The goal of an investor is to bag the best deal while buying stocks, from an ocean of available options. There are various parameters to value a stock, the companyâs earnings, dividends paid, growth and expansion drivers and outlook, to name a few. These parameters aid investors and stock market enthusiasts to decipher the stockâs stance amid the stock market and business dynamics.

In this article, we would understand one such parameter- the price-earnings ratio and look at 5 stocks from the consumer staples sector, with a decent current P/E multiple.

Let us dive right in!

Price-earnings ratio

Price-earnings ratio, referred to as the P/E ratio, price multiple or the earnings multiple, is the ratio utilised during companyâs valuation, which calculates its present market price relative to a shareâs earnings per share (EPS). The concept is believed to have been made famous by the Father of Value Investing, Benjamin Graham, who vouched that the P/E ratio was one of the quickest and easiest ways to determine whether the stock was trading on an investment basis or on a speculative basis.

Ideally, a high P/E ratio indicates that the investor sentiment is building positive as they anticipate higher growth from the company in the future. However, it should be noted here that a high price multiple does not guarantee a better investment than a comparatively lower one, as a high price multiple might be an implication that the stock is overvalued.

Players in the high-growth industries, like telecom and biotech are likely to have higher price-earnings ratios, than the players whose returns are comparatively steadier and stable such as mining companies.

Importance of P/E Ratio

The P/E ratio is often used by financiers and market specialists to decode the relative value of a businessâ shares while conducting reasonable comparisons. It is a significant parameter to judge the value of a stock:

- The P/E ratio can be used to compare a company against its own historical record and compare aggregate markets against one another or over time;

- It is a depiction of what the market is willing to pay for a companyâs earnings;

- The P/E ratio provides a good sense of the value of the company, and helps investors analyse the amount that should be paid for a stock based on its current earnings;

- It is one of the most trusted metric of stock valuation, and helps one determine whether a stock is overvalued or undervalued.

One must consider the holistic picture of a company, its management and its prospects and its comprehensive image before cherry-picking a stock, as no single financial ratio can determine whether a stock is a value or not.

Companies under Discussion

Now that we understand the concept of P/E ratio, let us browse through 5 companies from the consumer staples section, who have a decent P/E multiple (as on 3 October 2019):

| Company Name | Company Business | P/E Ratio (x) |

| Costa Group Holdings Limited (ASX: CGC) | Australiaâs largest grower, packer and marketer of fresh vegetables and fruit. | 12.370 |

| Bellamyâs Australia Limited (ASX: BAL) | Maker of premium certified organic baby formula. | 66.630 |

| Inghams Group Limited (ASX: ING) | The largest integrated poultry producer across ANZ. | 8.940 |

| Bega Cheese Limited (ASX: BGA) | An Australian dairy company producing cheese, spreads, bio-nutrients, to name a few. | 77.370 |

| Elders Limited (ASX: ELD) | A leading agri-business and iconic brand in Australia. | 12.480 |

Costa Groupâs Financial Results for 1H CY2019

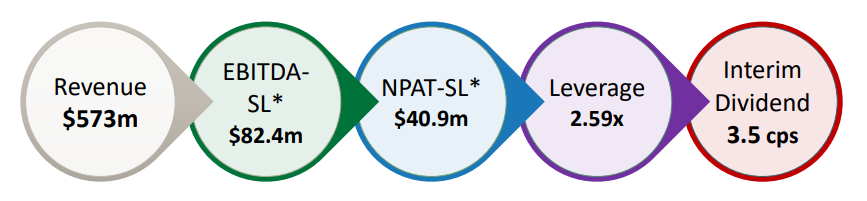

On 23 August 2019, CGC announced its financial results for the half- year ended 30 June 2019, with the below highlights:

- Revenue grew by 11.8% to $573 million;

- Statutory NPAT was $41.1 million;

- (EBITDA-SL) was reported to be $82.4 million, less than 8.4%;

- Fully franked dividend of 3.5 cps was declared (payment date of 3 October 2019);

- 2H CY2019 results are likely to be supported by a strong citrus crop with 75% to be harvested from July to November.

- China expansion is on track to achieve the five-year roll-out plan by 2020, planning underway for further expansion in 2021.

Financial highlights (Source: Investor Presentation)

Bellamyâs Scheme Implementation Deed

As intimated on 16 September 2019, BAL entered a SID or Scheme Implementation Deed, as per which, China Mengniu Dairy Company Limited would fully acquire the issued share capital of BAL. If the scheme would proceed, the companyâs stakeholders would receive $13.25 cash per share, which values the companyâs equity at around $1.5 billion.

The implementation of the Scheme is subject to various conditions, and the Board unanimously recommend that the shareholders vote in favour of the Scheme, which is expected to be implemented prior to the end of 2019.

Moreover, the company is permitted to pay a special dividend of $0.60 per share, conditional on the Scheme becoming effective.

Inghams Groupâs Chairmanâs Address

In its recently released Annual Report for 2019, ING Chairperson Peter Bush welcomed the new CEO Jim Leighton, and stated that FY19 was a âyear of changeâ. The company on-boarded Rob Gordon and Andrew Reeves to its Board.

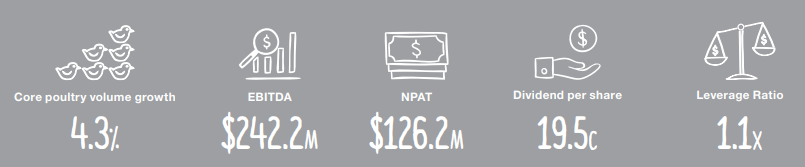

ING delivered a $126.2 million net profit after tax and the 4.3% growth in the core poultry volume was catalysed by strong demand in Australia and signs of a return to growth in the New Zealand market.

Even though rising feed costs continued to present a challenge to the business in FY2019, the company delivered the intended outcomes, offsetting inflation and focussing on sustainable improvement (Project Accelerate).

The company commenced a share buy back in 2H FY2019, purchasing 3.5% of issued capital, after announcing an interim dividend of 9.0 cents per share.

Financial Highlights (Annual Report)

Bega Cheese Limitedâs 2019 Sustainability Report

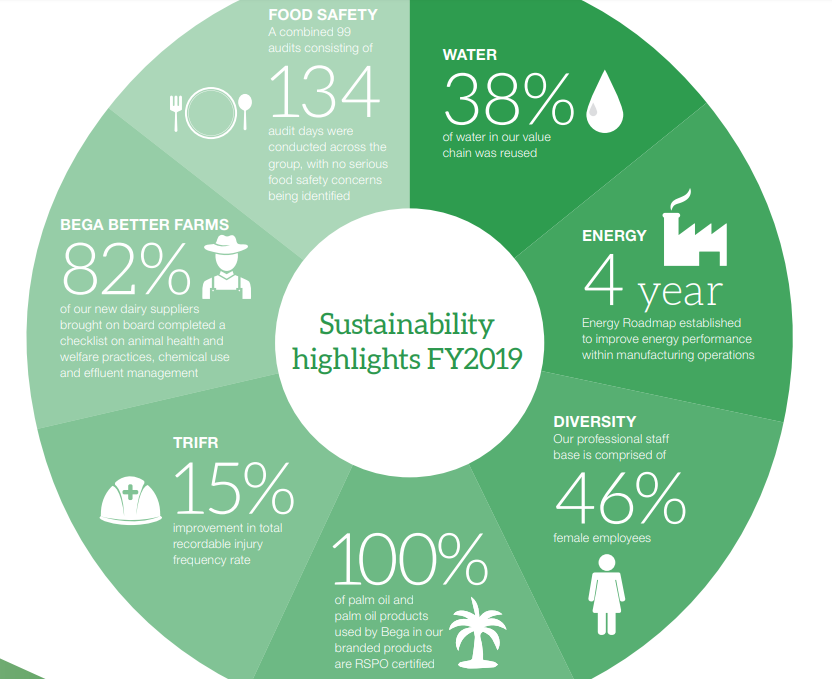

On 6 September 2019, the company released its 2019 Sustainability Report, addressing the performance and improvement plans in relation to the material sustainability impacts during the financial year 1 July 2018 to 30 June 2019, a year of drought and major changes in the domestic and international competitive environment.

This year the Bega Aspire Leadership Development Program centred on supporting sustainability initiatives in FY2019 and beyond. The acquisition of the Koroit facility in August last year showcased the growing diversity of the company, increasing the range of produces. The Capilano Honey investment showcased the companyâs interest in expanding its spreads offering to include honey. It acquired a controlling interest in 180 Nutrition, an online health and wellness business.

Moreover, BGA entered into a supply arrangement with a major international infant formula business which has led to an investment in a new lactoferrin plant at the Koroit facility, to be commissioned in FY2020. In the same year, the Bega Better Farms program would re-commence.

(Source: Sustainability Report)

On the financial front, the Group revenue increased by 13% to $1.42 billion and normalised EBITDA increased by 5% to $115.4 million. The company produced 280,405 tonnes of dairy and food products, up by 8% on the previous year.

Elders Limitedâs Bell Potter Emerging Leaders Conference Presentation

On 19 September 2019, in the Bell Potter Emerging Leaders Conference Presentation, CEO Mark Allison notified that ELD is a 180-year old Australiaâs largest listed full-service rural service and products supplier, servicing over 40,000 primary producers across Australia and global markets.

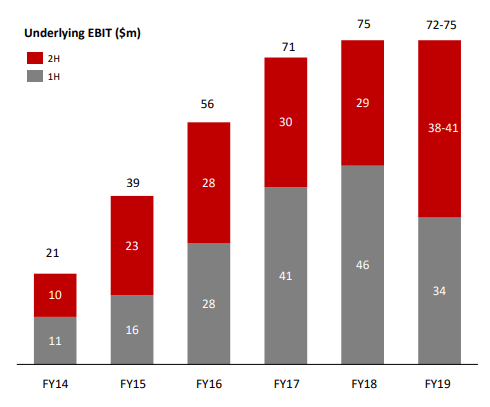

According to him, the companyâs stable platform was geared for the next wave of growth, under the second Eight Point Plan, including 20 new branches by 2020. The EBIT improvement in the FY20 is anticipated to be derived from organic and acquisition growth, focus on controlling base costs to offset inflationary increases and AIRR acquisition, which would settle on 1 December 2019.

On the financial end, the companyâs Underlying net profit after tax was $26.4 million, for FY19 half-year. The Underlying EBIT of $33.5 million and Operating cash outflow was at $13.1 million. The company declared a fully franked interim dividend of 9 cents per share.

ELDâs EBIT through the years (Source: ELD Report)

Share Price Information

The below table depicts the share price of the discussed companies, along with their respective year-to-date returns, after the close of the market on 4 October 2019:

| Company Name | Share Price ($) | YTD Return (%) |

| Costa Group Holdings Limited (ASX: CGC) | 3.5 | -51.53 |

| Bellamyâs Australia Limited (ASX: BAL) | 12.99 | 71.28 |

| Inghams Group Limited (ASX: ING) | 3.02 | -23.93 |

| Bega Cheese Limited (ASX: BGA) | 4.41 | -10.73 |

| Elders Limited (ASX: ELD) | 6.21 | -10.47 |

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.