The year 2019 was an exciting year for the technology sector, with the tech index S&P/ASX 200 Information Technology delivering growth of 32.96% and surpassing its benchmark index S&P/ASX 200, which delivered a growth of 22.44%.

The Australian tech sector in the month of February 2019 witnessed investments from three global players including Equinix, Cisco and Zoho towards their expansion in the country.

As per a report published by the Australian government, four emerging technologies - artificial intelligence, blockchain, IoT and quantum computing would be playing an important role in boosting the tech sector. Artificial intelligence has a huge potential for pumping trillions of dollars on a global level in the upcoming years. On this front, the Australian government has also introduced 8 AI Ethics principles and received support from big players like Telstra, Commonwealth Bank, NAB, Flamingo and Microsoft.

2020 is the beginning of a new decade and is expected to bring a significant improvement in the tech sector.

In this article, we would be looking at some of the popular tech stocks of 2019 with their outlook and progress towards achieving goals for the year.

Altium Limited (ASX: ALU)

Electronic design software company, Altium Limited (ASX: ALU), in FY2019 ended 30 June 2019, delivered a strong result with record growth of 27% in new Altium Designer seats and 13% in subscription base to over 43,600 subscribers.

Revenue during the period excluding interest went up by 23% to US$171.82 million, while EBITDA grew by 40% to US$62.72 million and PAT increased by 41% to US$52.89 million.

The company highlighted in its outlook that it is focused to become a market leader in PCB design software and aims to achieve market dominance by 2025 with a subscriber base of 100,000.

Let’s look at the company’s achievements post FY2019.

- Launched the next version, also the most powerful version of Altium Designer to date, Altium Designer 20

- Disclosed the first cloud-based application of the industry for ECAD component management.

Appen Limited (ASX: APX)

Appen Limited (ASX: APX), which is a global leader in the development of high-quality, human-annotated datasets for machine learning and AI, reported a 60% growth in revenue for 1H 2019 ended 30 June 2019. Its underlying EBITDA increased by 81% to $46.3 million while statutory EBITDA went up by 48%. Underlying net profit after tax (NPAT) went up by 67 per cent to $29.6 million and statutory NPAT grew by 33 per cent to $18.6 million.

For the financial year 2019 ended 31 December 2019, the company expects to register $96 million - $99 million in underlying EBITDA.

Recent Achievements of Appen:

- Introduced feature updates for its Artificial Intelligence (AI) training data solution during August 2019, designed to speed up the AI programs of customers.

- The company was recognized in the Technology Fast 50 & 500 of multinational professional services network, Deloitte.

- Strengthened the leadership team with appointment of two key executives to aid in registering continuous growth.

rhipe Limited (ASX: RHP)

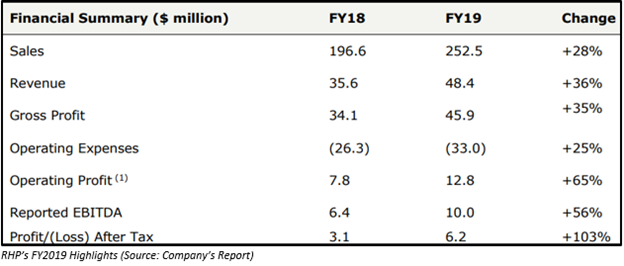

rhipe Limited (ASX: RHP), the cloud channel company, reported a 36% increase in revenue for FY2019 ended 30 June 2019.

In FY2020, the company expects its public cloud business to continue to be the growth engine for the business, with sales & revenue to grow continuously as more businesses in the Asia-Pacific region move their IT jobs to public cloud infrastructure.

On this front, the company, in FY2020, expects to invest in:

- Front office sales, marketing and technical staff to aid in boosting customer count in all nations.

- Microsoft Dynamics channel staff. Initially, the focus would be on assisting IT resellers with Dynamics sales & implementation opportunities in Australia.

- Development of Prism along with the development of ‘SmartEncrypt’.

- Expansion in other rhipe solutions staff.

Recent Achievements:

Microsoft Japan appointed rhipe Japan as an Indirect Cloud Solutions Provider (CSP). rhipe Japan is a joint venture company owned 80% by rhipe Limited and 20% by Japan Business Systems.

During FY2020, rhipe Limited anticipates investing ~ $3 million in rhipe Japan. The investment would be directed towards hiring personnel and delivering marketing, systems & enablement services for driving the adoption of Microsoft Cloud Subscriptions amongst small and medium-sized businesses in Japan.

Importance of investing in Japan:

- Japan ranks amongst Microsoft’s largest markets and it is expected that the cloud segment would grow at a three-year CAGR of 25%.

- SME market in Japan is expected to be five times that of the Australian market, representing a huge opportunity.

- Pay As You Go distribution is substantially lower than that of Australia in Japan, thus have a wide scope for the CSP business to grow.

Outlook post Q1 FY2020:

- Operating profit in FY2020 is expected to be noted at $16 million; however, this figure excludes any changes in market conditions or major expansion initiatives like geographical or vendor growth opportunities.

- Invest $0.6 million in FY2020, to develop SmartEncrypt.

Audinate Group Limited (ASX:AD8)

Audinate Group Limited (ASX: AD8), a developer of the professional AV-industry leading Dante® media networking solution, reported a 44% growth in revenue to $28.3 million in FY2019 ended 30 June 2019. Operating cash flows increased from $1 million to $3.6 million and EBITDA went up from $0.6 million to $2.8 million.

In FY2020, the company is well-positioned to pioneer the future of AV. During the period, the company would:

- Invest in order to double the engineering and R&D functions over the upcoming two years.

- Implementing the business infrastructure platform to assist the company in achieving long-term growth.

- Make Dante AV the technology of choice for OEMs.

- Increase Total Addressable Market by including video and software products.

FY2020 Key goals:

- Drive design wins to generate FY21 & beyond revenue pipeline.

- Broaden product offerings.

TechnologyOne Limited (ASX:TNE)

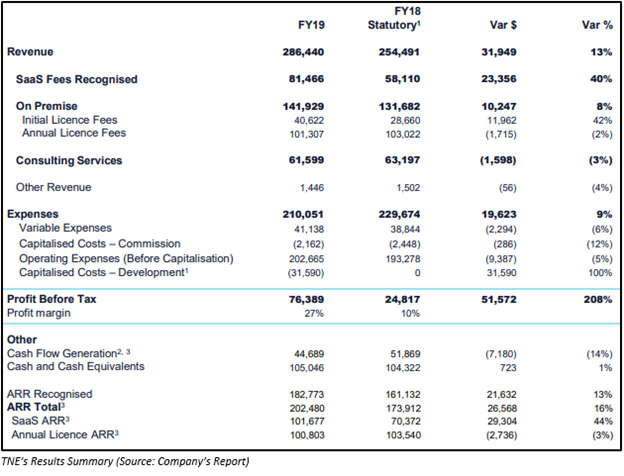

TechnologyOne Limited (ASX:TNE), one of Australia’s largest enterprise SaaS companies, reported a growth of 44% in SaaS Annual Recurring Revenue during FY2019 ended 30 September 2019. Revenue increased by 13% to $286 million, expenses declined by 9%, and cash flow generation for the period was $45 million, representing a drop of 14% as compared to the previous corresponding period. The company was able to achieve its top year-end guidance of NPBT of $76.3 million.

Outlook:

The company confirmed in its FY2019 results, that it is positioned strongly for FY2020 and would continue to deliver strong profit growth once again over the full year.

Recent Developments post FY2019 Results:

AVJennings, which is one of the best known and most trusted names in residential property in Australia, entered an agreement for a period of 5 years with TechnologyOne to build out its digital transformation. Under the agreement, TNE would provide a simpler, unified & advanced technology base for the organisation along with its extremely mobile, geographically diverse workforce spread across New South Wales, Queensland, Victoria and New Zealand.

Xero Limited (ASX: XRO)

Xero Limited (ASX: XRO), a provider of online accounting software for small businesses, registered a 32% increase in operating revenue in 1H FY2020 ended 30 September 2019. Subscriber base increased by 30% to nearly 2.06 million, with new subscriber base of 239,000, representing a growth of 24%. NPAT recorded for the period stood at $1.34 million.

Outlook:

In the upcoming period, the company would be focusing on boosting its global small business platform. It would prefer to reinvest the cash generated, depending on investment criteria & market scenario. The free cash flow in FY2020 ending 31 March 2020 is anticipated to be in a same proportion of the FY2019 total operating revenue.

Let’s look at some of the company’s achievements in 2H FY2020:

- RSM Australia, which is one of Australia’s top 10 accounting firms, selected Xero and GreatSoft as its preferred software solution.

- XRO strengthened its partnership with GoCardless to assist small businesses in the US and Canada to stay on top of their cash flow.

- Introduced new features to its platform to assist small businesses in understanding their finances, handling projects’ profitability as well as completing payroll benefits faster. These are real-time, smarter insights with business snapshot, connecting quotes with projects to support job profitability, manage car expenses without the complexity or paperwork, and automated payroll functionality.

- Announced that it is building deeper integrations with apps that small businesses use on a daily basis like Google, Microsoft Office 365, HubSpot & many more.

- At Roadshow Asia, the company announced innovations that would offer new tools for small businesses as well as their advisors to have greater visibility into business health.

- Unveiled the official opening of its Toronto office with a capacity of 200 employees with plans to grow & develop in the region.

Nearmap Ltd (ASX: NEA)

Nearmap Ltd (ASX: NEA), a provider of geospatial map technology for business, enterprises & government clients, reported a 45% growth in statutory revenue to $77.64 million during FY2019 ended 30 June 2019. The net loss for the period was $14.93 million, representing a growth of 35% from the previous corresponding period. The balance sheet of the company remained strong for the period with zero debt.

FY2020 Outlook:

Nearmap is well-positioned to extend its growth and deliver on its priorities in FY2020. Nearmap 3D and a beta release of NEA’s AI content would support the evolution of the company. Further, the company would increase investment in people and technology to offer superior content to clients.

Developments in 1H FY2020:

On 12 December 2019, the company announced the acquisition of technology and intellectual property from Primitive LLC to rapidly extract and disseminate roof geometry from its widescale 3D content as well as provide a new sort of location intelligence to clients. Primitive LLC is a deep learning and analytics technology company engaged in data extraction for providing roof geometry insights.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.