Highlights:

- NextEra Energy, Inc. (NYSE:NEE) reported revenue of US$5.04 billion in Q4, FY21.

- Duke Energy Corporation (NYSE:DUK) reported revenue of US$25.09 billion in Q4, FY21.

- Dominion Energy, Inc. (NYSE:D) returned over 12% gains in the past 12 months.

Investors typically invest in utility stocks as they stay relatively stable even during market upheavals. The demand for utility services also remains steady. Hence, they are considered for an extended keep.

The government generally regulates the costs for their services, which assures the companies a steady stream of income for expansion or paying dividends to investors. Let's explore some of the top S&P 500 utility stocks amid the volatile condition in the market.

Also Read: What is BORA (BORA) crypto and why is it rising?

NextEra Energy, Inc. (NYSE:NEE)

NextEra Energy is an electric power and energy infrastructure firm that focuses on generating, transmitting, distributing, and selling electricity. It is based in Juno Beach, Florida.

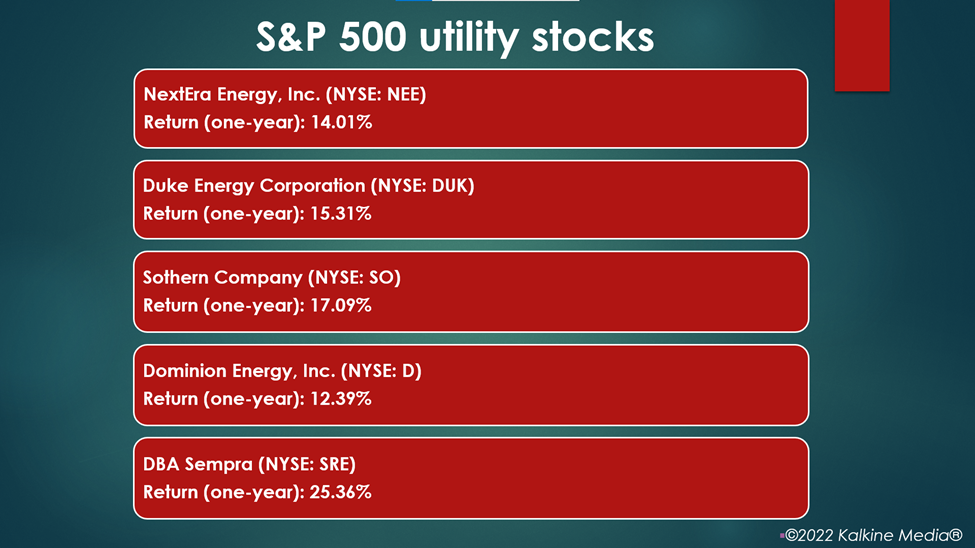

The shares of the company traded at US$85.56 at 12:01 pm ET on March 30, up 1.11% from their closing price of March 29. Its stock value increased by 14.01% over the past 12-months.

The firm has a market cap of US$168.05 billion, a P/E ratio of 47.3, and a forward one-year P/E ratio of 30.01. Its current yield is 2.01%, and its annualized dividend is US$1.70.

The 52-week highest and lowest stock prices were US$93.73 and US$69.79, respectively. Its trading volume was 8,954,273 on March 29.

The company reported a revenue of US$5.04 billion in Q4, FY21, while its attributable net income came in at US$1.20 billion, or US$0.61 per share. For fiscal 2021, the company's operating revenue was US$17.06 billion.

Also Read: Why did Stargate Finance (STG) rose over 98% in a week?

Source: ©2022 Kalkine Media®

Source: ©2022 Kalkine Media®

Duke Energy Corporation (NYSE:DUK)

Duke Energy is electric power and natural gas holding firm based in Charlotte, North Carolina. It offers retail electric service through generating, transmitting, and distributing electricity.

The stock of the company traded at US$110.9496 at 12:14 pm ET on March 30, down 0.02% from its previous closing price. The DUK stock rose 15.31% over the past 12 months.

The market cap of the company is US$85.66 billion, the P/E ratio is 22.57, and the forward one-year P/E ratio is 20.32. Its current yield is 3.58% and its annualized dividend is US$3.94.

The stock saw the highest price of US$110.99 and the lowest price of US$95.34 in the last 52 weeks. Its share volume on March 29 was 2,461,711.

The company reported net operating revenue of US$6.23 billion in Q4, FY21, while its attributable net income attributable from continuing operations came in at US$739 million. For fiscal 2021, the company reported net operating revenue of US$25.09 billion.

Also Read: Terra (LUNA) hits all-time high: Why is LUNA crypto rising?

Southern Company (NYSE:SO)

Southern Company is one of the leading gas and electric utility holding firms that focuses on the development, acquisition, and managing of power generation assets, as well as selling electricity in the wholesale market. Based in Atlanta, Georgia, it also engages in the distribution of natural gas.

The shares of the company traded at US$72.10 at 12:26 pm ET on March 30, up 0.06% from their closing price of March 29. Its stock value surged 17.09% over the past 12-months.

The firm has a market cap of US$76.60 billion, a P/E ratio of 31.97, and a forward one-year P/E ratio of 20.30. Its current yield is 3.72% and its annualized dividend is US$2.64.

The 52-week highest and lowest stock prices were US$72.07 and US$60.12, respectively. Its trading volume was 5,422,295 on March 29.

The company reported a revenue of US$5.76 billion in Q4, FY21, while its net loss came in at US$283 million. For fiscal 2021, the company's net revenue was US$23.11 billion.

Also Read: Why is Flux (FLUX) crypto rising?

Dominion Energy, Inc. (NYSE:D)

Dominion Energy is a power and energy company based in Richmond, Virginia. It specializes in the production and distribution of energy and provides electricity, natural gas, and other related services to its customers.

The stock of the company traded at US$84.94 at 12:33 pm ET on March 30, up 0.06% from its previous closing price. The company's stock value gained 12.39% over the past 12 months.

The market cap of the company is US$68.91 billion, the P/E ratio is 21.36, and the forward one-year P/E ratio is 20.65. Its current yield is 3.17% and its annualized dividend is US$2.67.

The stock saw the highest price of US$84.90 and the lowest price of US$70.37 in the last 52 weeks. Its share volume on March 29 was 2,673,070.

The company reported net operating revenue of US$3.88 billion in Q4, FY21, while its attributable net income came in at US$1.34 billion, or US$1.63 per diluted share. For fiscal 2021, the company's net revenue was US$13.96 billion.

Also Read: Why Lionel Messi wants to promote Socios.com crypto?

DBA Sempra (NYSE:SRE)

Sempra Energy is an energy infrastructure firm that engages in investing, developing, and operating energy infrastructures while providing electric and gas services to its customers. It is based in San Diego, California.

The shares of the company traded at US$167.05 at 12:38 pm ET on March 30, up 1.28% from their closing price of March 29. Its stock value soared 25.36% over the past 12-months.

The firm has a market cap of US$52.65 billion, a P/E ratio of 40.58, and a forward one-year P/E ratio of 19.57. Its current yield is 2.81% and its annualized dividend is US$4.58.

The 52-week highest and lowest stock prices were US$164.98 and US$119.56, respectively. Its trading volume was 1,805,856 on March 29.

The company reported a revenue of US$3.84 billion in Q4, FY21, while its net income came in at US$712 million, or US$1.90 per diluted share. For fiscal 2021, the company's net revenue was US$12.85 billion.

Also Read: Why is DexTools (DEXT) crypto rising? Volume up 700%

Bottom line:

The S&P 500 utilities index gained 3.27% YTD while increasing 15.16% in the past 12 months. On the other hand, the S&P 500 index fell 2.82% YTD. The market has been volatile this year amid various macroeconomic and geopolitical tensions. Hence, investors should apply due diligence before investing in stocks.