COVID-19 pandemic had spread across the world, and as per Johns Hopkins University data, the virus has infected more than 2.6 million individuals. While some nations are still experiencing the early phases of transmission, countries, who thought they had conquered the coronavirus are witnessing a resurgence of cases. On 22 April 2020, WHO advised that there is a ‘long way to go' concerning the infectious disease as global deaths surpass 183k.

While the COVID-19 crisis has wreaked havoc on the Australian economy, it has impacted the share market unequally. The financial sector, real estate, and energy sector in Australia have witnessed the biggest collapse, while the healthcare sector has outpaced the index and other sectors by a significant margin.

ALSO READ: The Run-up for 7 Quality ASX Shares in Healthcare Space

While during this turmoil companies are busy in updating the impact of COVID-19 outbreak on business and posting guidance withdrawal, some healthcare companies are focused towards their goals and working on it amid this challenging situation.

In this article, we will be discussing three ASX-listed healthcare stocks and their recent activities - VHT, CUV, RHC

Volpara Health Records Strongest Quarter in its History; Net New ARR over NZ$1.2 Million

Wellington, New Zealand based Volpara Health Technologies Limited (ASX:VHT) is a MedTech SaaS Company that provides digital health solutions. The healthcare player was founded in 2009 and listed on the ASX in 2016.

Volpara’s technology and services have been used by a research project or by customers in 38 countries, and the Company has various patents, regulatory approvals, and trademarks, which include CE marking and Food & drug administration approvals.

Quarterly Cash Flow Report for Fourth Quarter of FY2020:

Volpara Health Technologies released its quarterly cash flow report for the quarter ending 31 March 2020. Financial highlights include the following:

- Cash receipts from customers continue to be robust, with NZ$4.7 million received in the fourth quarter, up by 354% as compared to the previous corresponding period.

- Q4 FY2020 is Volpara’s third straight quarter in which the Company has cash receipts greater than NZ$4.5 million.

- Cash receipts in the first three weeks of the financial year 2021 have remained solid despite COVID-19 pandemic. However, the Company continue to monitor the current situation carefully, noting the different stages of COVID-19 across its primary market in the US.

- Concerning orders, VHT had the strongest quarter ever, with net new Annual Recurring Revenue (ARR) of more than NZ$1.2 million added, which is approximately 20% up on Q4 FY19 despite the COVID-19 turmoil.

- The Company exited its fourth quarter of FY20 with net operating cash outflow of NZ$4.2 million, in line with its expectations.

Some More Focal Points During Q4 FY20 and Early in Q1 FY21:

- Closed several Aspen® Breast SaaS contracts: The Company highlighted that it closed several Aspen® Breast SaaS contracts during Q4 FY20, continuing the move away from capital sales.

- Collaboration agreement with Ambry Genetics: As announced last week, Volpara signed a collaboration with Ambry Genetics for creating an online ordering procedure for genetic testing within the Aspen® Breast practice management software. This comprises using Volpara®Density™ for an automated measure of breast density and subsequently calculating risk, with the potential to considerably raise ARPU upon successful clinical implementation.

- ScreenPoint Medical’s Transpara™ software: For this software, Volpara acts as a distributor in critical markets and obtained clearance from the US FDA in March for the 3D version of its software. This has allowed numerous clinical studies to begin installations.

Volpara shares rose by 2.767% to $1.300 on 23 April 2020. VPT’s market cap was $276.38 million.

CLINUVEL PHARMACEUTICALS is Launching SCENESSE® in China In Collaboration with Winhealth Pharma

A global biopharmaceutical Company, CLINUVEL PHARMACEUTICALS LTD (ASX:CUV) is dedicated to developing and producing therapies for patients with various serious inherited and skin disorders. CLINUVEL is a pioneer in the area of photomedicine, and the Company’s R&D has led to innovative treatments for patient populations with a necessity of cure for photoprotection, repigmentation and genetic shortcomings.

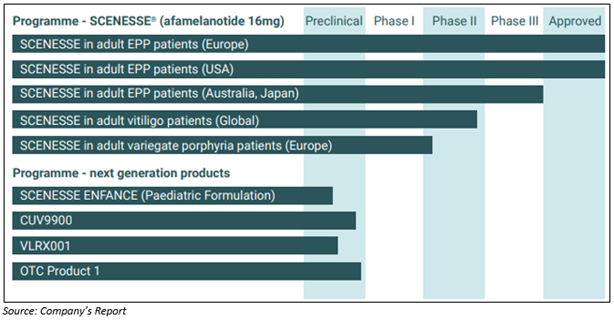

CLINUVEL has a strong product pipeline which provides growth opportunities for the Company:

Collaboration with HK Winhealth Pharma Group

CLINUVEL is launching SCENESSE® (afamelanotide 16mg) in China for the treatment of the rare genetic metabolic disorder erythropoietic protoporphyria (EPP).

The collaboration aims at facilitating early access for Chinese EPP patients while collecting data for a new drug application (NDA) to the Chinese National Medical Products Administration (NMPA).

Named Patient Program (NPP) In China for Treatment of EPP

The Company revealed that it would work on the Named Patient Program in collaboration with Hong Kong-headquartered Winhealth Pharma Group to launch SCENESSE® (afamelanotide 16mg) in China.

SCENESSE® is the first systemic photoprotective drug across the globe, approved in Europe by EMA and the US by FDA for adult EPP patients.

The collaboration will be under a Named Patient Program (NPP), and according to the US and EU protocols, the NPP will include up to ten Chinese EPP patients. The patients will be evaluated during a defined period.

The safety and effectiveness information captured under the NPP will be included in a Chinese new drug application (NDA) along with data obtained from CLINUVEL’s clinical trial and pre- and post-authorisation programs in Europe and the US.

Moreover, CUV mentioned that the collaboration with Winhealth would also emphasise subsequent registration of SCENESSE® on the National Drug Reimbursement List.

On 23 April 2020, CUV’s shares tumbled by 6.582% to $19.870. The Company’s market cap was $1.05 billion.

Ramsay Health Care Committed to its Strategy; Continues to Create Shareholder Value

A global healthcare sector player, Ramsay Health Care Limited (ASX:RHC) is into providing high-quality services and offering outstanding patient care as well as hospital management.

Ramsay is one of the biggest and most diverse international private health care companies and provides primary and acute health care services from its 480 facilities throughout 11 countries.

The forefront behind the success of the Company is providing high-quality outcomes for patients and focusing on relationships with staff and doctors.

Capital Raising worth $1,200 Million:

Global hospital operator Ramsay Health Care revealed that the Company is taking decisive action to strengthen its balance sheet in order to navigate an uncertain operating environment and to increase financial flexibility.

The Company announced that it had completed the institutional placement of approximately $1,200 million which was announced on 22 April 2020.

The institutional placement of ~21.4 million new ordinary shares (fully paid) was priced at $56 per share. Moreover, the Company also kicked off a non-underwritten share purchase plan (SPP) and will offer its existing eligible shareholders a chance to participate in the SPP to raise ~$200 million.

It is noteworthy to mention that Ramsay remains committed to its strategy and continues to create shareholder value through its focused strategy while behaving per the Ramsay Way ‘People caring for People’.

On 23 April 2020, Ramsay’s shares fell by 5.864% to $60.520. RHC’s market cap was $12.99 billion.