Highlights

- Gevo, Inc. (NASDAQ:GEVO) stock jumped 720.22% in the last twelve months.

- The Clean Energy Fuels Corp. (NASDAQ:CLNE) stock surged 277.24% in one year.

- SolarEdge Technologies, Inc. (NASDAQ:SEDG) expects its Q3, FY21 revenue to be between US$520 million and US$540 million.

Clean energy has been the center of attraction for global investors as the world shifts towards clean energy to fight global warming. Many countries, including the US, the UK, China, and Australia, are focusing on the renewables sector for the next development phase. However, other countries across the globe are also taking steps to mitigate the climate challenge.

In the recent sessions in the stock market, the energy sector has led gains as investors look for economically sensitive stocks with the economy recovering by leaps and bounds.

Let's explore some clean energy stocks that may benefit from the shift towards renewables.

Also Read: Red Cat (RCAT) stock rides high after NASA contract, stock jumps 50%

Gevo, Inc. (NASDAQ:GEVO)

Gevo is an Englewood, Colorado-based renewable chemical and biofuel company. The company produces renewable chemicals with zero emissions.

The stock traded at US$7.03 at 12:30 pm ET on Sep 28, down 3.70 percent from its closing price of Sep 27. The stock value increased by 720.22 percent in the last twelve months. The firm has a market cap of US$1.41 billion and a forward P/E one year of -25.17. Its EPS is US$-0.38.

The highest and lowest prices of the stocks for the last 52 weeks were US$15.57 and US$0.85, respectively. Its trading volume was 18,316,210 on September 27.

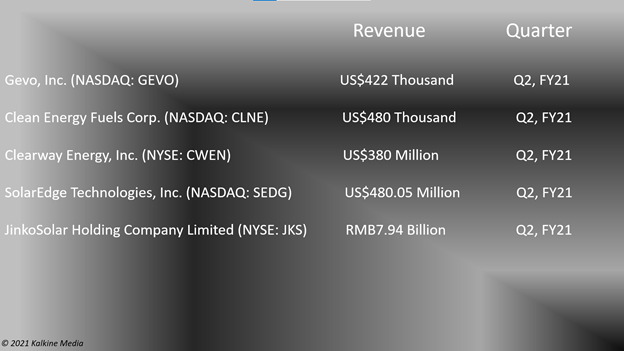

The total revenue of the company was US$422 thousand in Q2, FY21, compared to US$988 thousand in the same quarter of the previous year. It reported a net loss of US$18.25 million, compared to a loss of US$6.04 million in Q2, FY20.

Also Read: Dow Jones closes higher, S&P 500, Nasdaq drift after tech losses

Clean Energy Fuels Corp. (NASDAQ:CLNE)

Clean Energy Fuels is a Newport Beach, California-based renewable energy company that has interests in procuring and distributing renewable natural gas and conventional natural gas.

The stock was priced at US$8.61 at 12:36 pm ET on Sep 28, down 7.22 percent from its previous closing price. The CLNE stock rose 277.24 percent in the last twelve months. The market cap of the company is US$1.90 billion, and the forward P/E one year is 928.00. Its EPS is US$-0.44.

The highest and lowest stock prices for the last 52 weeks were US$19.79 and US$2.39, respectively. Its share volume on Sep 27 was 13,121,060.

The company's total revenue was US$480 thousand in Q2, FY21, compared to US$59.87 million in the year-ago quarter. It reported a net loss of US$79.94 million, compared to a loss of US$7.03 thousand in Q2, FY20.

Also Read: Top five stocks to keep an eye on this week

Clearway Energy, Inc. (NYSE:CWEN)

Clearway Energy is a renewable energy company and has wind and solar generation projects. It is based in New Jersey, US.

The shares traded at US$30.525 at 12:44 pm ET on Sep 28, down 1.05 percent from its closing price of Sep 27. Its stock value jumped 24 percent in the last twelve months. The firm has a market cap of US$3.56 billion, a P/E ratio of 78.56, and a forward P/E one-year of 29.38. Its EPS is US$0.39.

The highest and lowest stock prices for the last 52 weeks were US$37.23 and US$24.74, respectively. Its trading volume was 472,222 on Sep 27.

The company's total operating revenue was US$380 million in Q2, FY21, compared to US$329 million in the prior year's second quarter. Its net income came in at US$32 million, compared to US$76 million in Q2, FY20.

Also Read: Why are Tesla Inc (TSLA) & Rivian Inc catching the eyes of investors?

SolarEdge Technologies, Inc. (NASDAQ:SEDG)

SolarEdge Technologies is a renewable energy company that provides inverter solutions for solar photovoltaic (PV) systems. It is based in Israel.

The stock was priced at US$271.19 at 12:49 pm ET on Sep 28, down 3.33 percent from its previous closing price. The SEDG stock surged 28.51 percent in the last twelve months.

The market cap of the company is US$14.29 billion, the P/E ratio is 108.08, and the forward P/E one year is 82.02. Its EPS is US$2.53.

Also Read: 10 reasons why US should plan for a digital currency

The highest and lowest stock price for the last 52 weeks were US$377.00 and US$190.10, respectively. Its share volume on Sep 27 was 374,506.

The company's revenue was US$480.05 million in Q2, FY21, compared to US$331.85 million in the same quarter of the previous year. Its net income came in at US$45.09 million, compared to an income of US$36.66 million in Q2, FY20.

The company now expects its revenue to be between US$520 million and US$540 million in Q3, FY21.

Source: Pixabay

Also Read: Top five uranium stocks to watch as mines reopen

JinkoSolar Holding Company Limited (NYSE:JKS)

JinkoSolar is one of the leading solar panel manufacturers in the world. It is based in Shanghai, China. The stock traded at US$42.08 at 12:55 pm ET on Sep 28, down 4.45 percent from its closing price of Sep 27. Its stock value grew 16.6 percent in the last twelve months. The firm has a market cap of US$2.02 billion and a forward P/E one year of 35.80. Its EPS is US$-3.46.

The highest and lowest prices of the stocks for the last 52 weeks were US$90.20 and US$28.39, respectively. Its trading volume was 1,294,501 on Sep 27.

The company's total revenue was RMB7.94 billion in Q2, FY21, compared to RMB8.45 billion in the prior year's second quarter. Its net income came in at RMB269.81 million, compared to RMB344.96 million in Q2, FY20.

Also Read: Ford (F), Toyota (TM) stocks in focus after positive business update

Bottomline

The energy sector witnessed significant growth as the market reclaims ground from the pandemic disruptions. The S&P 500 energy sector surged 39.73 percent YTD while increasing 10.37 percent MTD.