Australiaâs competition regulator and national consumer law champion, Australian Competition and Consumer Commission (ACCC) thrives to promote competition and fair trading in the country. In the contemporary worldâs diverse and dynamic business environment it is essential to have governing bodies, which intimate people about their consumer rights and responsibilities. Regulation and monitoring are the needs of the hour to ensure smooth functioning of business activities in the world, which is always on the route to development.

Adhering to its responsibilities, the ACCC has recently alleged Australia's dominant steel manufacturer, BlueScope Steel for attempting to connive with rival companies regarding the pricing of flat steel products. Letâs understand the matter in this article:

About BlueScope Steel Limited

A major contributor of Australiaâs steel industry since 1915, BlueScope Steel Limited (ASX:BSL) has a diverse portfolio of businesses in some of the fastest growing economies of the world, and over 100 facilities in 18 countries. Some of BSLâs product brands include Clean COLORBOND®, LYSAGHT® steel building products, Varco Pruden® engineered buildings and ZINCALUME® steels, to name a few. The company is the third largest manufacturer of painted and coated steel products in the world and caters to customers across Asia, ANZ and North America. The company was listed on the Australian Securities Exchange in 2002.

The ACCC Allegation on BSL Regarding Price Fixing

The Aussie watchdog, ACCC, has acted against BlueScope Steel (ASX:BSL) and its former Sales and Marketing GM, Mr Jason Ellis, accusing both the parties for cartel conduct. As accused by ACCC, the company and Mr Ellis made attempts to persuade Australian and overseas steel distributors to sign agreements which had price fixing provisions included in them. The launched lawsuit has been filed in the Federal Court and pertains to the period between September 2013 and June 2014.

ACCCâs Chairman, Mr Rod Sims stated that BSL is Australiaâs major manufacturer of steel products (flat), a crucial substance in various major sectors of the economy in Australia. However, the allegations involve serious cartel conduct, and as the expiry of the six-year limitation period for taking civil proceedings for certain of the alleged conduct was close, the watchdog finds it apt to start the proceedings on a legal level. For the same, the Commission had been closely working along with the Commonwealth Director of Public Prosecutions, who is responsible for prosecuting criminal cartel offences, in accordance, with the Prosecution Policy of the Commonwealth. The CDPP consideration regarding BSLâs matter continues till date.

Acknowledging the depth and seriousness of the accusation, the companyâs Chairman, Mr John Bevan stated that the BSL Board was considering the case and had engaged with the ACCC to conduct its personal internal investigation. He also firmly stated that the company is confident of its stance and does not believe that its current or former employee would have been engaged in cartel conduct, as it has been accused of. The evidence prevailing presently cements this believe. BSLâs MD and CEO Mr Mark Vassella mentioned that BSL concedes matters of competition law compliance and corporate governance extremely seriously, and such would be the case with the current issue.

What do the experts say?

Manufacturing sector experts believe that the investor sentiment was unmoved by the ACCCâs six-year-old allegations, as the BSLâs stock did not slump post the ACCC accusation and BSLâs acknowledgement of the same was released. This could be due to the fact that the allegation centred around a former employee. However, the matter does emphasise on the fact that the ACCC is promptly committed to use its criminal powers to make the business environment conducive.

BSLâs FY19 Results

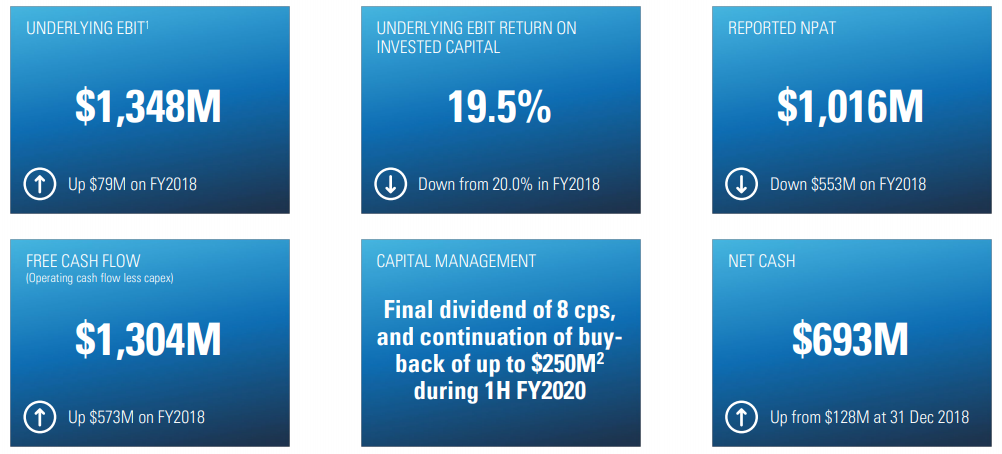

Amid the reporting season, on 19 August 2019 closed 30 June this year, BSL reported a FY19 net NPAT of $1,015.8 million and underlying NPAT of $966.3 million, up 17 per cent on pcp. The underlying EBIT was $1,348.3 million, up 6 per cent on pcp. The period registered the third successive full year underlying EBIT above $1.1 billion for the company, setting a milestone amid the softening in commodity steel spreads and domestic volumes in 2H19.

BSL continued to operate at 100 per cent capacity utilisation, and the operating cash flow, post capital and investment expenditure, was reported to be $1.3 billion. The underlying EPS was up by 22 per cent, and the company finished the year with a net cash of $692.7 million in its kitty.

Dividend

As part of the results, the company approved the payment of a final 100 per cent unfranked dividend of 8 cents per share, which would be paid to the shareholders on 16 October 2019. It has an ex date of 11 September this year and record date of 12 September 2019.

Financial Framework

The company further stated that the returns focus, optimal capital structure and disciplined capital allocation constituted BSLâs financial framework. The company thrives to distribute at least 50% of free cash flow to shareholders in the form of consistent dividends and on-market buy-backs.

BSLâs FY19 Highlights (Source: BSLâs Report)

On outlook front, BSL would target to have a revised capital structure, wherein the group net debt would be around zero. The previously stated target of net cash was in the range of $200 to $400 million. The 1H FY2020 buy-back would be $250 million (announced as part of 1H FY2020 capital management program). Subject to market conditions, in 1H 2020, BSL is likely to face weaker commodity steel spreads in North Star and ASP, which would slump the underlying EBIT by approximately 45 per cent lower than 2H FY2019, when it was $499 million.

BSLâs Stock Performance

After the close of the business hours on the ASX on 30 August 2019, the BSLâs stock was quoted A$12.49, up by 1.62 per cent relative to its last trade. It has an approximately 514.04 million outstanding shares, with a market capitalisation of A$6.32 billion. Its annual dividend yield has been 1.14 per cent and the EPS value was A$1.899. In the last one and six months, the BSL stock has generated negative returns of 5.75 per cent and 9.10 per cent, respectively and whereas, its YTD return is of 13.27 per cent.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.