Highlights:

- Energy Transfer reported total assets of US$ 105,735 million in Q3 2022.

- Enterprise Products Partners paid a quarterly dividend of US$ 0.475.

- The adjusted EBITDA of Enterprise was reported at US$ 2,258 million.

The year 2022 was a tumultuous one for investors and the equity market. However, with the expectation that the next year will pan out in a similar fashion, traders are taking a cautious approach. A long-term strategy might salvage some damage in the short term.

Amid, we take a look at two U.S. dividend stocks and how they have fared in the recent quarter:

Energy Transfer L.P. (NYSE: E.T.)

Energy Transfer owns a large platform of natural gas, crude oil, and natural gas liquid assets, mainly in Texas and the U.S. midcontinent.

The company holds a dividend yield of 8.975 per cent and paid a quarterly dividend of US$ 0.265. Energy Transfer has an EPS of 1.34 and a P/E ratio of 8.90.

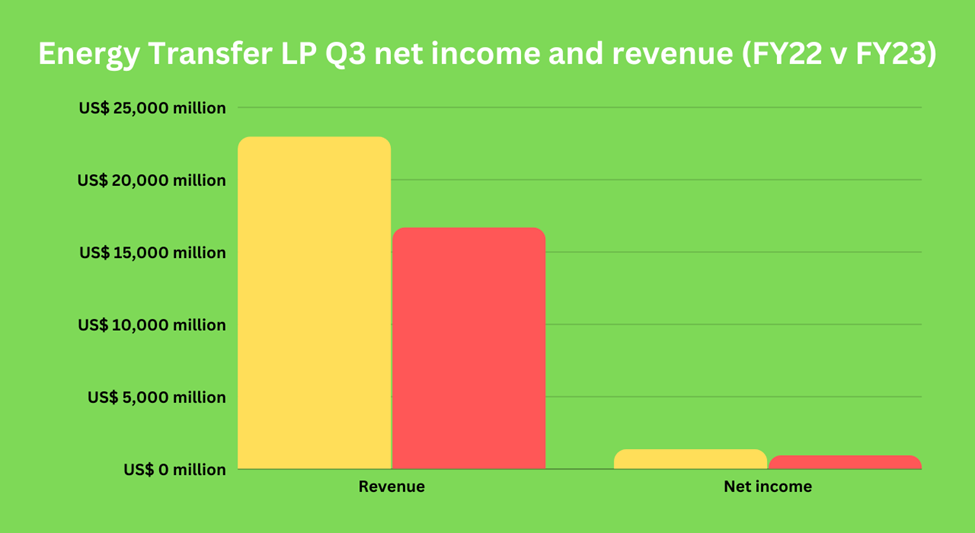

In the third quarter of 2022, Energy Transfer reported total assets of US$ 105,735 million compared to US$ 105,963 million in the quarter that ended on December 31, 2021. It clocked revenue of US$ 22,939 million in Q3 2022 against US$ 16,664 million in the same period a year ago. The company's operating income in the third quarter of 2022 was US$ 1,973 million compared to US$ 1,437 million in the corresponding quarter in 2021. The net income in the reported quarter was US$ 1,322 million versus US$ 907 million in the same comparative period in 2021. The E.T. stock gained 43.50 per cent year-to-date.

Source: ©Kalkine Media®; © Canva via Canva.com

Enterprise Products Partners L.P. (NYSE:EPD)

Enterprise Products Partners holds a dividend yield of 8.044 per cent and has a three-year dividend growth of 1.34. The transporter and processor of natural gas, gas liquids, crude oil, refined products, and petrochemicals paid a quarterly dividend of US$ 0.475. Its EPS is 2.31, and the P/B ratio is 2.065.

The company's net income attributable to common unitholders was US$ 1.4 billion or US$ 0.62 per unit on a fully diluted basis in the third quarter of 2022. In the same comparable quarter in 2021, it was US$ 1.2 billion or US$ 0.52 per unit on a fully diluted basis.

Enterprise Products' operating income in Q3 2022 was reported at US$ 1,712 million compared to US$ 1,513 million in the year-ago quarter. The adjusted EBITDA was reported at US$ 2,258 million compared to US$ 2,015 million in the same period a year earlier. The EPD stock jumped 7.56 per cent YTD.

Bottom line:

Investing in a volatile market can be challenging for investors. Several sectors have been on a downward spiral throughout the year. Even mega-cap stocks and sectors suffered this year. The stubborn inflation, the hawkish monetary policies of the Federal Reserve, and an impending recession early next year brought about a negative sentiment in the market, which triggered massive selloffs in the broader market. Hence, to hedge against such mishaps in the coming year, prepare a strategy to protect your money in the short term.