Summary

- COVID-19 pandemic has created an opportunity for many companies focused on meeting customer demands by delivering need of the hour products.

- Pushpay Holdings, through its online giving tool, proved instrumental in boosting donation for non-profit organisations that are actively assisting COVID-struck regions or recuperating from natural disasters.

- Pro Medicus, which provides technology-based imaging information, has weathered the pandemic by providing services to its long-term clients.

- a2 Milk experienced a surge in revenues during the pandemic led by panic buying.

The three stocks we will be discussing has been buzzing on the Australian Stock Exchange (ASX), primarily on the back of their stupendous financial performance, strong product offerings and client base expansion. Each company has weathered the pandemic with their product offerings that have been instrumental in supporting lives/businesses amid the COVID-19 scenario.

Do Read: Strategies to Build Recession-Proof Stocks

Let’s discuss these three ASX-listed companies in detail.

Pushpay Holdings Limited (ASX:PPH)

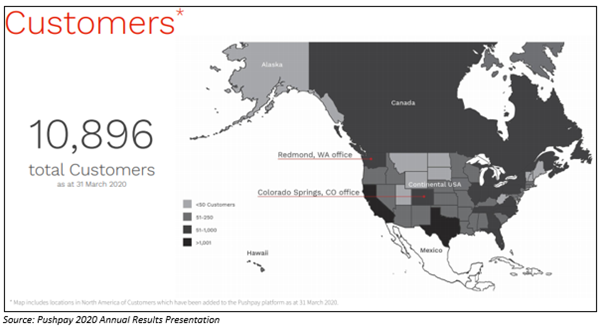

Donor management system provider, Pushpay Holdings Limited serves non-profit organisations, education providers and the faith industry.

In the year 2020, the Company has witnessed extraordinary growth with its share last trading at AU$6.800 on 12 June 2020, almost 75% year-till-date growth. COVID-19 restrictions prohibiting physical movement have presented Pushpay Holdings a unique opportunity to leverage its electronic payment tool to facilitate online giving. The Company’s acquisition of US-based industry leader in church management software (ChMS), Church Community Builder, also augmented Pushpay’s ability to provide more novel products to its customers.

For the 12-month period ended 31 March 2020 (FY20), PPH announced encouraging results with total revenue hitting US$129.8 million, a year-on-year increase of 32%. The Company recorded an NPAT of US$16.0 million for FY20, a year-on-year decrease of 15% from US$18.8 million. Operating revenue increased by 33% to reach US$127.5 million. Operating cash flow improved by 953% to reach US$23.5 million from negative US$2.8 million.

Outlook - Pushpay has given a positive guidance with expected EBITDAF for FY2021 in the range of US$48.0 million to US$52.0 million. The Company aims to keep a check on cost side of the business while ensuring efficiency remains high. PPH intends to drive its revenues by focusing on more digital-based services including a partnership with Stream Monkey, an online video streaming provider.

Under long-term goals, Pushpay plans to target over 50% of the medium & large church divisions, an opportunity representing annual revenue of more than US$1 billion.

Do Read: 5 FinTech Companies - Can These be The Tech Titans of Tomorrow

Pro Medicus Limited (ASX:PME)

Pro Medicus Limited is an Australia-based company offering technology-based solutions, providing health imaging information to hospitals, imaging centres and health care groups.

The share price of PME has increased only 4% on a month-on-month basis and around 23% on a year-to-date basis to reach AU$27.39 on 12 June 2020. Its products, Visage 7 platform and Visage RIS hold potential in the market with the Company having long-term contracts with two leading Australia-based radiology providers – Primary Healthcare and I-MED Network Radiology.

For half year 2020 ended 31 December 2019, results have been promising with revenue growth of 15.7% to AU$29.3 million. Profit after tax reached AU$12.1, indicating a rise of 32.7%. Cash reserves increased by 20.2% to AU$38.8 million with no debt.

Footprint Expansion in the US - On 1 June 2020, the Company announced an AU$22 million worth five-year long strategic contract with Chicago-based Northwestern Memorial HealthCare. The Visage 7 technology will be implemented at radiology departments of Northwestern under a transaction-based licensing model in Q1 FY21. The contract boosts the Company’s footprint in the academic hospital segment in the United States, in addition to regionally based community hospitals.

Business Amid COVID-19 - The COVID-19 pandemic ate away PME’s revenue in the last week of March and first two weeks of April, with maximum declines experienced in non-essential/ elective imaging. Since then, the volumes have picked up with Australia contributing major portion to the uptick. The Company claims to have strong pipeline of clients and expects its sales cycle to move forward with more growth opportunities.

Do Read: 5 ASX-Listed Companies with Solid Balance Sheet: CDA, ALU, MPL, PME, NAN

The a2 Milk Company Limited (ASX:A2M)

The a2 Milk Company provides milk and other dairy related products and operates in Australia, New Zealand, China, United States, and other selected emerging markets. The Company will be added to S&P/ASX 50 Index on 22 June 2020, as per the June 2020 Quarterly Rebalance announced by S&P Dow Jones Indices.

The Company, which boasted a 3000%+ increase in share price over 5 years, has seen sluggish growth since last year. However, stock market was not very upbeat about a2 Milk with investors shying away from the Company and shares experiencing around 30% increase over one year to reach AU$17.68 on 12 June 2020.

Majority of stocks experienced a massive fall, as S&P/ASX 200 touched its lowest mark in last four years on 23rd March 2020. Since the great fall, the Company is witnessing double digit growth in the range of 10% to 35%. The rise has been primarily driven by growing demand for products from supermarkets because of panic buying, lockdowns and closure of various physical brick and mortar shops.

A2M announced a 31.6% year-over-year increase in half yearly revenues to NZ$ 806.7 million at 31 December 2019. The Company recorded an NPAT of NZ$184.9 million for HY’ 2020, a year-on-year increase of 21.1% from NZ$152.7% million. EBITDA for HY’ 2020 increased by 21% to reach NZ$263.2 million.

International market proved to be lot more promising with sales boom experienced in China and the US. Emerging market such as China and other regions from Asia experienced almost 77% surge in revenues for HY’ 2020. Sales of a2 Platinum® China label Infant nutrition doubled in HY’ 2020 over the prior corresponding period. The US market recorded a 115.7% increase in revenues.

Primarily driven by changes in consumer purchase behaviour arising from the COVID-19 situation, the Company experienced revenue above expectations for the three months to 31 March 2020.

Outlook - a2 Milk anticipates FY20 EBITDA margin in the range of 31%-32% and revenue between NZ$1,700 million and NZ$1,750 million. The Company intends to boost revenue by expanding in various international markets.

A2M entered a production, distribution, and sale & marketing agreement with Agrifoods Cooperative in March 2020 for its a2 Milk™ products for the Canadian market. With Synlait, the Company’s manufacturing and supply partnership got extended to 2025, boosting the New Zealand business.

Must Read: Infant formula industry going steady: Lens on A2M, BUB, NUC, LON

_09_03_2024_01_03_36_873870.jpg)