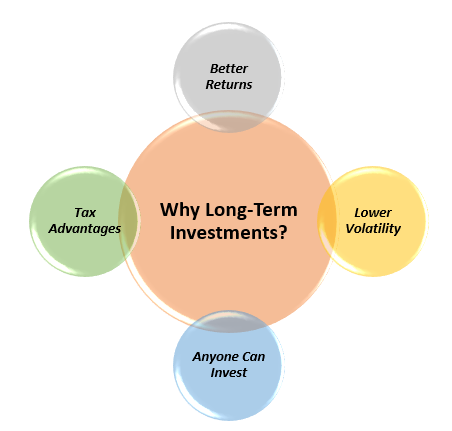

Though investments in the equity market have the potential to offer substantial returns, choosing the right stocks become a difficult task. Considering this, many experts advise to invest in the equity market for a long-term as the stock market returns are usually unstable in short time period.

Below are some of the benefits associated with long-term investing:

- The historical performance of the equity market suggests that the stocks deliver better returns in the long-term relative to short-term. For instance, the Australian equity marketâs benchmark S&P/ASX 200 Index has delivered a substantial return of more than 40 per cent in the last ten years, while a return of just over 4 per cent in the last one year (calculated till 4th September 2019).

- The stocks exhibit lower volatility in the long run than the shorter time frames. It has been observed that the effect of economic/political/business fluctuations on the stock market is comparatively higher in the short term than the long term.

- Long term investment help investors earn tax advantages. The capital gains tax in Australia is higher if an investor holds an asset for 365 days or less, while it is much lower when the asset is held for over 12 months.

- One of the greatest benefits of holding stocks for a long term is that anyone can go for long-term investing, evading hassles of an active trading.

Choosing Stocks for Long-Term Investment

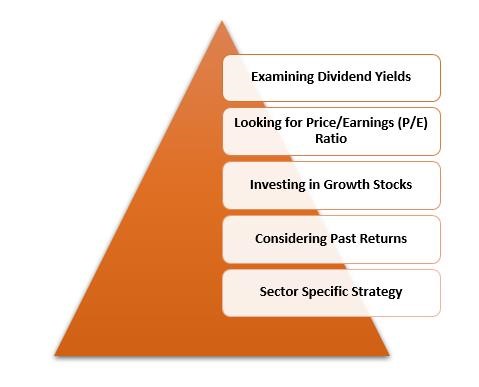

Even if one has decided to invest in the equity market for a longer time period, the major hurdle on the way of investment is the selection of stocks. Different investors adopt different criteria to select appropriate stocks. Following are some of the strategies used by investors to identify good long-term buys:

Let us now study each of these strategies in some detail below:

Examining Dividend Yields

A companyâs ability and consistency to pay dividends is generally considered as an important factor in ascertaining its stability. Investors look for dividend yields of stocks before investing, as dividends provide steady income and are considered as a safe investment. Dividend yield is determined by dividing the company's annual dividend by its share price. A higher dividend yield is generally considered as a better option as it signifies that the company is offering a higher percentage of its share price as dividends, thereby delivering a greater return for its shareholders' investments.

The below table summarizes the list of some ASX-listed stocks whose dividend yields are more than 10 per cent at the moment (as per ASX):

Looking for Price/Earnings (P/E) Ratio

The P/E ratio demonstrates the relationship between stock price of a company and its earnings per share (EPS). The high P/E ratio of a stock indicates that investors expect higher earnings from the stock in the future. So, investors seeking long term investments sometimes consider the P/E ratio as a tool to determine the right stocks. The below table summarizes the list of some ASX-listed stocks with high P/E ratio:

Investing in Growth Stocks

Growth stocks comprise the stocks that are projected to grow above the average market rate in future. This unique characteristic of these stocks attracts investorâs attention the most. The stocks of the companies belonging to a sector that has prospective growth outlook are usually considered as growth stocks.

Some of the growth stocks listed on the ASX include Appen Limited (ASX: APX), Bravura Solutions Limited (ASX: BVS), Xero Limited (ASX: XRO), Altium Limited (ASX: ALU), IDP Education Limited (ASX:IEL), Volpara Health Technologies Limited (ASX: VHT) and Webjet Limited (ASX: WEB).

Considering Past Returns

The historical performance of a stock is one of the best ways to determine its future prospect. Many of the stocks listed on the ASX have delivered substantial returns in the last 10 years. Let us take a look at few of them in the below table:

Sector Specific strategy

At times investors prefer to play sector-specific investing strategy based on the ongoing trends/performance. For instance â some market players tend to play safe and hunt for consumer staples stocks or the stocks of the companies offering essential products. These stocks are categorized as non-cyclical in nature, unlike consumer discretionary stocks. The demand for the products of consumer staples companies is relatively less or not affected by the economic fluctuations, so does the demand for these stocks.

Some of the consumer staples stocks listed on the ASX include Woolworths Group Limited (ASX: WOW), Bellamyâs Australia Limited (ASX: BAL), Coles Group Limited (ASX: COL), GrainCorp Limited (ASX: GNC), Inghams Group Limited (ASX: ING), Blackmores Limited (ASX: BKL) and The a2 Milk Company Limited (ASX: A2M).

It can be inferred that there are several strategies available that can be used by an investor to identify the right stocks for long-term investment. One can also adopt a combination of these strategies to create a stock portfolio, minimizing the risks associated with a single strategy.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.