Gold prices are finally retracing post a massive rally amid improvement in global tensions. The Spot Gold prices which surged from the level of US$1269.57 (Dayâs low on 21st May 2019) to the level of US$1438.99 (Dayâs high on 25th June 2019), started retracing back from the 25th June high to the present level of US$1389.61 (as on 02nd July 2019 12:37 PM AEST).

However, the rally in gold prices pushed the Australian Securities Exchange-listed gold miners share prices near their 52-week highs; however, the recent gold plunge dragged the miners from their 52-week highs. Let us take a look at the gold mining companies, which are retracing from their recent 52-week highs.

Northern Star Resources Limited (ASX: NST)

NST is among the top 25 global gold producers, and the company holds mines across Western Australia and North America. The business portfolio of the company in Australia contains many significant gold projects such as Tanami Project, Paulsen, the Jundee Operations, which is a gold endowment of 10 million ounces, and Kalgoorlie Operations, which is a gold endowment of 19 million ounces.

In North America, Pogo is the key asset of the company, which is a gold endowment of 8 million, and NST claims it to be the next Jundee Operations.

Jundee Operations:

In the Financial year 2018, NST sold 285-kilo ounces of gold with an All-in-sustaining cost of A$870 per ounce through the Jundee Operations, and the total Mineral Resources of the prospect stand at 4.3 million ounces and the Ore Reserves of the prospect is at 1.6 million ounces.

NST upgraded the plant processing capacity, which now stands at 2.4 million tonnes per annum, and with that the production guidance for the financial year 2019 stands in the range of 280,000-300,000 ounces with an AISC of A$895-A$980 per ounce.

The Pogo Operations:

Over the past 12 years, the prospect of the company produced about 3.8 million ounces of gold with an average grade of 13.6 gram per tonne. The Mineral Resources of the prospect stand at 4.15 million ounces at an average grade of 14.7 gram per tonne. The Ore Reserves of the prospect are at 760,000 ounces with an average grade of 11.9 gram per tonne, which as per the company is the third highest grade in North America.

NST planned the A$15 million exploration drilling for the second half of the financial year 2019 and mobilised four additional rigs to the site.

Kalgoorlie Operations:

NST sold 262-kilo ounce of gold in the financial year 2018 from the prospect with an AISC of A$1,174 per ounce. The Mineral Resources of the prospect stands at 8.6 million ounces, while the Ore Reserves stand at 2.3 million ounces.

The production guidance of the prospect for the financial year 2019 is in the range of 320,000-340,000 ounces with AISC between A$1,190-A$1,300 per ounce.

The Resource Delivery:

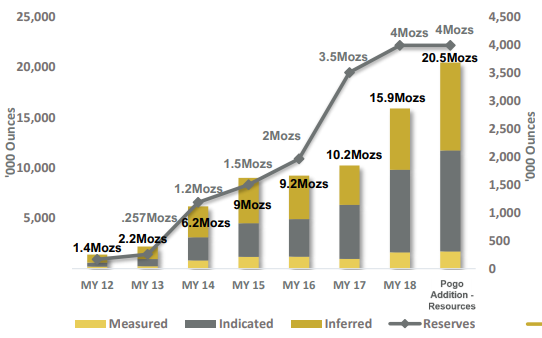

NST is inching up its resource and reserves steadily from the Mid-year 2012 and delivered value accretive organic and inorganic growth.

Source: Companyâs Investor Presentation

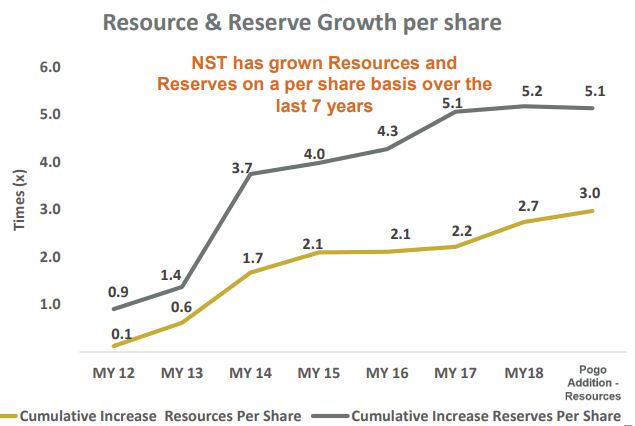

The reserves and resources grew on a per share basis as well, and over the last seven years, it progressed significantly.

Source: Companyâs Investor Presentation

52-Week High:

The share price of the company, supported by the gold price surge, reached a new 52-week high of A$11.920 (Dayâs high on 25th June 2019); however, the correction in gold prices is bringing down the share, which is currently trading at A$11.385 (as in 2nd July 2019 12:58 PM AEST), down by more than 4 per cent from its 52-week high.

Gold Road Resources Limited (ASX: GOR)

GOR is an Australian Securities Exchange listed gold miner, and the key asset of the company is its Gruyere Project. GOR is a fully-funded newbie with a 50 per cent Joint Venture with Gold Fields.

Gruyere Gold Mine:

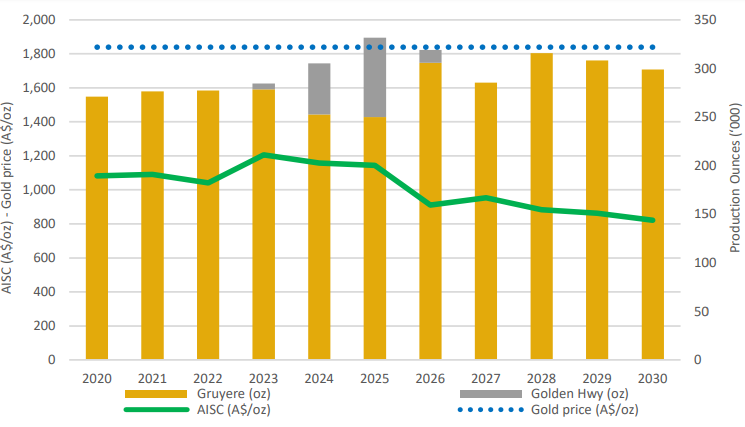

The annual production rate of the mine is 300,000 ounces of gold per annum with a mine life of 12 years. The throughput rate of the mine is 8.2 million tonnes per annum, and the Ore Reserves of the prospect are at 3.92 million ounces.

The current mine plan of the company is to inch up the production capacity and reduce the All-in-sustaining cost.

Source: Companyâs Report

Source: Companyâs Report

In an announcement today on ASX, GOR mentioned that the company poured first gold bar at the Gruyere Gold Project from the Carbon-in-Leach (CIL) circuit. The company produced three dore bars, which totalled 1139 ounces from the CIL and elution circuits.

As per the company, the less complex gravity circuit is underway, and now GOR would focus on commissioning the bill mill, which is among the final components of the process plant. The ball mill is estimated by the company to mark a completion in early September 2019 quarter.

The gold production would continue until the ball mill is fully functional, and once operational it would be integrated into the circuit. To reduce the gold losses associated with lower recoveries during the initial production phase, GOR plans to utilise low-grade ores during the commissioning and initial stages of ramp-up.

Once the ball mill becomes operational, that would mark the starting of an anticipated ramp-up period of 6-7 months. The Gruyere Joint Venture is forecasted by the company to attain commercial production in the mid-way of the ramp-up period.

A per the company, for CY2019, the production would be between 75,000 to 100,000 ounces, while the final capital cost remains under the companyâs previous estimate of $621 million on a 100 per cent basis.

Gruyere Resource and Reserves Profile:

The total Mineral Resources, which includes both Indicated and Inferred, stands at 155 million tonnes with an average grade of 1.32 gram of gold per tonne. The 155 million tonnes Mineral Resource would further account of 6.61 million ounces of gold.

Likewise, the Ore Reserves of the prospect, including both Proven and Probable, stand at 97 million tonnes with an average grade of 1.25 gram of gold per tonne. The 97 million tonnes Ore Reserves would further account of 3.92 million ounces of gold. The company recently inched up its gold resources.

52-Week High:

The recent gold rush did push the share price of the company to a new 52-week high of A$1.150 on 4th June 2019; however, the shares of the company dropped post that despite the continuation in the gold rally to the level of A$.900 (Dayâs low on 20th June 2019).

Currently, the GOR is trading at A$1.070 (as at AEST: 1:17 PM, 2nd July 2019), down by more than 6 per cent from its 52-week high.

Independence Group NL (ASX: IGO)

IGO is an Australian multi-commodity miner with core operations in non-operator gold mining such as Tropicana Gold Mine.

Tropicana Gold Mine:

In Tropicana Gold Mine, IGO holds 30 per cent interest, while AngloGold Ashanti controls 70 per cent interest. The mine delivered an EBITDA margin of 59 per cent during the third quarter of the year 2019.

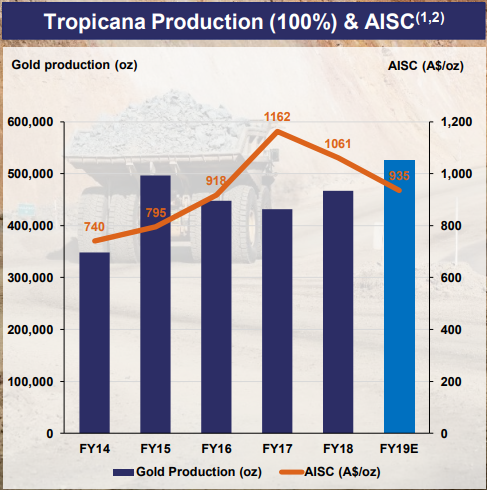

The current mine life is of 8 years, and in the financial year 2019 the Tropicana Gold Mine inched up the production while lowered the costs.

Source: Companyâs Report

The Resource and Reserve Profile:

The total Mineral Resources at the Tropicana Gold Mine stand at 7.70 million ounces, while the complete Ore Resource at the prospect stands at 3.74 million ounces.

The open pit hosts 4.14 million ounces of Mineral Resource and 2.92 million ounces of Ore Reserves. Likewise, the stockpiles host 0.70 million ounces of Mineral Resource and 0.32 million ounces of Ore Reserves.

The underground hosts 2.85 million ounces of Mineral Resource and million ounces of Ore Reserves.

52-Week High:

As IGO is a multi-commodity miner, the gold rally somewhat supported the gold prices, but the overall commodity market decides the actions of the share price. The gold rush supported the share price of the company, which surged from the level of A$4.240 (Dayâs low on 6th June 2019) to the level of A$4.910 (Dayâs high on 21st June 2019).

The 52-week high of the company is at A$5.265, and the share price of the company is trading at A$4.770 (as at AEST: 1:17 PM , 2nd July 2019), up by 0.421 per cent from its previous close, but down by more than 9 per cent from its 52-week high.

In a nutshell, the recent gold rush supported by global uncertainties, supported the gold miners, and the stock price of the gold miners climbed up the ladder to reach their respective 52-week highs; however, post the recent events, the gold prices are correcting as global cues are improving, which in turn, is further dragging the gold miners down along with it.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.