In Australia, the banking industry is dominated by the four major banks that include Australia & New Zealand Banking Group Limited (ASX: ANZ), Commonwealth Bank of Australia (ASX: CBA), National Australia Bank Limited (ASX: NAB), and Westpac Banking Corporation (ASX: WBC).

These banking corporations are among the top companies in the country, recognised in the S&P/ASX 20 index, among other indices. As a large-cap, blue-chip companies, the major banks are known for their dividends and stability. Increasingly, the income earning capabilities of the major banks are in jeopardy.

The competition watchdog â Australian Competition and Consumer Commission (ACCC) is turning its focus to the major banks, as reported by media. It is said that the competition commission is planning to initiate an enquiry to crack down the barriers to make an entry in the retail banking â a sector dominated by the major banks.

Remediation Costs â customer is the king!

Remediation costs are not only impacting the major banks but substantial financial services in the country, following the sector-wide enquiry by â Haynes Royal Commission last year. Presently, the companies, having disclosed substantial costs in the results release, are trading in the fresh fiscal year with increased compliance all around.

On 8 October 2019, ANZ has reported that it expects that the second half (ended 30 September 2019) cash profit to be impacted by $559 million (post-tax) for the remediation of customer costs. This includes $405 million (after-tax) in customer remediation from continuing operations, and $154 million (after-tax) from discontinued operations.

This month NAB notified on the additional charges of $1.18 billion after-tax associated with the enhanced provisions for consumer-related remediation and a shift to the application of the software capitalisation policy. In addition, the bank has incurred remediation costs of $525 million in the first half of the year ended 31 March 2019. In the half-year ended 31 March 2019, WBC had incurred $896 million in provisions for customer remediation.

Recently, CBA was served with criminal proceedings against its insurance arm for 87 counts of the anti-hawking provisions of the Corporations Act 2001 by the Commonwealth Director of Public Prosecutions. In addition, CBA had incurred a total of $2.2 billion in the year ended 30 June 2019 (FY 2019), an increase of $1 billion over the previous year.

Divestments â becoming a better bank

Major banks have been aggressively divesting businesses, and this was triggered after the recommendations by Haynes Royal Commission. As such, divestments not only helps to realise the gain/loss upon the sale of an asset but also seeks that the parent company is strategically aligned to achieve its goals.

Starting with ANZ, the bank had part of its business in discontinued operations, at the half-year ended 31 March 2019. In October 2017, the bank had announced to sell its OnePath Pensions & Investments business, aligned dealer group to IOOF Holdings (ASX: IFL), and the bank is expected to make an announcement regarding the transaction this month. Previously, in December 2017, the bank had agreed to sell its life insurance business to Zurich, and it was completed in June this year.

In August, the bank reported that it concluded the sale of 55 percent interest in Cambodian Joint venture. In September, the bank reported on the transaction of its Retail & SME or Small-Medium Sized Enterprise businesses in PNG region.

CBA recently closed the sale of Count Financial Limited to CountPlus Limited (ASX:CUP). In August, the bank had reported divesting its Australian life insurance business (CommInsure Life) to AIA Group Limited, and lately, the life insurance business has been charged criminal proceedings.

In FY 2019 (ended 30 June 2019), the bank had divested its sovereign, life insurance business in New Zealand. The sale of Colonial First State Global Asset Management was completed in August 2019. Besides, the bank is committed to exiting from Colonial First State, Aussie Home Loans, and a stake in Mortgage Choice.

At the half-year ended 31 March 2019, NAB had incurred a loss of $210 million related to customer remediation costs associated with the life insurance business sale, which occurred in the financial-year 2016.

At the half-year ended 31 March 2019, WBC had sold its interest in Ascalon Capital Managers (Asia) Limited and Ascalon Capital Managers Limited. Besides, the bank had sold its interest in several offshore Hastings subsidiaries, entities in the UK, US & Singapore in the previous corresponding period.

Are the dividends poised to go downhill?

In Australia, if anyone thinks of dividends, he might buy the stock of the major banks. However, the dividends paid by the major banks have been largely flat or down in the preceding periods.

As the major banks are aggressively pursuing divestments, it might provide some room for the dividends in the form of gains arising out of the transactions. However, increasing remediation costs are suppressing this possibility.

As such, WBA has been already downgraded in terms of dividends by the brokerages. Since FY 2016 (ended 30 September 2016), the full-year dividends paid by the bank have been flat with no increase. In May 2019, the bank announced an interim dividend, which was also flat compared to the previous corresponding period.

Meanwhile, NAB has already cut its interim dividend this year, resonating the sector-wide implications of Royal Commission, among others. Since FY 2015 (ended 30 September 2015), the full-year dividends paid by the bank have remained flat.

Since FY 2016 (ended 30 September 2016), ANZâs full-year dividends have been flat with no growth, and its latest interim dividend was also flat from the previous corresponding period at 80 cents per share.

CBA had ended the year on 30 June 2019, the full-year dividend paid by was $4.31, flat from the previous year. However, the bank has provided growing dividends in some of the preceding years.

Interest Rate Sensitivity â are margins increasingly becoming important?

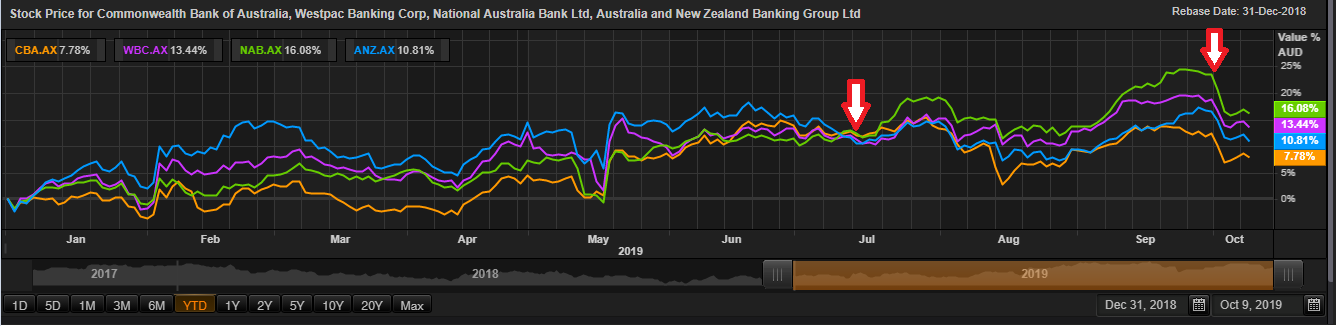

Following the latest rate cut announced at the start of this month (October 2019), the stocks of the major banks headed to the southern territory. Subsequently, the major banks had lost substantial gains in the periods after the rate cuts.

The first arrow is marked for the July rate cut, and the second is marked for the October rate cut decision. Unlike last time, the latest rate cut was severe in terms of relation with the stock price.

It presents a challenging environment for banks, as the lending rates are expected to go down after the latest rate cut. However, it is even more challenging for the major banks to convince customers with deposits, which might see further cuts. In the calendar year, the RBA Cash Rate has been lowered, and the cash rate now stands at 0.75%.

Also Read: Trading in Banks Under Focus; Three Reasons Impacting the Scenario

Also Read: Are Dividend Cuts On The Cards For The Bank Stocks

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.