Lithium is estimated to experience a turnaround in the years ahead over the anticipated battery boom, which in turn, is promoting many miners to jump into the segment and engage themselves in the production of battery-related materials. While the market is relying on Teslaâs Gigafactory and EV global penetration, the below mentioned ASX-listed lithium players are progressing over the production of lithium or its related chemicals.

Ioneer Limited (ASX: INR)

INR, an emerging Lithium-Boron supplier on ASX, presented the quarterly activities report for the June 2019 quarter on 29 July 2019.

Rhyolite Ridge Lithium-Boron Project:

INR recently updated the mineral resources of the prospect, which now stand at 154.0 million tonnes at 1,650 parts per million lithium or an equivalent of 0.9 per cent lithium carbonate and 14,100 parts per million of boron or equivalent to 8.0 per cent boric acid.

The total Mineral Resource of 154.0 million tonnes would now account for 1.3Mt of Li2CO3 and 12.4Mt of H3BO3.

The recent upgrade in mineral resources underpins an increase of 200,000 tonnes of Li2CO3 and 3.8Mt of H3BO3. The total maiden Measured Resource of the prospect now stands at 41.0 million tonnes with a grade of 1,700 parts per million lithium and 14,400 parts per million of boron.

Out of total 41.0 million tonnes of Measured Resources, 27.5 million tonnes are of high-grade with 1,900 parts per million of lithium and 17,800 parts per million of boron for the upper zone.

Mineral profile of the prospect (Source: Companyâs Report)

High-Purity Boric Acid:

INRâs Rhyolite Ridge pilot plant with the primary processing of lithium-boron ore produced high-purity boric acid, and as per the company, the production of lithium carbonate is in the pipeline. The company dispatched the samples of the produced boric acid to potential offtake partners and is presently hosting inspections of the pilot plant with potential customers and partners.

Kemetco Research Inc- Canada-based contract research and development laboratory are operating the INRâs pilot plant, where the company plans to take further testwork.

Leap in Lithium Hydroxide:

INR engaged Veolia Water Technologies Inc- a significant supplier of evaporator & crystalliser systems and a processing expert, to complete the extensive testwork, which in turn, stimulated major unit operations within the DFS process flowsheet and produced boric acid, lithium carbonate, and battery-grade lithium hydroxide.

U.S. Policy Advantage:

INR could potentially benefit from the United States policies to promote the domestic supply market and reduce dependency on external (foreign) supply. The American Mineral Security Act, which seeks to codify in part, the 2017 Executive Order from the United States President Donald Trump, which aimed to create a comprehensive approach to protect the domestic mineral resources along with the supply chain of refined products, could boost the domestic mineral demand for material such as lithium, graphite, nickel, etc.

INR could potentially take advantage of such policies as the company holds the potential to produce 20,000 tonnes of lithium carbonate per annum with more than 30 years life-of-mine (LOM).

The shares of INR closed the trade at $0.190, down by 5% as compared to its previous closing price.

Mineral Resources Limited (ASX: MIN)

Mineral Resources Limited (ASX: MIN) is an Australian Securities Exchange-listed multi-business company, whose core business pillars include Mining Services, Commodities, Profit-Share Projects, Innovation & Infrastructure, and Energy.

Under the roof of mining services, the company provides service such as Crushing, Processing, Road and Rail Bulk Haulage, Camp Services, and Marketing & Shipping Services. Under the commodities segment, MIN holds exposure to lithium, Iron ore, and Graphite. The lithium projects of the company are hard-rock based project, which is in Western Australia with Wodgina Lithium Project and Mt Marion at the Pilbara Region.

Spodumene Pricing:

MIN on the behalf of Reed Industrial Metals Pty Ltd- who is the owner of the Mount Marion Lithium Project made a public announcement on 29 July 2019. MIN advised the investors that the realised price for 6 per cent spodumene concentrate for the September 2019 quarter will be at US$608.95 per dmt, down by over 10.75 per cent as compared to the June quarter realised price of US$682.38 per dmt.

Joint Venture with a Mammoth:

MIN entered into a binding agreement with the lithium chemicals behemoth- Albemarle Corporation, a New York Securities Exchange-listed company in December 2018. The agreement was concerning the sale of a 50 per cent interest in the Wodgina Lithium Project to form an equally proportionate Joint Venture to produce spodumene and lithium hydroxide.

In relation to the agreement, MIN recently reported about the notification provided by the Albemarle Corporation Inc. The company said that Albemarle secured an unconditional approval from the China State Administration for Market Regulation (or SAMR) for the proposed transaction between MIN and Albemarle. However, the completion of the transaction remains conditional over the approval from the Australian Foreign Investment Review Board (or FIRB) and from certain third parties, who have shown interest in the Wodgina Lithium Project.

June 2019 Quarter Highlights:

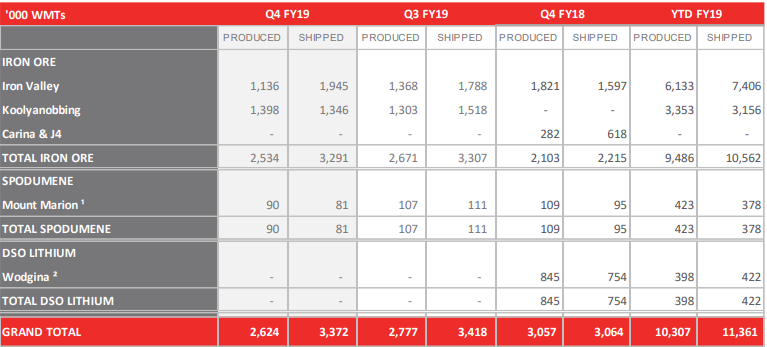

(Source: Companyâs Report)

While the company produced no lithium from its Wodgina prospect amid the ongoing deal with the Albermarle, MIN produced 90,000 wet metric tonnes of spodumene from its Mount Marion prospect during the June 2019 quarter, which was less as compared to the previous quarter production of 107,000 wet metric tonnes.

However, the production-grade of 6 per cent spodumene increased from previous 66 per cent level to 69 per cent.

The shares of MIN closed the trade at $16.175, down by 0.216% as compared to its previous closing price.

Lepidico Limited (ASX: LPD)

LPD a lithium chemicals developer and producer, who is engaged in the production of lithium carbonate and lithium hydroxide from the non-traditional lithium-rich sources such as lepidolite and zinnwaldite (or mica minerals). The companyâs patent technology- L-Max® allows the production of lithium carbonate from non-traditional lithium-rich mica minerals.

While its LOH-Max® allows LPD to produce lithium-hydroxide from lithium sulphate without sodium sulphate being as a by-product of the process; and, LPD is presently targeting commercial production by 2021 for its Phase 1 lithium chemical plant.

L-Max® Trail Completion:

In an announcement made public by the company on 29 July 2019, LPD mentioned that the L-Max® incorporated pilot plant had completed the 10-day trial period. Now, the pilot plant campaign 1 is listed to complete post the production of SOP fertiliser and Li2CO3.

LPD dispatched over 500 assay samples for the assessment of the overall performance, which would receive the complete interpretation and result in mid-August 2019, and from which the company would identify the focus areas for plant optimisation.

June 2019 Quarter Highlights:

On the operation counter, the Karibib Lithium Project of the company in Namibia, in which LPD holds 80 per cent interest commenced in early of June 2019 post the business merge with Desert Lion Energy.

During the quarter, LPD concluded and design and construction phase of the L-Max® Pilot Plant on 30 April 2019 and completed the leach and impurities removal circuit in June 2019 and following it the company started the Campaign 1 in early July.

LPD entered an MoU with Gulf Fluor LLC to secure than sulphuric acid supply coupled with the provision of land to construct the Phase 1 plant and for marketing the by-products produced from the Phase 1 plant.

The company increased the Mineral Resource tonnes at the Alvarroes by 290 per cent and contained lithium resources by around 210 per cent against the December 2017 estimates. The overall Mineral Resource of the prospect is now estimated to be 5.87 million tonnes with an average grade of 0.87 per cent lithium oxide in Indicated and Inferred categories (JORC 2012).

The shares of LPD closed the trade flat at $0.025, as compared to its previous closing price.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.