Highlights

- Data showed that Ocugen's vaccine candidate, Covaxin, provides a strong immune memory against the virus.

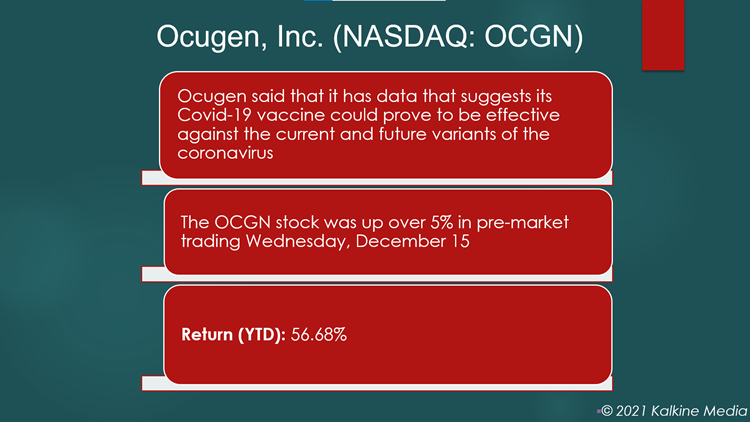

- The OCGN stock was up over 5% in pre-market trading Wednesday, December 15.

- The OCGN stock gave a return of over 56% year-to-date.

The stocks of Ocugen, Inc. (NASDAQ:OCGN) were trending on Wall Street Wednesday, December 15, after the company said that it has data that suggests its Covid-19 vaccine could prove to be effective against the current as well as future variants of the coronavirus. Its stock was up over 5% in pre-market trading on December 15.

Ocugen is a biopharmaceutical company that primarily engages in the development of gene therapies for treating diseases related to blindness. In addition, it is also well known for developing a vaccine for Covid-19. Ocugen is based in Malvern, Pennsylvania.

On December 15, the firm announced that the data analyzed from the immune response of two doses of its vaccine candidate, Covaxin (BBV152), through a third-party study is published on the preprint server, medRxiv. Data was compared among the immune memory response of 71 vaccinated and 73 naturally infected subjects with SARS-COV-2, which also includes variants of concern for a period of 6 months.

Also Read: Top 5 US bank stocks to watch amid Fed’s tapering of asset purchases

Notably, the study showed that its vaccine candidate, Covaxin, provides a strong immune memory against spike and nucleoprotein, comparable to natural Covid-19 infection for the levels of antibodies, memory B cells, and memory CD4+ T cells.

Notably, apart from curbing the infections, the adaptive immune system generates immunological memory like memory B and T cells that offer long-term protection against the virus.

Also Read: Top 5 US Lithium stocks to watch in 2022

Also Read: What is Decentralized Social crypto? DeSo coin hits all-time high

Ocugen (OCGN) stock pricing and earnings highlights:

The stocks of Ocugen, Inc. (OCGN) were priced at US$5.09 at 8:26 am ET on December 15, up 5.82% from its previous closing price when it closed at US$4.81. It has a market cap of US$958.08 million.

The OCGN stock saw a highest price of US$18.77 and lowest price of US$0.29 in the last 52 weeks. Its trading volume was 21,984,120 on December 14.

Also Read: 5 US real estate stocks to watch in 2022

The company's loss from operations was US$10.78 million in Q3, FY21, as compared to a loss of US$10.18 million in the same quarter of the previous year. For the period, it reported a net and comprehensive loss of US$10.75 million, or a loss of US$0.05 per share, against a loss of US$10.47 million, or a loss of US$0.07 per share in Q3, FY20. As of September 30, 2021, the company had cash and cash equivalents of US$107.34 million.

Also Read: Olympus (OHM) crypto rallies after falling for a week

Bottom line:

Covaxin has been primarily developed by Indian biotech firm, Bharat Biotech in collaboration with the Indian Council of Medical Research, National Institute of Virology. Meanwhile, Ocugen is co-developing the vaccine for the US and Canadian markets. In addition, it may start marketing the vaccine in those countries, once it gets approval from the regulators.

The stock value of OCGN surged 56.68% YTD.