Small cap stocks are the stocks of those enterprises that have a low market capitalisation. Estimated market capitalisation of small cap companies is between $300 million and $2 billion. Small cap stocks have several advantages such as the opportunity to beat institutional investors. Below discussed are three companies that belong to the small cap space and are trading on the Australian Stock Exchange in the health care segment.

Immutep Limited (ASX: IMM)

Biotechnology company headquartered in Sydney, Immutep Limited (ASX:IMM) is in the business of developing new immunotherapeutic treatments targeted towards cancer and autoimmune diseases. Immutep develops therapeutics that modulate Lymphocyte Activation Gene-3 or "LAG-3â. The company is currently working on eftilagimod alpha (efti), which is a soluble LAG-3Ig fusion protein.

Positive Final Efficacy Data

Recently on 15 October 2019, the company announced to have achieved positive results for efti in combination with KEYTRUDA® (pembrolizumab) from its TACTI-mel Phase I clinical study, targeted towards the treatment of metastaftic melanoma.

About TACTI-mel Trial- Trial TACTI-mel (Two ACTive Immunotherapies in melanoma) involves four cohort of six patients per cohort and is a multi-centre, open label trial used for evaluation of combined effect of eftilagimod and pembrolizumab in metastatic melanoma patients who do not have had optimal response or had disease progression with pembrolizumab monotherapy.

This trial has two parts-

- Part A comprises of first three cohorts testing at 1mg, 6mg and 30 mg of efti in combination with pembrolizumab.

- Part B comprises of cohort testing efti (30mg) in combination with pembrolizumab. The testing commences at cycle 1, day 1. The treatment duration is one year.

Key results-

- efti is safe and well tolerable in combination with pembrolizumab without any dose limiting toxicities;

- This trial also evaluated recommended dose for phase II trial, which is 30mg of efti;

- The responses of efti from this clinical trial have been found to be deep and durable.

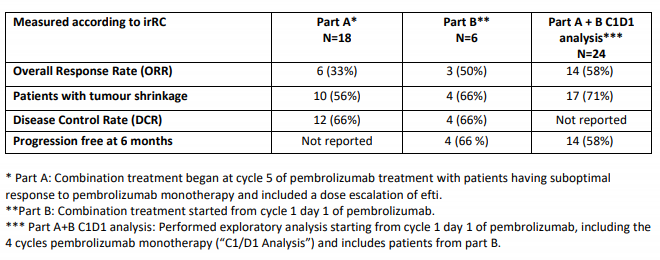

Key Efficacy Findings (Source: Companyâs Report)

French R&D Tax Incentive

Immutep Limited has received $2.5 million in R&D funds from the French government and the company announced that these incentives will be used for the clinical development of eftilagimod alpha and for preclinical development of IMP761.

New Patent for Antibody

A Japanese patent entitled as âAntibody molecules to LAG-3 and uses thereofâ was awarded to Immutep by the Japan Patent Office and the claims of the patent are directed to LAG525 and its use in the treatment of cancer and other infectious diseases. The expiry date of this patent is 13 March 2035 and the patent is co-owned by Novartis AG and Immutep S.A.S.

European Patent

In another market in August 2019, the company unveiled to have received a European patent for eftilagimod alpha in cancer by the European Patent Office. This new patent entitled as âLAG-3 dosage regime for use in the treatment of cancerâ provides intellectual property that protects Immutepâs method for treatment of cancer by administration of different doses of recombinant LAG-3 protein or derivatives. This patent is scheduled for expiry on 3 October 2028.

Stock Information

The companyâs stock was trading at a price of $ 0.027 on 18 October 2019 (AEST 12:55 PM) with a daily volume of 645,818 and a market capitalisation of approximately $ 104.68 million. The stock has a 52 weeks high price of $0.049 and a 52 weeks low price of $0.021.

Oventus Medical Limited (ASX: OVN)

Oventus Medical Limited (ASX:OVN) is a medical device company based in Brisbane and is developing treatment for improving sleep by reducing apnoea and snoring.

Lab in Lab Sites in North America

The company recently updated the market regarding the launch of the first five âlab in labâ customer clinical delivery sites in the US and Canada. The company is expecting revenue in the fourth quarter of calendar 2019.

The recent announcement follows the launch of its oral device O2Vent® Optima in the US sleep and dental channels. In September 2019, Oventus received the FDA approval for the O2Vent® Optima oral device. O2Vent® medical devices are particularly for patients with nasal obstruction.

Source: Companyâs Report

The company announced first agreements in Canada in June and the United States in July 2019. O2Vent sleep treatment platforms are designed for treatment of obstructive sleep apnoea (OSA). It is expected that further agreements may be announced in these key markets over next 1 or 2 years.

Additionally, the company is strongly positioned to make investments towards boosting its operations and scaling sales, backed by its recent placement and entitlement offer (Total funds raised $9.3 million).

Stock Information

The stock of OVN was trading at a price of $0.740 on 18 October 2019 (AEST 12:56 PM), up 2.778% with a daily volume of 21,172 and a market capitalisation of approximately $93.98 million. The stock has a 52 weeks high price of $0.910 and a 52 weeks low price of $0.198.

Creso Pharma Limited (ASX: CPH)

Creso Pharma Limited (ASX:CPH) is a leading global cannabis company, which is engaged in developing cannabis or hemp derived products having therapeutic and nutraceutical importance. The company has rights for various delivery technologies which are unique and innovative and help to increase bioavailability and absorption of cannabinoids.

First Shipment of 10% Medicinal CBD Oil

On 17 October 2019, the company announced to have delivered medicinal 10% CBD Oil as the first orders to a New Zealand player, JC Logistics Ltd t/a Medleaf Therapeutics. The development represents the second product introduction of the partnership between Creso Pharma and Medleaf to New Zeeland during the year 2019. The CBD Oil contains CBD from full spectrum hemp plant extracts, refined to 98% purity.

Source: Companyâs Report

Processing Licence for Cannabis Facility

According to another announcement made by Creso Pharma, its subsidiary Mernova Medical Ltd has secured a license by Health Canada for the processing of cannabis, effective from 13 September 2019. With this license, the company has authority to extract, produce, and wholesale distribute cannabis oil and other cannabis derived products.

Creso Pharma has signed an agreement with Pharma Dynamics, a leading South African pharmaceutical company, for sole distribution of cannaQIX®10. This agreement will allow the customers in South Africa to buy cost-effective, good-quality, broad-spectrum hemp oil GMP nutraceutical product.

What is cannaQIX® 10

cannaQIX® 10 is particularly designed for buccal absorption and for dissolving in the mouth, available in the form of lozenges. cannaQIX® products contain hemp oil extract with cannabidiol, vitamins and zinc, having the main function of reducing stress and supporting mental and neuronal activities. These products do not contain any tetrahydrocannabinol and are sugar free.

Medleaf Distribution Agreement

In August 2019, Creso Pharma signed an agreement with Medleaf for the distribution of cannaQIX® 50 and 10% CBD Oil in New Zealand. This agreement is effective till 31 December 2022. With this agreement, people of New Zealand can use low-cost, high quality cannabidiol products for medicinal and nutritional value.

Creso pharma has authority to cancel the deal anytime by giving a six-month notice, provided the required targets are not met.

Creso Pharma and its marketing partner received regulatory approval from Brazilian Health regulatory agency for import of medical cannabis product of the former named as cannaQIX®50. It is the first medicinal cannabis product of Creso Pharma to be made available in Brazil. This product is imported and distributed by MedDepot Brazil.

Stock Information

The stock of CPH was trading at a price of $0.290 on 18 October 2019 (AEST 12:57 PM) with a daily volume of 50,563 and a market capitalisation of approximately $43.95 million. The stock has a 52 weeks high price of $0.650 and a 52 weeks low price of $0.285.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.