From their morning coffee to midnight pharmacy needs, Australians are now getting home deliveries available for everything.

In recent weeks, the federal government has disclosed various moves for covering the costs of prescription delivery, especially for Australians who are vulnerable. And, many of pharmacy players in the country are now providing home delivery services for medication, with the use of digital medication system registering robust growth due to restrictions amid COVID-19 pandemic. Several industry players have also highlighted that the industry experienced strong progress with respect to digitisation adoption in just a few weeks. Consequently, across the country, pharmacy operators are preparing to address increasing demand for home delivery of prescription medicines.

The federal government has sped up its work towards a formal roll out of an e-prescription framework for pharmacies. As per the plan, electronic token would be sent to a patient via SMS, email, or printed paper that can then be examined by a pharmacist for medicine dispensing. This electronic token would allow pharmacy operators to obtain prescriptions from isolated subjects of care with no need to get a prescription on paper. Via this e-prescription, there could be a reduction in the load of remaining prescriptions and enable new models to be established, such as increased delivery services, for patients’ benefit.

ASX-listed player Sigma Healthcare Limited (ASX:SIG) a leading network of independent as well as franchised pharmacy stores have started home delivery of pharmacies from last month, while digital medication management player MedAdvisor Limited (ASX:MDR) launched home delivery and telehealth services in Australia.

Let us acquaint you with these two key healthcare sector players’ activities towards supporting the community with home delivery of critical products/services, in addition to their latest market updates.

Sigma Healthcare Rolls Out Home Delivery Service with Drive Yello

ASX-listed healthcare sector player, Sigma Healthcare Limited (ASX:SIG), engaged in providing a range of quality and affordable private & exclusive label products, is a leading network of independent as well as franchised pharmacy stores such as Amcal, Chemist King, Discount Drug Stores (DDS), Guardian and PharmaSave.

In early April 2020, the Company rolled out a new delivery platform for providing home delivery service for medicines. The platform named Yello was launched in collaboration with Drive Yello, a nimble Australian logistics entity. The platform supports the existing delivery services of pharmacies and makes medicine access simpler, quick, safe and secure, particularly during restrictions on social movement imposed due to COVID-19. It will be helpful for patients to receive timely home delivery of their critical medicines and other products from pharmacies.

Moreover, contactless delivery options were also introduced, targeted towards ensuring protection of customers’ health and wellbeing.

Given the new funding package rolled out by the federal government for supporting in home delivery facilities, the enhanced home delivery service from pharmacies in most instances is not chargeable to vulnerable and for patients who are at risk.

The Home Medicines Service funding package by the federal government is for providing eligible patients with a free monthly delivery of PBS (Pharmaceutical Benefits Scheme) medication to their home while aiding COVID-19 induced restrictions related to social distancing.

Stock Information- On 7 May 2020 (AEST 02:36 PM), SIG stock was trading downward by 0.87% to $ 0.570 with a market cap of $609.13 million. With nearly 1.06 billion outstanding shares, the stock has 52-weeks high and low price of $0.750 and $0.450, respectively. The annual dividend yield of SIG stock was noted at 5.22%.

MedAdvisor Surpasses 1.5 Million Patients Digitally Connected in Australia

Australia-based leading digital medication management player, MedAdvisor Limited (ASX:MDR) has a world-class medication management platform that enables users to more easily manage their prescription and improve adherence. The Company has connected more than 1 million Australian consumers through ~60% of pharmacies in the country and a network of thousands of General Practitioners (GPs).

The Company launched home delivery and telehealth services in Australia during the first quarter of 2020, with the platform now enabling end-to-end medical consultation, pharmacy engagement along with medication delivery.

Business Update

COVID-19 pandemic has increased demand for digital health, resulting in robust patient pool growth. Over the March quarter, MDR made addition of nearly 200k patients to bring its total connected patients to 1.5 million in Australia.

The Company has rolled out the PlusOne pharmacy software at Chemist Warehouse with launch of few branded apps such as Amcal, DDS and Guardian.

MedAdvisor has responded to the COVID-19 pandemic by expanding its services to comprise telehealth and fast-tracking the roll out of its on-demand home delivery services, now live in Melbourne, Sydney and Brisbane.

About 1k pharmacy operators are now offering the functionality to MedAdvisor app patients, since the home delivery launch in March 2020. Already over three thousand delivery requests have been made by patients, with more than 9k items ordered. The Company has also witnessed considerable growth in pharmacies offering pay in advance, a method of contactless payment for its consumers. It has increased from nearly 11% of the MedAdvisor pharmacy network to approximately 80%.

Moreover, MedAdvisor disclosed that during the quarter, the Company observed an upswing in need for GP Link and it makes fees off each consultation. To match the Company’s existing GP network, telehealth would become available, at a small scale, but owing to growing demand, MDR would provide more capacity to enable a faster rollout.

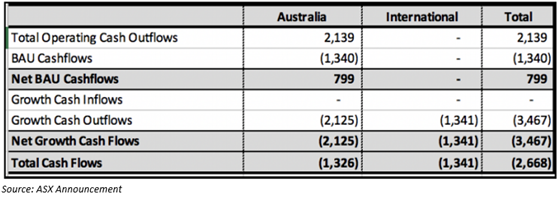

Highlights on cash flow front- The Company reported operating cash receipts of $2.1 million in the third quarter of the financial year 2020, a decline of 10.8% on the prior corresponding period. The Company exited the third quarter with nearly $13.7 million in cash.

Operating cash flow breakdown of MedAdvisor for March Quarter-

Stock Performance- MDR share price climbed by 16.667% to close the day’s trade at $0.560, on 6 May 2020. On 7 May 2020 (AEST 02:53 PM), the stock was trading flat with a market cap of $137.73 million. With nearly 245.94 million outstanding shares, the stock has 52-weeks high and low price of $0.605 and $0.280, respectively. MDR stock has delivered a positive return of 55.56% on the basis of YTD and a positive return of 63.27% in last six months.