Despite the myriad of challenges, the global economy faced in 2019, from the trade war between the US and China to the uncertainty surrounding Brexit in the UK, the global markets performed remarkably, and rather surprisingly well, with all the key global indexes generating positive returns. 2019 has seen a significant rise in global stocks, something which was last seen in 2009.

While 2019 proved to be a promising year for investors across the globe, the picture might not be a rosy one for 2020. While the major financial institutions do not anticipate a recession-like situation, they are of the opinion that the global markets are likely to show mild growth. They believe that recent events such as the US-Iran conflicts could adversely impact the global markets.

Key Steps to Build a Profit-generating Portfolio

In a time when globalisation, despite its various benefits, have increased the interdependence of local security markets, it is imperative for an investor to have a well-managed portfolio in order to generate earnings in the future. An investor, while making an investment decision, must consider multiple factors such as financial objectives, risk appetite, time frame, and sector/industry preference among others.

In this article, we will highlight some important steps that we believe one must take to build a profitable portfolio.

Step 1: Rationale behind Investing

The first, and probably the most important aspect of being a successful investor is to have a clear aim in mind. An investor should define the returns or the amount he/she wants to reach, and the time frame in which to achieve that goal. With a clearly defined purpose, an investor can decide on the investment amount to begin with, securities/asset classes to invest in, and the industries/sectors to focus on.

A well-defined objective with a clear understanding of the risks involved goes a long way in building a robust portfolio. Also, it is always advisable to invest time in building an understanding of how a stock market works and what are the challenges and risk involved in investing. The better informed and educated an investor is, better the chances of him/her making favourable returns.

Step 2: Allocation of Assets

Once an objective has been set, the next step is to develop a portfolio. While creating a portfolio an investor must look at the following factors:

- Age: Financial expectations or requirements differ for every individual. For example, an individual who has just started his/her professional career might be eager to invest in securities that might be risky but offer higher returns, while an individual who is on the verge of retirement might look for investments with guaranteed, albeit relatively small returns;

- Marital Status: An unmarried individual will have different goals compared to a married individual and thus the investment strategies would also differ. For instance, a married individual might have a financial goal related to the higher education of his/her child;

- Risk Appetite: One should build a portfolio based on one’s risk appetite. In general, a risk-averse investor would assign a higher weightage to fixed income securities in his/her portfolio while a risk seeker would prefer investing heavily in the equity market, expecting high returns;

- Financial Position: An investor who has substantial savings would be willing to invest in risky securities as he/she has something to fall back on while an investor with limited savings would be more prudent in his/her investments.

Step 3: Diversification of Portfolio

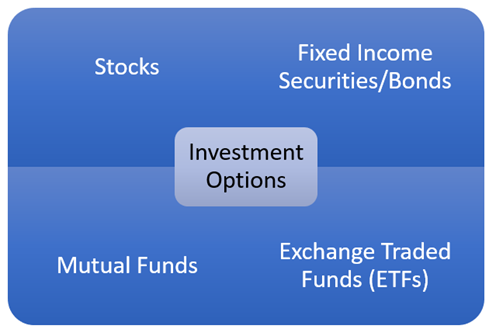

An important strategy in making sure that the loss, if any, in portfolio value is restricted or kept to a minimum level is the diversification of portfolio. Investing portions of capital in different securities and asset classes such as stocks, bonds, exchange-traded funds (ETFs) and mutual funds help minimise risks. For example, if investments in equity have depreciated over time, investments in other securities that are generating positive results will partially or even fully negate the adverse impact of equity investments on the entire portfolio.

Also, diversification within asset classes will improve the chances of an investor to generate positive returns. Investing in different sectors and sub-sectors within an asset class provides further exposure to different stocks.

Step 4: Rebalancing Portfolio

An investor must continuously track the performance of his/her portfolio to ensure whether the allocation of assets is meeting his/her goals. Regular tracking and monitoring of the portfolio gives an opportunity to the investor to re-allocate funds from one asset class to another based on the performance of those asset classes. For instance, if the equity market has not performed well over time, an investor can reduce his exposure to equities and divert some of the funds towards fixed income securities or other securities.

An important aspect in rebalancing the portfolio is the impact on tax. For example, suppose an investor books profit from his/her performing stocks and re-invests the earnings in other securities or assets, he/she will have to pay tax on the short-term capital gains.

In addition to the steps mentioned here, there are a few things an investor must keep in mind:

- Patience: It is one of the most important aspects an investor needs to consider while building a portfolio. No matter how good one’s asset allocation is, generating positive returns doesn’t happen overnight. An investor needs to give the investments time to develop;

- Remain calm: Compared to previous decades, markets have seen more fluctuations than ever. While it is easy to panic, and withdraw or move your investments to safer options, the preferred approach would be to remain calm, assess the situation, and make use of the opportunities;

- Minimise costs: Expenses such as broker commissions, fees and mutual funds expense ratios, if incurred regularly, ends up as a significant expense and it is advisable to keep these costs to a minimal level.

While creating a profitable portfolio sounds easier than it is, an investor can build one by following a stepwise approach while being prudent, disciplined and patient.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.