Investing is productively justified if the fruits of oneâs labour (investment amount) can eventually fill in oneâs pocket (dividend). Profit from a company is ideally utilised for growth and further operations, and a chunk of it is distributed amid the companyâs shareholders as a reward amount, the dividend.

The thriving residential property market of one of the urbanised societies of the world, Australia, has supported homeowners with great and valuable returns on their real estate investment over the years. Despite the ripple effect of turbulent conditions, falling interest rates, a turnaround in the housing market and weak growth price, the publicly listed Australian real estate players have balanced the shareholdersâ sentiments. These companies would be discussed in the course of this article:

Real Estate Companies to Consider for Dividend Income

Charter Hall Group

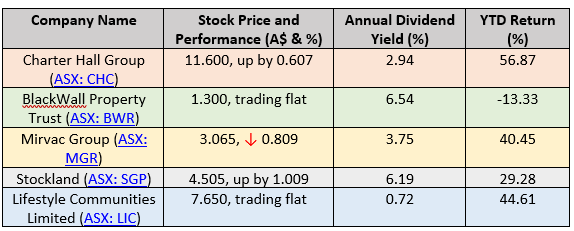

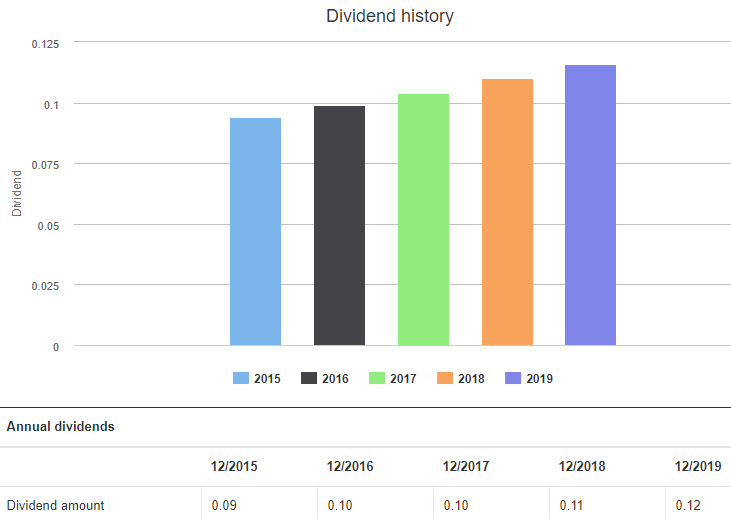

CHC is a part of the dividend income paying real estate groups, as the highlight of the companyâs FY19 results was 25.5 per cent OEPS Growth. Moreover, the company announced distributions of 33.7 cents per share, up by 6 per cent on pcp. According to MD and Groupâs CEO, David Harrison, 2019 was the largest ever year for transactions, with $5 billion of gross transactions and $3.3 billion of net acquisitions. Consequently, CHCâs Funds Under Management was up by $7.2 billion to $30.4 billion at year-end 30 June 2019. In FY20 through August 2019, the Groupâs FUM had grown to $34.6 billion.

On dividend distribution guidance front, the company expects a 6 per cent growth over FY19. The future distribution pay-out ratio would be 60 per cent to 95 per cent of OEPS.

CHCâs dividend history (Source: ASX)

BlackWall Property Trust

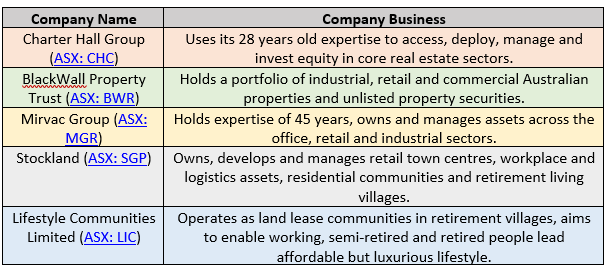

With 11 properties and an NTA of $1.48, BlackWall Property has gross assets worth $317 million and gearing of just 18 per cent, as per its annual report of FY19. On the dividend front, the company announced a 3.5 cents per unit distribution, 100 per cent tax deferred, which would be paid on 8 October 2019.

According to the Chairman, Seph Glew, 2019 has been a good year for the company, primarily catalysed by the sale of the Bakehouse Quarter and a doubling of the size of the BlackWall Property Trust. The fruitful results, as discussed above, leave the company in a defensive portfolio position with significant capacity to respond to future opportunities. He added that even though the property yields were at record lows at the current time, BWR wishes to keep the hunt for active investments and special situations continue. The company anticipates that commercial property yields are at unsustainably low levels, and a correction is coming. BWR is prepped up to act when investors are most fearful.

BWRâs dividend history (Source: ASX)

Mirvac Group

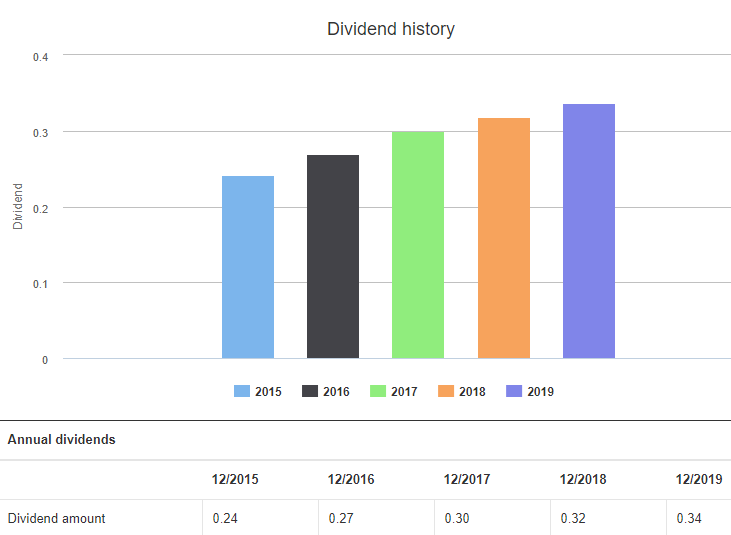

Pleased with the companyâs FY19 results CEO and MD Susan Lloyd-Hurwitz believes that MGR is well-positioned to generate strong returns for its security holders and make a positive contribution to MGRâs urban landscape. During the year, MGRâs operating profit increased by 4 per cent to $631 million, primarily catalysed by MGRâs Office and Industrial business.

While discussing the dividend, it can be observed that the full-year distributions soared by 5 per cent to $440 million, representing 11.6 cents per stapled security. Following the suit of the companyâs dividend, the EPS was 17.1 cents per stapled security, up by 4 per cent on FY18.

Ms Lloyd-Hurwitz notified that the company was Australiaâs second-largest office manager, with $15 billion worth of assets under management.

On the outlook front, the company expects an operating EPS guidance ranging from 17.6 to 17.8 cents per stapled security for FY20 period and distribution guidance of 12.2 cents per stapled security, which would be an increase of 3 to 4 per cent and 5 per cent, respectively.

MGRâs dividend history (Source: ASX)

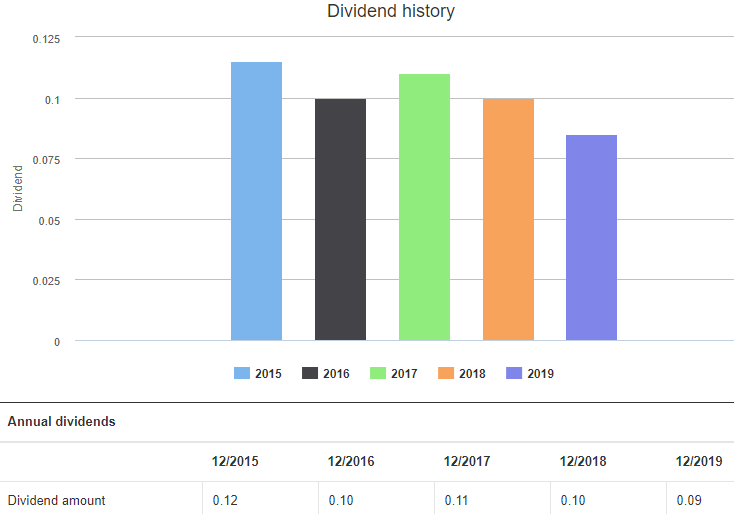

Stockland

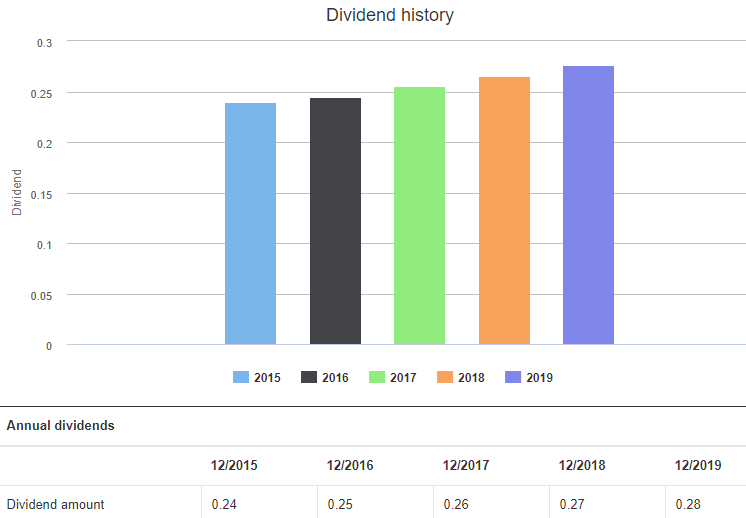

Stockland is one of the largest diversified property groups in the country with $15.2 billion of real estate assets. A major highlight of the companyâs 2019 results was the completion of the $192 million of the $350 million buy-back of SGPâs securities to support the resilience of shareholder returns into the future. Moreover, the company achieved $505 million of retail town centre divestments, exceeding the $400 million target of non-core retail divestments ahead of the anticipated timeframe.

However, due to tougher market conditions, the uncertainty of the election camps and an evolving regulatory environment, SGPâs Statutory profit was down by 69.6 per cent to $311 million. Through the launch of LAB-52 and the Stockland Accelerator, powered by BlueChilli, good progress was registered by the company during the FY19 period.

On the dividend distribution front, SGPâs full-year distribution was 27.6 cents per security, representing a payout ratio of 74 per cent of funds from operations.

SGPâs dividend history (Source: ASX)

Lifestyle Communities Limited

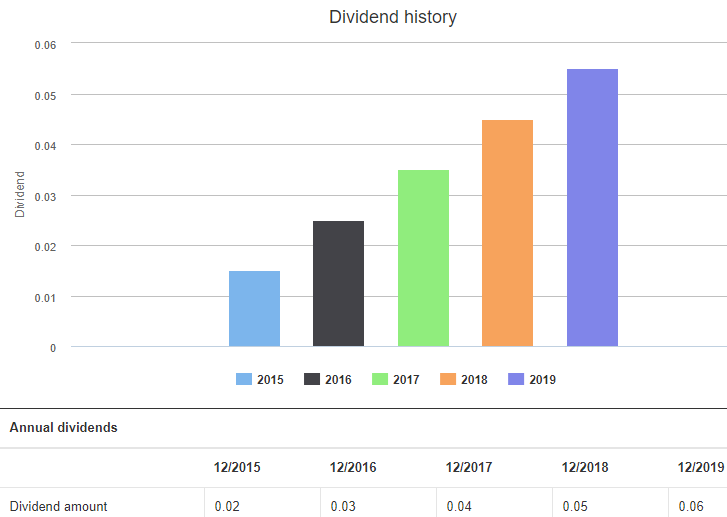

Lifestyle Communities has 18 residential land lease communities in planning, development or under management. In FY19, the companyâs underlying profit after tax was up by 21.6 per cent to $41.1 million, and the statutory profit after tax was $55.1 million. The year welcomed 337 new home settlements for the company, which currently provides 2,285 settled homes within LICâs communities. The company believes that the greatest growth opportunity remains in Victoria with low saturation and accessible land.

While discussing the dividend distribution, the shareholders of LIC would receive a final fully franked dividend of 3 cents per share, taking the total dividend for the year to 5.5 cents per share (from 4.5 cents per share in 2018).

LICâs dividend history (Source: ASX)

Share Performance

Let us now browse through the sharesâ performance and returns generated by the stock of the companies discussed, as on 25 September 2019 at 12:02 PM AEST:

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.