Summary

- Since the Royal Commission into Banking, the industry has been going through multiple changes and new legislations.

- Leadership in most of the business is completely new, and they are focusing on improving long term prospects of the businesses.

- Divestments and exiting non-core businesses have been the theme across the major banks over the recent past.

- Incumbents go for overhaul, CBA- goes lean and WBC new leadership at helm.

Banking and financial services industry has been navigating troubled waters for over two and a half years now. In November 2017, the Banking Royal Commission enquiry was launched. A month later, Commonwealth Bank revealed breach of Anti Money Laundering/Counter Terrorism Financing breaches. A long list of hearings, uncovering breaches and misconduct continued – ravaging stature of prominent players in the industry.

Consequently, the industry has been plagued with class action suits, heavy fines, criminal proceedings that have led incumbent companies to sell parts of businesses. And, now the industry, especially the banking industry, has been taking large hits due to COVID-19.

Some have called this moment as a redemption moment for the banks, largely due to support launched by the banking companies to support the economy in a crisis. Since COVID-19 implications became apparent in March, the banking industry has been introducing a range measures to support the economy.

Conflict of Interest

In the first round of enquiry, the Royal Commission looked into consumer lending, which included scrutiny of credit cards, mortgages, car financing and insurance. It was revealed that commissions were being paid to individual referring products, and there was a conflict of interest between the brokers and clients.

The Australian Competition and Consumer Commission, in its interim report on residential mortgage enquiry, also revealed major banks refrained from competition and chose to have mutually beneficial interest rates.

Fees Levied for No Service Rendered

Round 2 of hearing was into financial advice, which included conducts of financial advisors and fee for no service. Several businesses were accused of misconduct and fees for no service. In one case, advisor continued to charge fees, despite the client being dead for the past ten years. Similarly, the enquiry conducted investigations into other services, including superannuation and insurance, revealing substantial misconduct by the service providers.

Introducing -APRA Heatmap

In May 2018, Productivity Commission published a report on Superannuation, revealing scrapping unintended multiple accounts and underperforming funds will likely benefit members by $3.9 billion a year.

It was noted that around 10 million unintended super accounts are costing $2.6 billion to members in fees and insurance. These revelations also prompted the Australian Prudential Regulatory Authority to release APRA Heatmap.

But banking companies are effectively redeeming their sins. As of 3 June 2020, the total number of loans deferred by the industry stood at around 762k, of which 476k were mortgages and 214k were business loans, according to the Australian Banking Association.

Total amount of deferred loans was $232.64 billion, which included $172.24 billion of mortgages and $59.2 billion of business loans. Banks had originated $109.53 billion in new business loans, which constituted around $60 billion loans to SMEs, $14.7 billion to sole traders and $22.32 billion to large corporations.

CBA Going Lean

Commonwealth Bank of Australia (ASX:CBA) intends to become a simple and better bank with leading digital offering and superior position in retail and commercial banking. It has been divesting non-core business aggressively and has completed sale of Colonial First State Global Asset Management, TymeDigital, Sovereign, and Count Financial.

Last month, it announced divestment of 55% interest in Colonial First State to KKR for $1.7 billion. CBA would continue to invest in the business in partnership with KKR, and the entity would operate as a standalone business. The transaction delivered a post-tax gain on sale of around $1.5 billion.

It also announced that final regulatory approval was received for 80% sale of its interest in Indonesian life insurance business, which is expected to close this month.

CBA is selling its interest to PT FWD Life Indonesia, but it will continue to distribute life products through its Indonesian business for 15 years under the agreement with the acquiring party. Both transactions would improve the CET1 Level 2 ratio of the group.

Also, divestment programs are underway for CommInsure Life and BoCommLife. In the second-half 2020, the bank would cease trading within Financial Wisdom and CFP-Pathways.

Source: CBA HY Presentation, February 2020

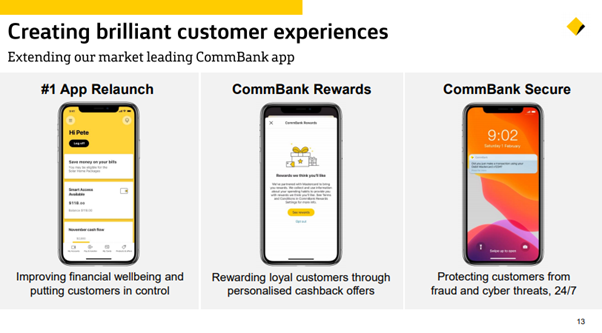

Commonwealth Bank continues to invest in growth initiatives and innovation. Its partnership with Klarna has provided shop now pay later services for the customers in the bank’s market leading mobile application. It is leveraging X15 Ventures to invest in a pipeline of new digital businesses to deliver best customer experience. CBA intends to invest launch 25 ventures over the course of 5 years.

On 5 June 2020, CBA last traded at $68.73.

WBC New Stewardship

Westpac Banking Corporation (ASX:WBC) is now operating under new leadership. Banking and turnaround veteran John McFarlane is leading the Board. Peter King, who was CFO of the group, has filled in the shoes of CEO of the group.

WBC appointed Jason Yetton to lead the Specialist Businesses – a new division. It has been said that Westpac will focus on banking business in Australia and New Zealand.

This new division, led by Mr Yetton, is undergoing a strategic review to consider the future of the businesses within the division. Under the new division, the businesses include auto finance, life insurance, general insurance, wealth platforms, investments, Pacific business, retirement products, and wealth platforms.

In these businesses, the group doesn’t have sufficient scale to generate the returns that compensate for risks associated with these entities. Mr Yetton was associated with CBA most recently, and he had held various roles at Westpac earlier.

On 5 June 2020, WBC last traded at $18.79.

Banking and financial services industry is operating under a new regime with a focus on improving operational ethics as well as profit sustainability. A crisis has provided the incumbents with an opportunity to reposition the businesses and deliver long term prosperity.