Good real estate stocks remain to be one of the most desired investing options for investors, because they offer several advantages including potentially higher returns, stability, inflation hedging, and portfolio diversification. Real estate stocks are prone to have low volatility when compared to other equities, and are often tagged to be recession saviours, as investing in REITs (real estate investment trusts) allows investors to avoid the challenges of direct ownership while still benefitting from what investment real estate offers, comprising of recurring dividend income and property appreciation.

The Australian Real Estate Debacle

The Australian property market underwent a property bubble and became significantly overpriced and witnessed a significant downturn in the past two years, with house prices in Australiaâs major cities ballooning for over a decade. The late 2017 to mid-2019 housing downturn, which saw real estate values fall 8.4% nationally. The expensive housing market was in free fall, as higher interest rates made the monthly repayments soar, mortgages were unaffordable, and households were forced to limit their spending and consequently, unemployment rose.

However, a silver lining has been apparent this year, with property prices in the metropolitan hubs beginning to fall, resulting in the market to turnaround. For the first time in two years, the outlook seems to be noticeably changing as:

- There has been a loosening of credit restrictions;

- There were no changes to the tax incentives that property investors rely on;

- The Morrisonâs government election win in May changed the regulatory landscape;

- The Banking Royal Commissionâs crackdown on lending practices by big banks in Australia triggered government-led inquiry and corrections in the major banks;

- Three (and historic) rate cuts by the Central Bank (Reserve Bank of Australia), aimed to help stimulate a struggling broader economy, transformed the housing market with buyers enjoying the leverage of the low rates;

- Population growth created a large underlying accommodation requirement in a few cities.

Whatâs the Latest in Australiaâs Real Estate?

According to an Australian Bureau of Statistics (ABS) report, the Australian economy grew by 1.9% in 2018-19, where the household net worth increased by $47.7 billion to $10.5 trillion, the smallest increase in a decade.

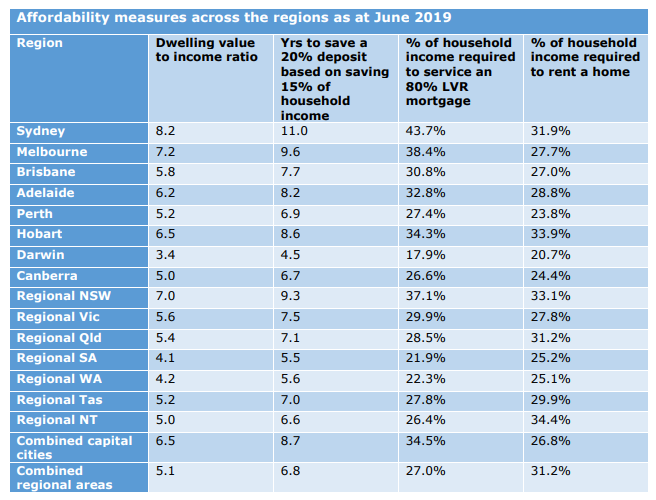

Interestingly, housing affordability has progressed over the past two years as dwelling values have trended lower, incomes have noticeably risen, and mortgage rates are held around generational lows.

(Source: ANZâs Report)

(Source: ANZâs Report)

Data Company CoreLogic believes that the Housing affordability (which peaked in June 2019), and the property prices are likely to reach record highs in the first half of 2020, given the current rates are maintained (they were last shunned by 25 basis point in October 2019 and are currently at the record low of 0.75%). A further reduction (which remains much anticipated for February 2020) only amp up this projection.

It should be noted that in Melbourne and Sydney (cities that have recorded a more substantial rise in housing values over the past decade), housing values have risen 6 per cent and 5.3 per cent since May. Moreover, according to a report published by Australia and New Zealand Banking Group Limited (ASX: ANZ), from 2001 through June 2019:

- Household incomes have risen at the annual rate of 3.8%;

- Dwelling values have increased by 6.0% per annum nationally;

- Rents have increased by 4.7% per annum.

A recent ABS report states that the seasonally adjusted value of new lending commitments to households rose by 1.1% in September 2019 (registering a fourth-month straight record).

Whatâs in for Investors?

Despite micro and macro-economic factors impacting the dynamic nature of businesses around us, it is a long-believed investing notion that real estate and property investment is one of the most lucrative industries to get involved in, as it generates secondary income via non-liquid assets.

Australia is home to a solid and one of the most consistent real estate and property investment markets across the globe and has a rich investment history.

Experts believe that the current times are an excellent time for the American buyers to invest in the prestigious Aussie suburbs, given that the Australian dollar is currently trading at less than ~70 US cents (some believe it is at a decade low!), which makes room for currency saving on their purchase. Moreover, there prevails a comparatively reduced competition from Australiaâs largest international property investors, an opportune period.

For the Australia investors, the low interest rate regime, and the Central Bankâs quantitative easing has built positive sentiment, encouraging them to go ahead with (riskier) investments. Investors have seen a keen interest in self-managed super funds, besides equities listed on the Australian Securities Exchange (ASX).

Real Estate Stocks On ASX

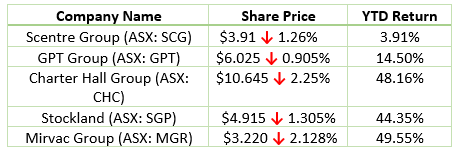

Let us now browse through the performance of some of the real estate stocks listed and trading on the ASX, during the trading session on 20 November 2019 (at AEST 3:19 PM). Also, the S&P/ASX 200 Real Estate (Sector) index was trading at 3,833.2, down by 1.84% or 70.6 basis points (at AEST 3:06 PM).

It is safe to say that the if one looks at the property market in Australia over the last 25 years, one will see that it has grown, amid the soars and lows. The fewer risks, tax benefits and deductions, hedge against inflation are advantages unique to this sector and with the increasing number of listings and available options in Australiaâs share market, one can always include some property stock, to up their investing portfolio and game.

We leave you to this fact, believed by several property industry experts- the current property prices in Australia are rising more rapidly than expected and it is highly likely that the national house values will grow upwards over 4% next year.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.