Did you know that in 2018, solar power accounted for approximately 5 per cent of Australiaâs total electrical energy production? Experts believe that in 2019, almost 60 solar PV projects with a combined capacity of 2,881 MW are in completed/work in progress stage. These facts prove that the Renewable Energy Pied Piper of Australia is gradually tuning the country to move towards a renewable energy hub.

Latest Energy Statistics

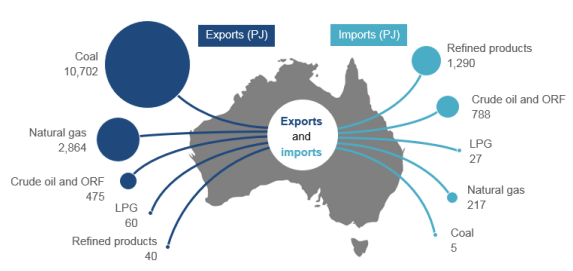

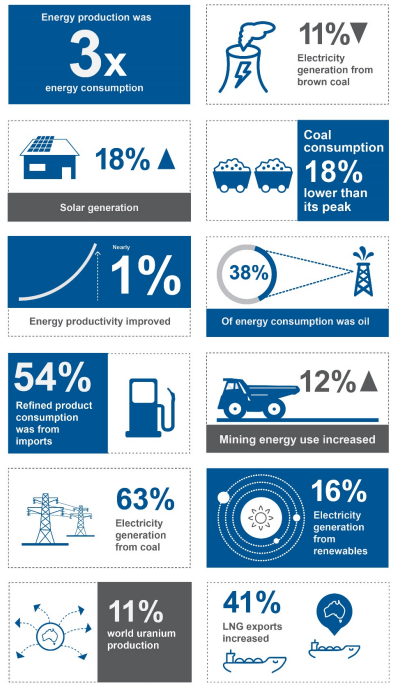

According to the Department of Environment and Energy, Australia is presently utilizing around 20 per cent less energy per person than it was at the beginning of this century, although overall consumption has increased (as on 20 September 2018). In 2016-17, Electricity generation and transport were the largest energy-using activities. Oil was the largest energy source, with a consumption rate of 38 per cent of total energy consumption, followed by Coal, natural gas and renewables. The country has been a notable exporter of energy as well.

Australian energy trade, 2016â17 (Source: Department of the Environment and Energy)

Latest Energy Scenario in Australia

The present Morrison Government of Australia believes that the country is transitioning to an all together new energy future. The top priority of this phase is to ensure sufficient energy generation for the Australians at affordable prices. The new âprice safety netâ has been aiming at lowering the power bills since its introduction in October 2018.

Australian Energy Statistics (Source: Department of the Environment and Energy)

With the goal of improving market competition and transparency in the retail sector dealing with energy and based on the recommendation made by the Australian Competition and Consumer Commission (ACCC), a default market offer (DMO) was set to be implemented.

A recent implementation has been the Competition and Consumer Regulations 2019 (the Code), which, from 1 July 2019 sets a price cap on standing offer prices in electricity distribution regions where prices are not exposed to price regulation and allow easier competition.

Commencing July 2019, the electricity prices are expected to be capped for approximately 800,000 users on standing offers in the south-eastern Queensland, NSW and South Australia with the start of the DMO.

According to a government report, households shifting to the DMO from standing offer agreements could save approximately $662 in NSW, $526 in South Australia and $663 in south-east Queensland. Likewise, businesses would also save up to $2,851 in NSW, $1,913 in South Australia and $2,373 in south-east Queensland.

The Underwriting New Generation Investments program

In the recent energy space of the Aussie land, The Underwriting New Generation Investments program needs a special mention, as it is a prime focus of the government to provide affordable and reliable power to Australians.

The Program has been a hit and received up 66 proposals across a range of generation types and states in the National Electricity Market (NEM); 12 out of which have been shortlisted in which half pertain to renewable pumped hydro projects, five gas projects and a coal upgrade project. The main objective of the program is to target a 25 per cent to 30 per cent drop in wholesale charges in each of the NEM regions by 2021. Eventually, it is likely to be a huge leap towards achieving the 2030 target.

What do the experts say?

The positive response to the underwriting program is a clear depiction of the profound willingness of investors to put their money in the future of Australiaâs energy supply. With increased competition and aggravated supply, the government is focussed to shun down electricity prices.

Looking at an example of the enhanced renewable energy wing in the country, the Australian Renewable Energy Agency (ARENA) would grant $1.5 million to ATCO Gas Australia for a hydrogen energy innovation hub, a $3.3 million project. Projects like this would be ground-breaking for the Australian renewable energy hub.

Besides this, Powershop Australia, a subsidiary of ASX listed Meridian Energyâs (ASX: MEZ), has signed an agreement with virtual player Kogan.com Limited (ASX:KGN) to offer power and gas services to the Aussie households under the brand, Kogan Energy.

Keeping an open eye towards every aspect of this discussion, in his first term of being the energy minister, Angus Taylor had vouched to cut down energy prices. A section of market experts believe that the commitment was not fully fruitful, as wholesale electricity prices were at a record high in the March quarter.

With him being re-appointed as the new energy minister leading Australiaâs energy policy, it would be interesting to witness the improvements that would occur on the emission reductions, which are now the responsibility on the energy, and not the environment section of the government.

Experts believe that emissions have increased consecutively for four years in Australia, and they would not improve, given that the LNG production is set to increase by approximately 13 per cent in 2019.

Investors need to watch the challenges being thrown upon by the global warming and climate damage situation and make prudent decisions in the Energy space.

With this backdrop, let us look at two related stocks from the energy space, listed and trading on the Australian Securities Exchange:

Origin Energy Limited (ASX: ORG)

A leading energy retailer of Australia with a plan to halve the carbon emissions by 2032, ORG provides renewable energy options and hunts for natural gas reserves. On ASX, ORGâs stock was trading at A$7.690, up by 1.45 per cent by the close of trading hours on 23 July 2019.

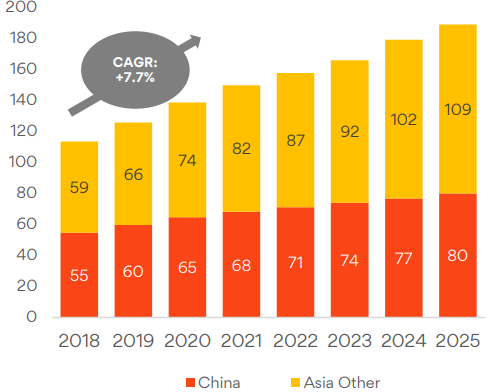

Macquarie Conference Highlights: At the Macquarie Conference on 1 May 2019, the company stated that it was targeting an additional 530 MW contracted wind online by 2020. Through the DMO, ORG estimated a $44 million annual revenue reduction. On the retail front, the company would have over $100 million cost reduction by FY2021. On the LNG front, Asian demand is projected to grow, and a significant new US supply is expected in 2020 â 2022.

Asia LNG demand 2018-2025 (MTPA) (Source: ORGâs Presentation)

AGL Energy Limited (ASX: AGL)

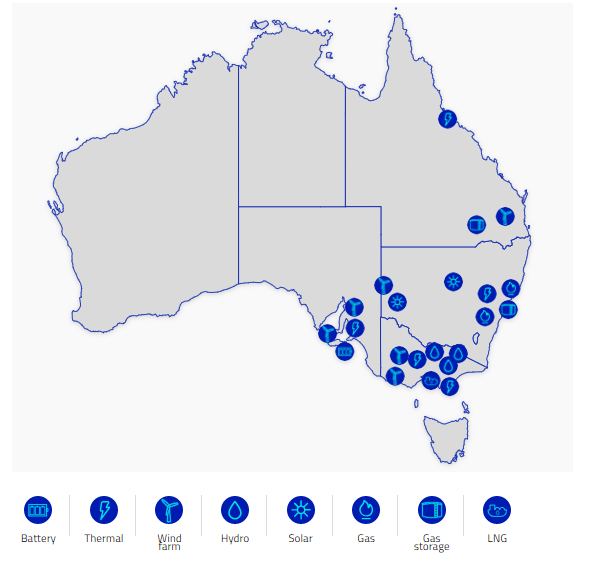

Aiming for a sustainable, secure and affordable energy future for Australia, AGL operate the countryâs largest electricity generation portfolio. On ASX, AGLâs stock was trading at A$20.690, down by 0.05 per cent by the close of trading hours on 23 July 2019.

AGL expects an Underlying Profit after tax to range between $970 million and $1,070 million in FY19.

AGLâs Asset Map (Source: AGL Website)

Crib Point gas import project: On 28 June 2019, the company announced that first gas to be delivered from the proposed AGL Gas Import Jetty at Crib Point, Victoria was most likely to take place in the second half of FY22, and not in FY21.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.