Nickel prices are knocking the heavens door in the international market over the high demand forecast for lithium-nickel based batteries and stainless steel. The ASX-listed nickel miners are welcoming the rally in nickel price, which has reached closer to its multi-year high of US$19,932.00, recorded in September 2014.

While the nickel prices are moving to establish a new 5-year high, the ASX-listed nickel stocks are already making multi-year high.

Nickel Market:

Nickel markets are charging high over the bullish demand estimation from the energy storage industry and stainless-steel future forecasts. The prices of LME nickel future CFD skyrocketed from the level of US$12,775.00 (low in June 2019) to the present month high of US$18,842.50 (Dayâs high on 2 September 2019), a 47.5% jump.

Nickel is on a bull run from past four months amidst the supply shortage forecast. Many industry experts anticipate that the worldâs nickel demand could soon surpass the global production chain, which in turn, propelled the nickel prices.

To Know More, Also Read: Nickel Future Prospect And Lens Over The Potential Shiners- POS, MCR and MLX

Steel Markets

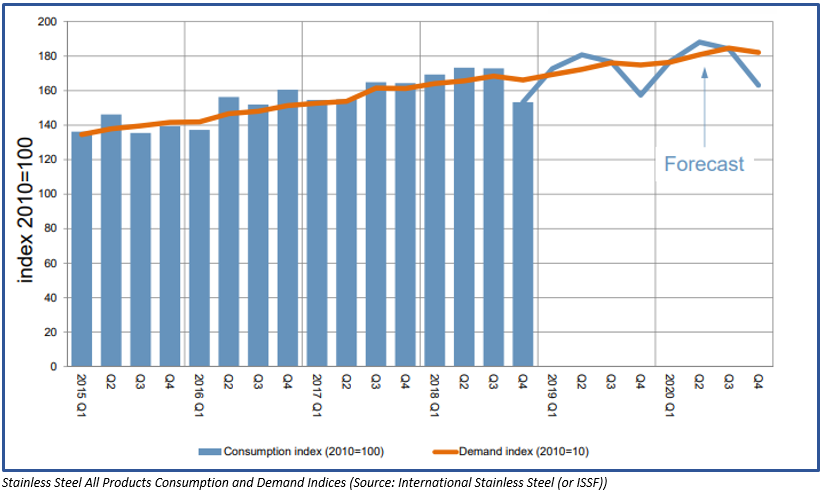

The global stainless-steel sector consumes 68 per cent of nickel, while the worldwide battery sector consumes only 3 per cent of the global production. The market experts are bullish on both the segments over the longer-term, despite the gloomy global economic scenario.

World steel production is set to touch a new milestone in 2019 as robust production in China offsets the diminished output across the globe.

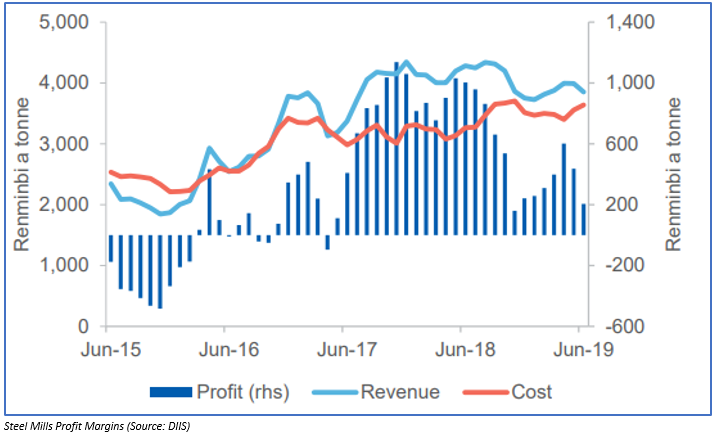

As per the Australian Department of Industry, Innovation and Science (or DIIS) estimation, the world steel production witnessed a 4.9 per cent yearly increase in the first five months to May 2019 amid healthy output from China.

Chinese steel production inched up by 10 per cent year-on-year in the first five months to May 2019 as steel mills ramped up production over high steel prices in the international market and improved profit margins.

The DIIS estimates that global steel production would remain in line with global consumption. However, global production is still anticipated to witness a muted growth, which could boost the nickel prices if the supply shortage forecast from industry experts come into play.

Stainless Steel Growth Projections:

While the steel market is anticipated to witness a slight increase, the stainless-steel market is expected by the industry experts to witness a boost post the last quarter of the year 2019 till the end of the year 2020, which is further propelling the nickel prices, and in turn, the prices of ASX-listed nickel stocks.

ASX-Listed Nickel Stocks:

Independence Group NL (ASX: IGO)

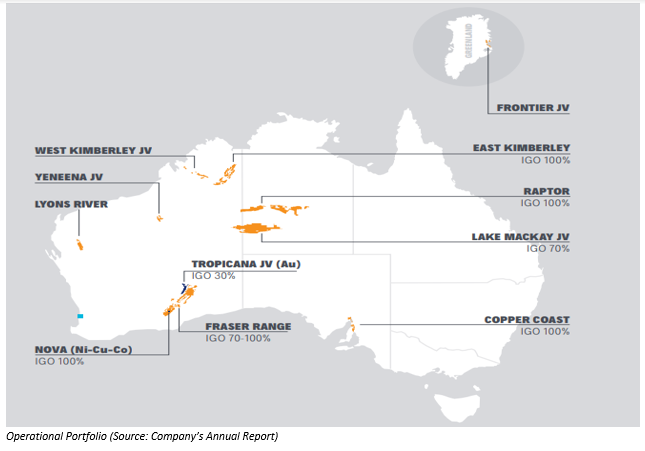

IGO is an ASX-listed nickel miner engaged in the development of high quality, longer life and larger scale nickel and gold prospects. The operational portfolio of the company includes Nova and Tropicana, along with many other regional exploration and development projects and Joint Ventures.

Nova Operations:

The wholly owned nickel, copper, and cobalt prospect of the company is in the Fraser Range, Western Australia and contains an underground contract mining along with an owner-operated processing plant.

The nickel production from the prospect in FY2019 stood at 30,708 tonnes, while copper and cobalt production for FY2019 stood at 13,693 tonnes and 1,090 tonnes, respectively. The overall production in FY2019 surpassed the top end of the FY19 guidance by 2.4 per cent.

The project demonstrated steady-state production above the nameplate with a throughput of 1.5 million tonnes per annum.

The other nickel prospects of the company include Fraser Range, lake Mackay JV, West Kimberley JV, Raptor and Yeneena JV Option.

Price Movement:

The stock of the company is on an upsurge from the last four months, and from the level of A$4.240 (low in June 2019) to the present high of A$6.370, which in turn, underpins the growth of over 50 per cent. The stock is currently trading above the June 2011 high of A$6.200.

Mincor Resources NL (ASX: MCR)

MCR is an ASX-listed nickel company, which strategically holds land in the Kambalda District of Western Australia, which is a substantial nickel and gold producing hub in Australia.

Cassini Update:

The ongoing diamond drilling at the Cassini in Kambalda, which is a part of a drilling program, intersected a high-grade massive sulphide zone, which returned an outstanding intercept of 6.3m @ 7.1 per cent of nickel.

As per the company, the new intercept includes 4.5m @ 9.0 per cent nickel along with an ultra-high-grade zone of 16.1 per cent (for 0.4m), which hosts millerite (the highest grade of nickel sulphide).

Also Read: Mincor Resources Announces $23 Mn Capital Raising For Kambalda Nickel Project

Price Movement:

The stock crossed its March 2015 high of A$0.725 and marked a new 52 week high at A$0.735 (Dayâs high on 2 September 2019). The stock of the company is gaining from the level of A$0.41 (low in June 2019) to trade on a multi-year high of A$0.735, which in turn, underpinned a growth of almost 80 per cent.

Poseidon Nickel Limited (ASX: POS)

POS is a publicly trading nickel mining company with various nickel prospects including the flag Lake Johnston, Mt Windarra and Black Swan.

Black Swan Back in Production:

POS recently announced that it is restarting its Black Swan nickel prospect as the nickel market demonstrated high spot nickel price over the recent months.

The 30 days nickel price remained above US$6.50/lb with intraday highs ofUS$8.40/lb (as on 2 September 2019).

POS Board considered and approved an accelerated program of works for the restart of Black Swan nickel operations, and the works include, rehabilitation of mine escape ladderways at the Silver Swan mine along with the restoration of all accessways and structures of the Black Swan plant. The restart work will also witness dewatering of the Black Swan open pit.

The estimated contracted cost for the above-mentioned works totals to $2.9 million, and all the anticipated works are time-critical and mandatory to accelerate the bulk of mine and plant rehabilitation work.

Price Movement:

The share price of the company reached a new 52-week high of A$0.061 (Dayâs high on 3 September 2019) post surpassing its 2018 high of A$0.060 (high in September 2018). The stock is charging high from the level of A$0.035 (low in June 2019) to the present month high of A$0.061, which in turn, underpinned the growth of over 74 per cent.

In a nutshell, nickel is sailing high in the market over the industry estimation of a rise in stainless steel demand. Apart from the anticipation of upcoming demand from the stainless steel and energy storage sector, the estimate of the decline in supply is also fanning the nickel prices in the market.

The high price of nickel in the market is fuelling the Australian nickel miners, and the ASX-listed nickel stocks are currently trading to set new multi-year highs.

However, the global economic conditions and China tepid stimulus over the infrastructure growth contains a potential risk for the future nickel demand, and investors should monitor the global scenario to reckon the next movement.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.