Healthcare Sector in Australia has always been a decent choice for investments, owing to an efficient regulatory system and world-class research capabilities in the country. Moreover, given the COVID-19 situation, increasing number of investors are keeping their eye on the healthcare sector, on the back of many momentous advances expected in the near future. In the Australia healthcare sector, there are several ASX-listed players that have the potential for significant development, backed by favourable tailwinds and advanced technologies.

GOOD READ: Unveiling Current Challenges & Opportunities in Healthcare Sector Amid Coronavirus Threat

On 12 May 2020, S&P/ASX 200 Health Care Sector settled at 43,275.7, indicating a rise of 1.52% compared to the previous close, while benchmark index S&P/ASX 200 traded at 5,403.0, a drop of 1.07%.

ALSO READ: How will the ASX look post COVID-19

In this backdrop, let us skim through how these five ASX-listed healthcare stocks are performing- PAA, VHT, TLX, COH, MDR.

Successful Anti-Cancer Findings from PharmAust’s Monepantel Trial

ASX-listed clinical-stage company PharmAust Ltd (ASX:PAA) is engaged in the development of targeted cancer therapeutics for humans and animals. The Company focuses on repurposing of marketed medicines reducing the risks along with developmental costs. Monepantel (MPL), the lead drug candidate of PAA, is a novel compound with strong potency and is a safe inhibitor of a key driver of cancer, mTOR pathway.

On 12 May 2020, PharmAust disclosed that its monepantel canine trial achieved a successful outcome. The Company released a provisional update for its Phase 2 study (veterinary), which is for investigation of the anti-tumour properties of MPL tablets in dogs along with naive B cell lymphoma treatment.

The study results showed that one pet dog achieved more than 60% decrease in tumour burden, with one of its tumours regressing entirely. The higher efficacy at lower plasma MPL levels offers a strong basis for target dose reduction in future Phase 3 clinical trials and simplifies the path to commercialisation.

It is noteworthy to mention that the tablet trial of MPL outperformed original monepantel liquid trial.

The stock of PAA skyrocketed by 20% to A$0.120 on 12 May 2020 (at AEST 1:11 PM), while at the end of the day’s trading session, the stock settled at A$0.115. With a market cap of A$30.2 million and approximately 302.02 million outstanding shares on ASX, the Company has delivered a one-month return of 44.93%.

Volpara’s Cash Receipts Soared 354% in Q4 FY20

ASX-listed MedTech SaaS company Volpara Health Technologies Limited (ASX:VHT) offers digital health solutions to its customers. The services and technology by Volpara have been used by customers in thirty-eight nations and are supported by several regulatory approvals (FDA clearance and CE marking), patents, and trademarks.

On 23 April 2020, Volpara released its quarterly cash flow report for Q4 FY2020, three-month period ended 31 March 2020.

- Cash receipts from customers for the fourth quarter amounted to NZ$4.7 million, representing an increase of 354% as compared to the previous corresponding period (pcp);

- In the quarter, the Company completed a successful placement of A$28 million and launched a share purchase plan (SPP) for an additional A$7 million.

- Volpara has cash on hand of nearly NZ$31.4 million at the end of this quarter with post-capital increase cash reserves of nearly NZ$67 million.

- This was another strong quarter for the Company, with net new annual recurring revenue (ARR) of over NZ$1.2 million added, nearly 20% up on pcp in spite of the uncertainty due to COVID-19.

Moreover, Volpara disclosed that its software products are contracted to nearly 27.1% of US women, who undergo screening and have a minimum one group product applied to their images and data.

On 12 May 2020, stock of VHT advanced further by 1.504% to close the day’s trade at A$1.350, with the Company boasting a market cap of A$319.22 million and approximately 240.02 million outstanding shares on ASX.

Telix Pharma Submits MAA in Europe for TLX591-CDx

ASX-listed clinical-stage biopharmaceutical company Telix Pharmaceuticals Limited (ASX:TLX) is engaged in developing therapeutic and diagnostic products focused on Molecularly Targeted Radiation (MTR). The Company is developing clinical-stage oncology products for cancers with unmet medical needs such as prostate cancer, renal cancer and glioblastoma.

On 1 May 2020, Telix Pharma announced to have lodged the TLX591-CDx (68Ga-PSMA-11 Injection) marketing authorisation application (MAA) in Europe for the imaging of prostate tumour with Positron Emission Tomography (PET).

Moreover, the Company highlighted that its European MAA for TLX591-CDx is an outcome of an extensive pan-European partnership and includes clinical information obtained in more than 2k patients from both prospective as well as retrospective studies at leading European nuclear medicine centres.

TLX stock dwindled by 2% to A$1.470 on 12 May 2020, with the Company boasting a market cap of A$380.17 million and ~253.44 million outstanding shares on ASX.

Cochlear Confirms COVID-19 Impact on Trading, Remote Servicing Ongoing

ASX-listed medical device player Cochlear Limited (ASX:COH) is into manufacturing, development as well as supply of implantable hearing solutions, targeted towards offering a lifelong of hearing outcomes.

In an ASX announcement dated 11 May 2020, Cochlear provided an update to current trading conditions, disclosing that surgeries had been deferred as expected across the United States and Western Europe due to prioritising of COVID-19 responses in hospitals.

The Company highlighted that revenue from sales across the business declined by nearly 60% year-on-year in April 2020, with its cochlear and acoustic implants being the most severely impacted.

Cochlear implant unit sales fell by approximately 80% across all developed markets, while maximum elective surgeries were deferred across Western Europe and the United States.

Notably, the remote servicing capability of Cochlear with tools such as Cochlear Link and Remote Check is assisting some clinicians and recipients with performance and troubleshooting in those markets where they are approved. In acknowledgement of the importance of providing support, the US Food and Drug Administration (FDA) fast-tracked approval of remote check in April 2020.

The stock of COH traded downward by 1.22% to close the day’s trade at A$188.670 on 12 May 2020, with the Company boasting a market cap of A$12.55 billion and ~65.69 million outstanding shares on ASX.

MedAdvisor Exceeds 1.5Mn Patient Base Digitally Connected in Australia

Australia-based MedAdvisor Limited (ASX:MDR) is a world-class medication management platform that allows users to more easily manage their prescription and improve adherence.

On 29 April 2020, MedAdvisor released its quarterly report for three months to 31 March 2020.

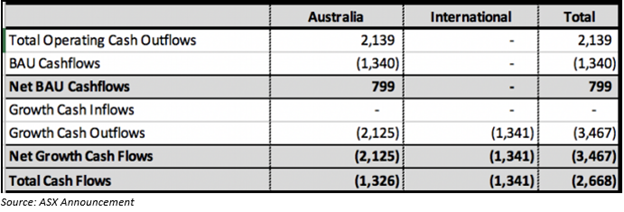

On cash flow front, the Company disclosed total revenue of A$2.2 million (up by 5.5% compared to pcp) and cash receipts of nearly A$2.1 million (down by 10.8% compared to pcp). Moreover, the Company is well capitalised to implement expansion activities with nearly A$13.7 million cash at bank.

Operating cash flow breakdown for the March 2020 Quarter has been given in the figure below.

On the operational front, the Company disclosed that in Australia, it crossed a patient base of 1.5 million who are now connected to its platform. MedAdvisor continues to scale to capture global med-tech opportunities with wins across the United States, South East Asia, UK, and Australia.

It is noteworthy to mention that MedAdvisor has responded to the COVID-19 pandemic with the expansion of its services to include telehealth as well as accelerating the rollout of its on-demand home delivery facilities, which are now live in Melbourne, Brisbane and Sydney.

The MDR stock settled at $0.530 on 12 May 2020, going down by 7.018% from its previous close. The market capitalisation of the Company was noted at A$140.35 million with ~246.22 million outstanding shares on ASX.