APA Group and WorleyParsons Limited, both are significant players associated with the resources sector. The oil price has recently been affected due to decline in exports from Saudi Arabia, which is the world's top oil exporter and, due to the uncertainty for the global economic outlook on the back of the US-China trade war. Now, Saudi Arabia has planned to keep its crude exports below 7 million barrels per day (bpd) in August and September this year. Saudi Arabia has taken this measure despite, strong demand from customers, and which would bring the oil market back to balance. Presently, the market is awaiting clarity from the next round of discussion on US-China trade.

On this backdrop, let us now go through the two stocks and their respective full year report released recently.

APA Group

Decent FY 19 financial performance with robust outlook for FY 20:

On 21 August 2019, APA Group (ASX: APA) released full year report closing 30 June 2019.

Outlook

For fiscal 2020, APA expects EBITDA to be in the range of $1,660 million to $1,690 million. The company anticipates net interest costs to be a range of $505 million to $515 million, distributions per security are projected to be of approximately 50 cents per security and the company may allocate franking credits to the distributions, which will depend upon the corporate tax paid during fiscal 2020. The company has projected the growth capital expenditure to be in the range of $300 - $400 million per annum for the next two to three years. Also, from the Orbost Gas Processing Plant, the company expects to deliver first gas sales in the fourth quarter of CY2019, which means there will be an increase in the earnings and operating cash flow (OCF) of the company in fiscal year 2020 and beyond.

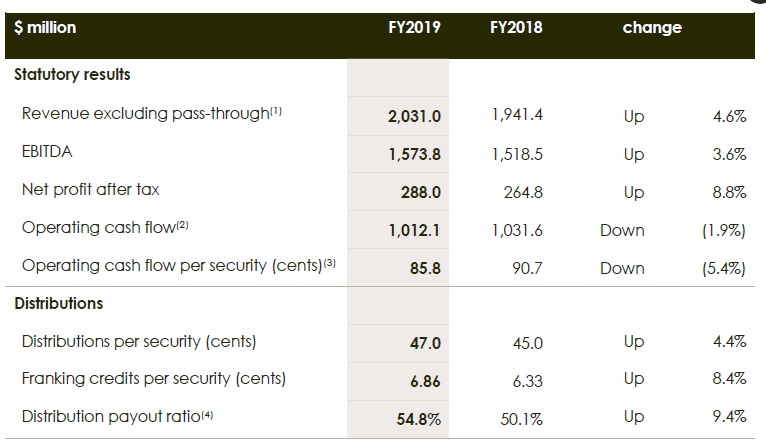

Financials

Meanwhile, for FY 19, the company has reported 4.6% rise in the revenue (excluding pass-through revenue) to $2,031.0 million on the previous corresponding period. The revenue grew on the back of full and part-year contributions made by the new assets that had begun during the FY18 and FY19 period. The continuous advantage from an increase in CPI among most of the consumersâ contracts and favourable exchange rate variations were associated with the revenues received from the Wallumbilla Gladstone Pipeline contracts. Further, the company has posted 8.8% growth in the net profit after tax to $288 million over the previous corresponding period.

However, in FY 19, operating cash flow declined by 1.9% to $1,012.1 million compared with the previous year on the back of a rise in income tax paid that is paid by the company in FY 19. As a result, the operating cash flow per security has contracted by 5.4% to 85.8 cents per security. During FY 19, the company has refinanced the debt of $700 million, which will reduce the annual interest expense of the company and had extended the average time period of the debt book.

Additionally, the company has declared the final dividend for FY 19 of 25.5 cents per security which the company would pay on 11 September 2019. The ex date for the dividend was 27 June this year and the record date was of 28 June this year.

Largest Capital Investment Programme:

APA had undertaken the largest capital investment program in the last three years, under which the company is investing more than $1.4 billion in the new projects. The new infrastructure includes 8 new assets, 272 km of transmission pipelines, 45 MW gas-fired power station, and approximately 278 MW of renewable generation. Also, there is 260 kilometres of additional transmission pipelines being added and the power generation capacity are expanded by more than 300 MW, that includes more than 275 MW of renewable energy assets.

In FY 19, the company has completed major projects like 198 km Yamarna Gas Pipeline, 45 MW Gruyere Power Station, 25 km Agnew Lateral, 130 MW Badgingarra Wind Farm, 17.5 MW Badgingarra Solar Farm and 110 MW Darling Downs Solar Farm.

Moreover, the company in FY 19 has signed three significant contract variations and new services with customers of total value in the order of $175 million. The company in 2019 had extended Incitec Pivot GTA, which will help Gibson Island Plant to operate further for another three years, the MoU has been signed with Comet Ridge Ltd and Vintage Energy Ltd for build, own and operate the proposed 240 km Galilee Moranbah Pipeline which will connect the Galilee Basin in QLD to gas markets. The company has already got Survey Licence for it. The companyâs Dandenong Power Project has been shortlisted as part of the Federal Government's Underwriting New Generation Investments (UNGI) scheme.

FY 19 Financial Performance (Source: Companyâs Report)

On 23 August 2019, APAâs stock last traded at A$10.89, sliding down by 0.092 percent from the prior close. In the last three months duration, the stock of the company has generated a return of 6.45 percent.

WorleyParsons Limited

Strong Performance in FY 19:

WorleyParsons Limited (ASX:WOR)

On 21 August 2019, WOR declared full year report for the time period ending 30 June this year.

ECR acquisition

The company has acquired Energy, Chemicals and Resources division (ECR) from Jacobs Engineering Group Inc for an aggregate value of $4.6 billion in April this year. The acquisition was funded by an entitlement offer of A$2.9 billion, 11.1% of WOR stock issued to Jacobs and additional debt. ECR has substantial operations in the countries like US, Canada, the Middle East and India. The financial results of FY 19 comprise of the performance of ECR for the two-month period from the acquisition date (26 April 2019).

Financials

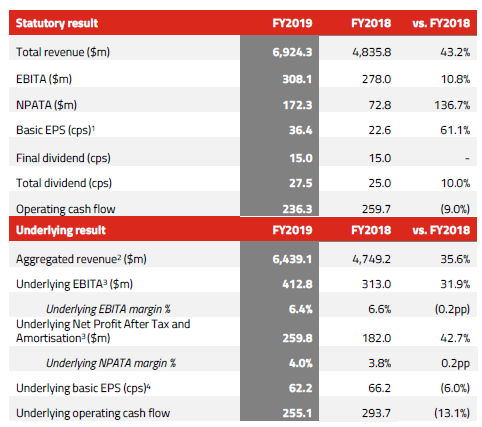

Further, in FY 19 the company has reported 35.6% rise in the aggregated revenue to $6,439.1 million, on back of an improvement of market environment and the inclusion of the ECR business. The company has reported 43% growth in the Underlying NPATA standing at $259.8 million.

During FY 19, there has been 32% increase in an Underlying EBITA to $412.8 million. The companyâs backlog has risen by 10% to $18 billion from $16.4 billion (proforma), the company has reduced Leverage to 1.9x from 2.1x at 31 December 2018.

Moreover, on statutory result basis, the company has reported 43% rise in revenue to $6,924.3 million and 137% growth in NPATA to $172.3 million. However, Cash flow from operations fell to $236.3 million from $259.7 million for the prior corresponding period.

At the end of FY 19, the companyâs net debt to EBITDA has fallen to 1.9x and the gearing stands at 20.9%. Additionally, WOR has refinanced the companyâs core syndicated debt facility. The new multi-currency facility comprises of revolving credit facility of total worth- US$500 million and a US$800 million term loan. The facility is projected to mature in February 2024.

In addition, the company will pay a final dividend of 15 cents per share, fully unfranked, on 25 September 2019. It has an ex date of 27 August this year and the record date of 28 August this year.

On the outlook front, for FY 2020 period, the company is anticipating receiving benefits from its newly acquired business - ECR.

FY 19 Financial Performance (Source: Companyâs Report)

On 23 August 2019, by the end of the trading session, WORâs stock was at a price of A$13.52, slipping down by 2.312 percent from its last close. For the last three months duration, the stock of the company has provided a negative return of 0.50 percent.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.