Highlights

- President Joe Biden and China’s Xi Jinping likely to hold a virtual meeting later this year.

- Pinduoduo Inc’s (NASDAQ:PDD) revenue jumped 89% YoY in Q2, FY21.

- Baidu, Inc’s (NASDAQ:BIDU) total revenue grew by 20% YoY in Q2, FY21.

The news of a likely summit between US President Joe Biden and his Chinese counterpart Xi Jinping later this year has raised expectations in the markets. Several Chinese stocks, which have been wavering recently, saw a comeback on Thursday following the news. Media reports claimed that the two leaders might meet in a virtual summit by the year-end.

A likely thaw in bilateral relations might give a major boost to the US-listed Chinese stocks. China’s crackdown on some domestic companies led to their stock rout in the US exchanges. Likewise, the US regulators also had called for greater scrutiny of Chinese firms. Here we explore five US-listed Chinese stocks that gained traction after the news of the Biden-Xi summit.

Also Read: Grom Social (GROM), Rocket Lab (RKLB) stocks rally after recent deals

Alibaba Group Holdings Limited (NYSE:BABA)

Alibaba Group Holding is a China-based multinational technology company with interests in e-commerce, retail, and other sectors.

The stock traded at US$156.60 at 12:56 pm ET on Oct 7, up 8.67 percent from its previous closing price. The BABA stock has declined 36.76 percent YTD.

Also Read: Helen (HELE), ConAgra (CAG) raise sales guidance after solid results

Alibaba has a market cap of US$427.23 billion, a P/E ratio of 19.22, and a forward P/E one year of 18.74. Its EPS is US$8.20. Its 52-week highest and lowest stock prices were US$319.32 and US$138.43, respectively. Its trading volume was 14,875,900 on October 6.

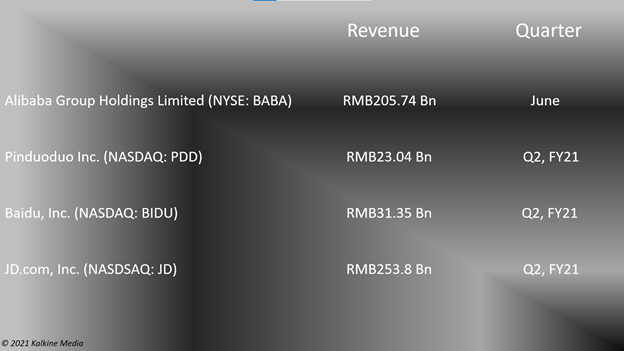

Its revenue increased by 34 percent YoY to RMB205.74 billion in the June quarter of 2021. Its net income was RMB42.83 billion against RMB46.43 billion in the same period in the prior year.

Also Read: Earnings Alert: Lamb (LW), Tilray (TLRY) post solid quarterly revenue

Also Read: Earnings Update: Levi Strauss’ (LEVI) net revenue jumps 41% in Q3

Pinduoduo Inc. (NASDAQ:PDD)

Pinduoduo is a Shanghai-based technology company that focuses on the agricultural sector. It provides an e-commerce platform to clients.

The stock was priced at US$94.44 at 1:06 pm ET on Oct 7, up 5.73 percent from its previous closing price. The stock fell 46.44 percent YTD. Its market cap is US$118.48 billion, and the forward P/E one year is 141.78. Its EPS is US$-0.36. Its 52-week highest and lowest stock prices were US$212.60 and US$73.01, respectively. Its share volume on October 6 was 4,397,836.

Its total revenue was RMB23.04 billion in Q2, FY21, representing an increase of 89 percent YoY. Its net income was RMB2.41 billion against a loss of RMB899.3 million in Q2, FY20.

Also Read: Top five value stocks to consider in October

Baidu, Inc. (NASDAQ:BIDU)

Baidu is a multinational technology company based in Beijing. It focuses on internet services and products, artificial intelligence (AI), and other related services.

The shares traded at US$157.48 at 1:14 pm ET on October 7, up 5.44 percent from its closing price of October 6. Its stock value declined 31.11 percent YTD. It has a market cap of US$54.63 billion, a P/E ratio of 8.19, and a forward P/E one year of 25.27. Its EPS is US$19.17.

The highest and lowest stock prices for the last 52 weeks were US$354.82 and US$125.32, respectively. Its trading volume was 2,142,963 on October 6.

The total revenue of the company surged 20 percent YoY to RMB31.35 billion in Q2, FY21. Its net loss was RMB583 million compared to an income of RMB3.57 billion in Q2, FY20.

Also Read: Voyager Therapeutics (VYGR) stock jumps 56% on Pfizer licensing deal

DiDi Global Inc. (NYSE:DIDI)

DiDi Global is a ride-hailing company that offers mobility services to consumers. It is based in Beijing. The stock was priced at US$7.91 at 1:22 pm ET on October 7, up 4.35 percent from its previous closing price. The DIDI stock plunged 46.39 percent YTD.

Its market cap is US$38.24 billion. Its 52-week highest and lowest stock prices were US$18.01 and US$7.16, respectively. Its share volume on October 6 was 9,937,903.

The company started trading in the US stock market in June.

Also Read: Cheap EV stocks to explore in the fourth quarter of 2021

Source: Pixabay

Also Read: Three hot growth stocks under US$1400 for income investors

JD.com, Inc. (NASDAQ:JD)

JD.com is a Beijing-based e-commerce company and is one of the leading business-to-consumer (B2C) online retailers.

Its shares traded at US$76.08 at 1:28 pm ET on October 7, up 5.86 percent from its closing price of October 6. Its stock value tumbled 16.75 percent YTD.

The firm has a market cap of US$117.94 billion, a P/E ratio of 22.09, and a forward P/E one year of 92.14. Its EPS is US$3.44.

The highest and lowest prices of the stocks in the last 52 weeks were US$108.29 and US$61.65, respectively. Its trading volume was 6,398,160 on October 6.

Its revenue rose 26.2 percent YoY to RMB253.8 billion in Q2, FY21. Its net income attributable to ordinary shareholders was RMB794.3 million against RMB16.4 billion in the year-ago quarter.

Also Read: Constellation (STZ), Acuity (AYI) post strong quarterly sales growth

Bottomline

Many Chinese companies might have delayed their US IPOs due to trade tensions between the two countries, say market observers. However, improving bilateral ties might help regain some lost ground for the Chinese companies in the US markets. Nevertheless, investors should evaluate the companies carefully before investing in stocks.