Mirvac Group (ASX:MGR) is a well-known diversified Australian property group with an integrated development and asset management business. Mirvac owns and manages assets across the office, retail and industrial sectors in the four prime cities of Australia including Sydney, Melbourne, Brisbane and Perth, with more than $ 18 billion of assets currently under management (AUMs).

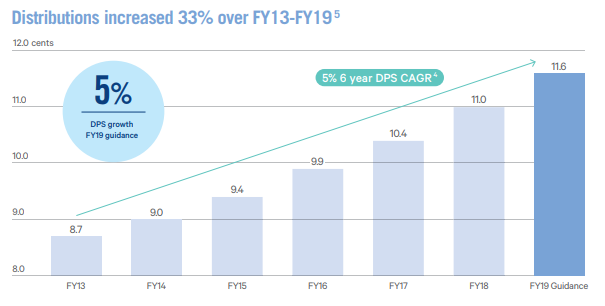

On 29 May 2019, Mirvac Group announced that it expects to deliver earnings of 17.1 cents per stapled security for the financial year 2019 (FY19), which reflects a 4 % growth on the prior financial year (FY18). The guidance has been revised due to the Groupâs strong business performance in FY19 so far. Besides, this is at the top end of its previous guidance range of 16.9-17.1 cents per stapled security (cpss). In addition, the Group restated, in the recent release, that its FY19 distribution per stapled security (DPS) guidance is around 11.6 cpss, also reflecting a 5 % DPS growth of on the prior FY18.

Source: Mirvac Group â Equity Raising for Strategic Growth Initiatives Presentation

In the same announcement, Mirvac has also provided Preliminary Guidance for FY20 DPS and earnings per stapled security (EPS), with the following:

- Preliminary FY20 DPS guidance of 5% growth compared to FY19, supported by passive earnings that are expected to grow by at least 5 % per annum on average over FY19-21;

- Preliminary FY20 EPS guidance of greater than 2 % growth relative to FY19, incorporating the impact of the Placement and assumed divestment of the non-core Tucker Box (Travelodge Hotels) asset;

- The payout ratio for FY20 is expected to remain at a sustainable level of ~70% of operating earnings supported by the increased contribution from passive earnings.

The company is expected to release its annual results to the Australian Securities Exchange (ASX) on 8 August 2019, wherein it will confirm and give additional details concerning the FY20 guidance.

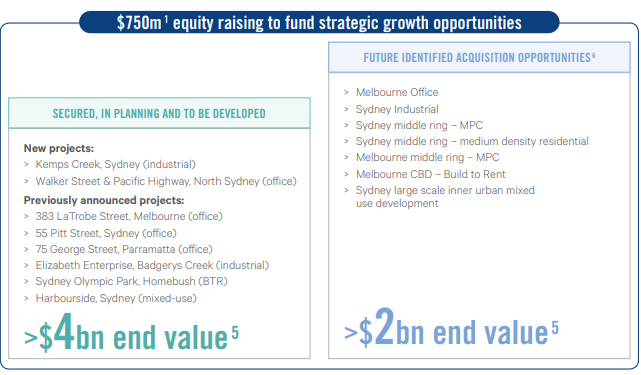

Recently, Mirvac has launched an AU$ 750 million fully underwritten institutional placement at a fixed price (Placement Price) of AU$ 2.97 per new stapled security, which represents: a 4.2 % discount to Mirvacâs closing price of AU$ 3.10 per stapled security on Tuesday, 28 May 2019; and a 4.5 % discount to the five-day volume-weighted average price (VWAP) of AU$ 3.11 per stapled security as on 28 May 2019.

In addition to the placement, Mirvac is also offering the eligible securityholders in Australia or New Zealand the opportunity to participate in a non-underwritten SPP. The securityholders may acquire up to AU$ 15000 of New Securities per securityholder at AU$ 2.90 per New Security. The SPP price is the Placement Price adjusted for the payment of distribution of 6.3 cpss relating to the six months to 30 June 2019.

Mirvac is currently intending to cap the SPP at AU$ 75 million and may, in its absolute discretion, scale-back applications over this amount.

Source: Mirvac Group â Equity Raising for Strategic Growth Initiatives Presentation

Stock performance

At the beginning of the market trading on 29 May 2019, the securities of Mirvac Group were placed at a trading halt, pending the release of an announcement related to the completion of the institutional placement. The halt is expected to last until the commencement of normal trading on Friday, 31 May 2019 or whenever the announcement is released to the market.

The MGR stock last traded at a price of AU$ 3.100 on 28 May 2019.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.