Australiaâs leading fully integrated property group, Charter Hall Group (ASX: CHC) is focused on utilising its expertise to access, deploy, manage and invest equity in core real estate sectors.

On 4th June 2019, Charter Hall Group, along with Abacus Property Group, a leading Australian diversified property group, announced that it has acquired a 19.9% strategic interest in Australian Unity Office Fund (ASX: AOF) for a total value of $95.6 million, equivalent to $2.95 per AOF unit.

Further, both the companies (Abacus and Charter Hall Group) have established a special purpose entity for the purposes of the acquisition, and both the parties own 50% of the Consortium Entity.

Abacus and Charter Hall entered into a framework agreement pursuant to which it is proposed that the parties co-operate for the purposes of pursuing a transaction involving the acquisition of all of the AOF units not currently held by the Consortium Entity.

AOFâs securities were placed in a trading halt today, pending an announcement in connection with the receipt of a non-binding indicative offer relating to the units of AOF. AOF has now received the offer from Abacus Property Group and Charter Hall Group, in which both the companies have together offered to acquire all of the issued units in AOF that it does not already hold for $2.95 cash per AOF unit, by way of a trust scheme.

As per the terms of the Proposal, AOF unitholders will be entitled to receive $2.95 cash per unit (Offer Price). The Offer Price represents a 6.1% premium to AOFâs closing price of $2.78 on 3rd June 2019. Further, the offer price represents 8.5% premium to AOFâs 30-day VWAP of $2.72 up until 3rd June 2019.

AOF unitholders will be entitled to retain distribution of up to 3.95 cents per unit in respect of the quarter ending on 30th June 2019, paid prior to the date of scheme implementation without any reduction to the Offer Price.

Currently, the Proposal is subject to various conditions, including confirmatory due diligence on an exclusive basis. Further, Australian Unity Investment Real Estate Limited (AUIREL), a Responsible Entity of AOF needs to enter into a Scheme Implementation Agreement with the consortium to complete this proposal. The proposal also requires approval from the Foreign Investment Review Board.

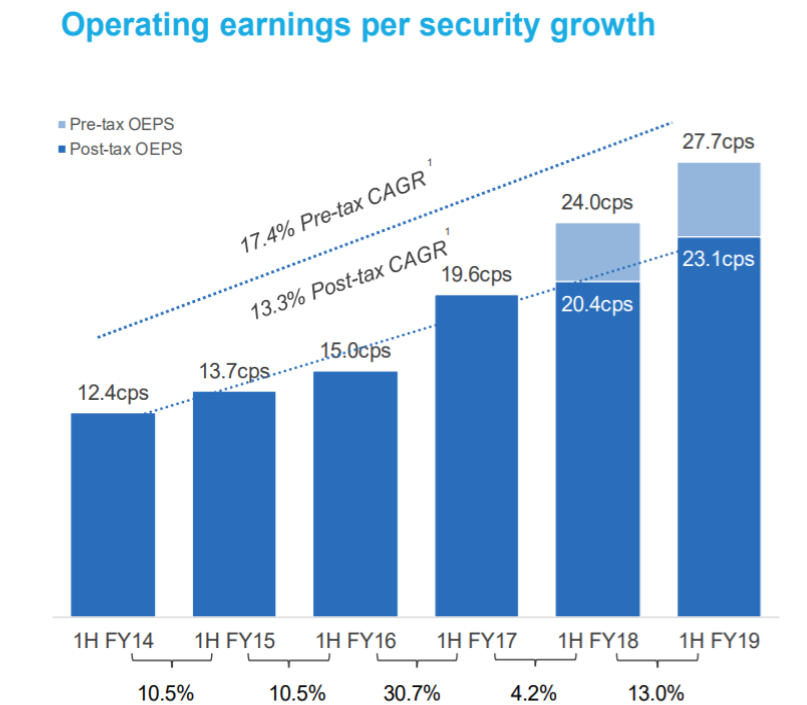

For quite some time, Charter Hall Group has been demonstrating robust financial and operational performance. In the past five years, the company has achieved operating earnings per security compound average growth of 13.3%, which is a testament to the companyâs ability of creating and delivering sustained growth for its capital partners and investors.

Operating earnings per security growth (Source: Company Reports)

In the first half of FY19, Charter Hall Group reported operating earnings of $107.5 million. During the period, the companyâs Property Investment portfolio grew by 6.7% to $1.8 billion and generated a 12.0% Total Property Investment Return.

In the last one year, the companyâs stock has provided a return of 61.90% as on 3rd June 2019. Further, in the last six months, CHCâs shares increased by 46.83% as on 3rd June 2019. The stock of CHC last traded at $10.550, up 1.345% during the intraday trade, with a market capitalisation of circa $4.85 billion as on 4th June 2019.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.