These two stocks are trading in contrast, with one trading close to its 52-week low, while the other trading close to its 52-week high. Both the stocks, however, are from the health care sector. For the Australian healthcare industry disruption is on the horizon, it is not the demographics which is shaping the future but the advancements in technology from the arrival of big data, robotic surgeons and artificial intelligence are impacting the industry.

Two of the stocks under this sector are discussed in detail below:

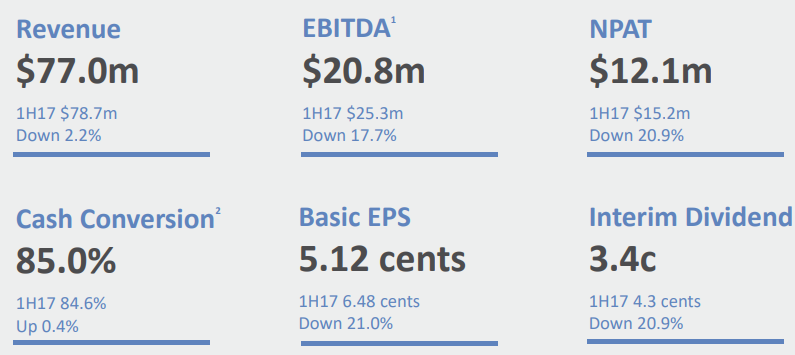

MONASH IVF GROUP LIMITED (ASX:MVF) â For 1H 18, the company reported 2.9% fall in the revenue to $77 million, 20.9% fall in the profit and 17.7% fall in EBITDA to $21 million. The revenue in FY 18 is affected due to a Specialist departure and a decline of 0.6% in the Australian ARS market. The EBITDA Margin for FY 18 declined to 25.3% from 31.6%, and additionally and EBITDA was down 22.2% to $38.1 million from $49.0 million in FY 17 with a five-year CAGR of 4.0%. NPAT is down 27.9%, which is broadly in line with guidance provided in February 2018 with a five-year CAGR of 6.6%. Basic EPS was also down by 21.0% to 5.12 cents from FY17 of 6.48 cents also impacting the dividends from total 8.8 cents in FY17 to 6.0 cents in FY18. The stock of Monash dipped by -3.03% to a market price of $0.960, the stock has undergone a performance change of -34.87% over past 1 year. The company maintains the view that the long term Stimulated Cycles growth rate is expected to be approximately 3% per annum.

2018 results highlights, Source: Company Reports [optin-monster-shortcode id="wxhmli4jjedneglg1trq"]

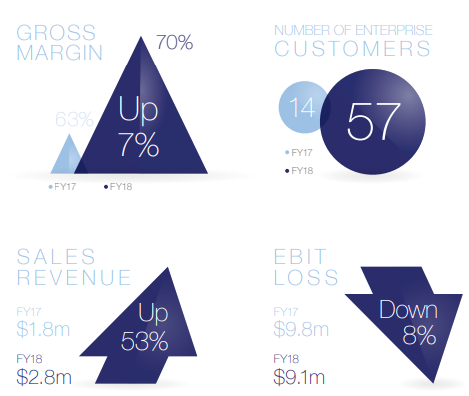

VOLPARA HEALTH TECHNOLOGIES LIMITED (ASX:VHT) â The company successfully raised capital of A$20 Mn which would be utilized to expand the sales team in the United States and NZ research and development teams. At the end of the first quarter 2019, company enjoys a healthy cash position with cash reserve of NZ$22.8 Mn. The company saw an EBIT loss of 8% which is down from $9.8 million from FY17 to $9.1 million in FY 18. However, net loss dropped from NZ$9.5M to NZ$8.8M, a decrease of 8%, which may be because of increase in revenues while keeping a stable, controlled cost base. At the end of the year, Volparaâs Annual Recurring Revenues (ARR) of ~NZ$3.6M and Total Contract Value (TCV) signed in FY18 of ~NZ$11.2M, an increase of 223% and 173% respectively over FY17. No dividends have been paid or declared for payment during the financial year. The stock of Volpara surged by 0.826% to a market price of $1.220, the stock has undergone a performance change of 81.95% over past 1 year.

2018 results highlights, Source: Company Reports

The Income available from dividends remains attractive for many investors.

We take a look at the best yields on the market and assess what they say about a companyâs prospect.

One Thing is certain, though, Australia interest rates are still low, making income difficult to come by and keeping the focus for many investors on high yielding stocks. Kalkineâs team of analysts bought you handpicked report for âTop 25 Dividend Stocks For 2018.â

ASX-relevant Special Reports are published year-round to provide a detailed analysis into an investing opportunity or a potential risk to your portfolio.

Click here to get your free report.

Disclaimer

The advice given by Kalkine Pty Ltd and provided on this website is general information only and it does not take into account your investment objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. Kalkinemedia.com and associated websites are published by Kalkine Pty Ltd ABN 34 154 808 312 (Australian Financial Services License Number 425376). website), employees and/or associates of Kalkine Pty Ltd do not hold positions in any of the stocks covered on the website. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations.