Banking

Australia encompasses a vibrant financial sector with a range of established companies, including banking, insurance, asset management, brokerage, investment banking etc. Royal Commission had already left much of its impact on the industry, leading to large provisions, expenses, strategic review of segments by the companies, and new regulations.

Latest GDP numbers from Australian Bureau of Statistics for the second quarter of 2019 suggest that trade & exports remain one of the best contributors to the GDP growth in the country, implying significant applications of primary funding such as bank facilities to the businesses contributing to any trade activity in the country.

Further, the second quarter data also suggest that wage growth is also picking up with all states and territories depicting an increase in compensation except Northern Territory. Meanwhile, household final consumption expenditure moderated, in seasonally adjusted terms, with a growth of 1.4% over the year to the second quarter of 2019, and 0.4% in second the second quarter of 2019.

Three Reasons Impacting Status Quo

Open Banking

Keeping up with the pace of constantly changing environment of banking is very important for established players. In this course, banks might need to unlock capabilities that deliver robust technologies to complement the changing scenario.

Open banking is said to be changing the status quo in banks. Open banking allows the consumers to share their banking data with accredited third parties securely, and it provides room to improve the consumer experience, products & alter the competitive landscape.

In August this year, Consumer Data Right (CDR) legislation was passed in the country, which allows consumers to share their data to respective third parties. In the meantime, banks and similar service providers are actively tracing opportunities to become an accredited third party to leverage the opportunities provided by the shared data.

Open banking would allow customers to compare and select the product according to their preferences. It provides an option to the consumers, if they want their data to be shared with other service providers.

Sharing the data with other providers would enable the customers to choose from a range of services provided by other institutions. Therefore, it would enable the customer to choose products based on their demand, need, pricing or accessibility.

According to the timeline provided by the Australian Governmentâs Treasury, in July this year, the big four banks were supposed to provide access to the product data, including credit card, debit card, deposit accounts and transaction accounts.

According to Australian Governmentâs Treasury, three of the big four banks had voluntarily provided the data related to the aforementioned products in July this year for testing purposes. In August, the Australian Competition & Consumer Commission (ACCC) had sent an expression of interest for the Data Recipient Accreditation, and the survey closed on 6 September 2019.

Presently, it has been published that the big four banks would be providing consumer data by no later than February 2020. More importantly, all the steps taken by the other banks are required to follow 12 months after the big four banks.

By February 2020, it is expected that consumers of the big four banks would be able to direct them to share their data with accredited third parties. Open banking would be free in the country.

Implications

- It is likely to bring more competition to the existing highly concentrated market dominated by the big four.

- Cost structures of the banks may witness adjustments due to increased competition while maintaining a customer base.

- Service to the customers would play an important role, as better services are likely to have an edge over others.

- It may lead to a uniform cost structure around the country across all the banks.

- Customers are likely to choose low-cost products that could result in substantial changes in market share composition or maybe increased cost-competition.

- Budding Fintech industry in the country is likely to benefit from the change.

Regulators Across Australia & New Zealand

Lately, the banking shepherd in Australia â Australian Prudential Regulation Authority (APRA) has significantly altered the capital requirements of the banks. In July 2019, the authority had directed big four banks to improve their respective capital requirement by 3% of the risk-weighted assets by January 2024.

This move would require the big four banks to have additional ~$50 billion (collectively) in the capital. Besides this, three of the big four banks were directed to keep aside an additional $500 million, which included National Australia Bank Limited (ASX: NAB), Westpac Banking Corporation (ASX: WBC) Australia & New Zealand Banking Group Limited (ASX: ANZ).

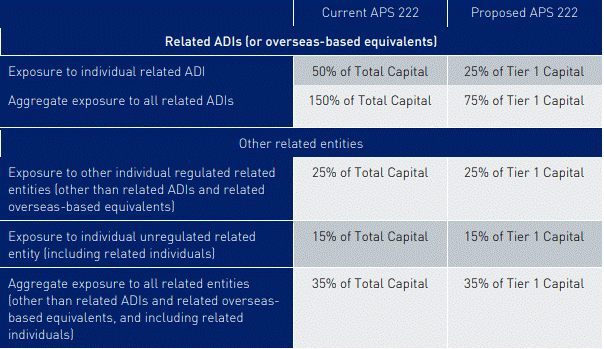

In August this year, APRA released new guidelines for APS 222, which proposes to trim the tier 1 capital used in overseas operations from 50% to 25%, among others. More specifically, banks with international operations would only use 25% of their capital exposed to overseas operations.

APS 222 (Source: APRA)

In New Zealand, the big four banks have substantial operations, and the banking shepherd of the country â Reserve Bank of New Zealand (RBNZ) has come up with new capital requirements. RBNZ would now require the big four banks to maintain tier 1 common equity capital at 16% of the risk-weighted assets, which was 8.5% earlier.

Implications

- Capital raising activity is likely to be undertaken by the big four banks.

- Existing low-interest rate environment means the interest outgo on the fresh capital is likely to be lesser.

- Australia & New Zealand Banking Group has sold its Papua New business catering to retail, commercial & SME, and this follows the sale of retail businesses in Singapore, Hong Kong, China, Taiwan, Indonesia, Vietnam, and some joint ventures.

- Capital funding could provide headroom to deliver shareholder value.

- Fresh capital to enable big four banks to successfully implement plans to effectively navigate the evolving market.

Low-Interest Rates

Low-interest rates are likely to trim banks earnings and its net interest margins. A relatively lower yield on sovereign debt, trims the spreads in a bankâs loan rates and deposit rates. Moreover, the mortgage rates tend to follow the yields on the sovereign debt, a lower yield on sovereign debt means a lower interest rate on mortgages as well. However, banks have to cut deposit rates in order to stimulate the impacts, which could be a struggle since the banks have to convince customers to keep deposits at a lower rate.

Meanwhile, the shrinking net interest margins could be idiosyncratic to banks due to diversified revenue streams of the banks. Further, it also depends upon the management of the banks, who could take necessary decision to maintain the earnings of the banks through alternative ways.

More importantly, when the banks are actively passing the rate cuts to the consumers, it is likely that the impacts may get offset. However, the spread on the short-term debt and long term debt yields also plays an important role.

Implications

- The banks could have access to fresh capital at lower yields, majorly due to low rates.

- Banks with superior credit quality would access capital at premium levels, i.e. lower yields.

- Low-interest rates provide an opportunity to expand the credit segment, if consumer sentiments are favourable.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.