Wall Street indices ended the week mixed on Friday, August 5, after stronger-than-anticipated job data by the Labor Department renewed fears over Federal Reserve's anticipated aggressive stance to rein the inflation.

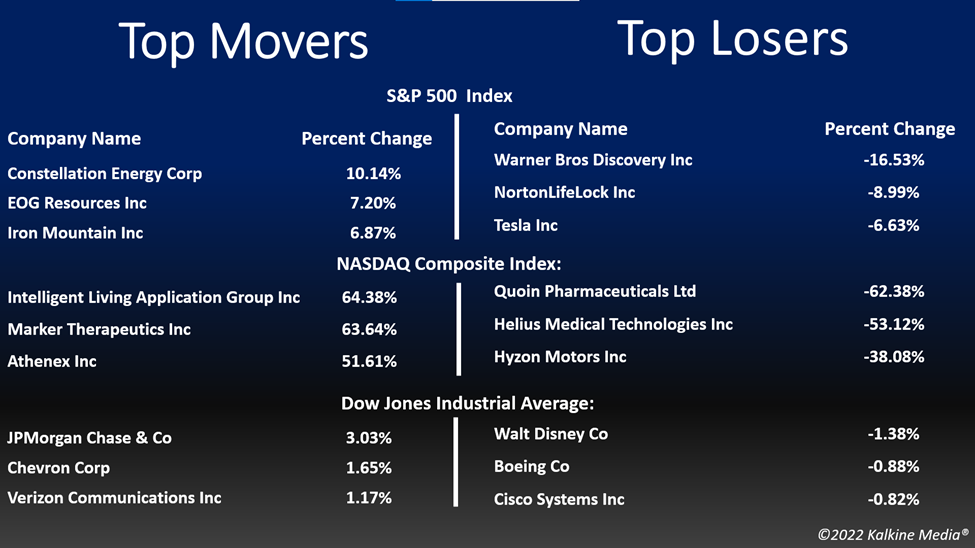

The S&P 500 fell 0.16 per cent to 4,145.19. The Dow Jones was up 0.23 per cent to 32,803.47. The NASDAQ Composite lost 0.50 per cent to 12,657.55, and the small-cap Russell 2000 rose 0.81 per cent to 1,921.82.

The non-farm payroll employment jumped by 528,000 in the previous month, bouncing back nearly to its pre-pandemic level, the Labor Department reported on Friday, despite decreasing consumer spending and soaring inflation. In addition, the US unemployment declined to 3.5 per cent in the previous month..

The robust job report indicated that the economy is not in a recession yet, raising concerns over Fed's hawkish move to curb inflation. Additionally, wage inflation also weighed on the market sentiment.

On Friday, eight of the 11 segments of the S&P 500 index stayed in the negative territory, with consumer discretionary and information technology sectors declining the most. The energy and financial sectors were the top movers.

Shares of the spaceflight company, Virgin Galactic Holdings, Inc. (SPCE) plummeted 16.75 per cent in intraday trading after the firm delayed the launch of its space tourism program.

Warner Bros. Discovery, Inc. (WBD) stock fell 16.68 per cent, a day after the firm reported a quarterly loss of US$ 3.40 billion in the latest quarter. The company cited charges for the recent merger for the loss.

Shares of the meme-stock, AMC Entertainment Holdings, Inc. (NYSE:AMC) soared over 19 per cent in intraday trading, after the movie-theater operator reported a significant growth in its revenue.

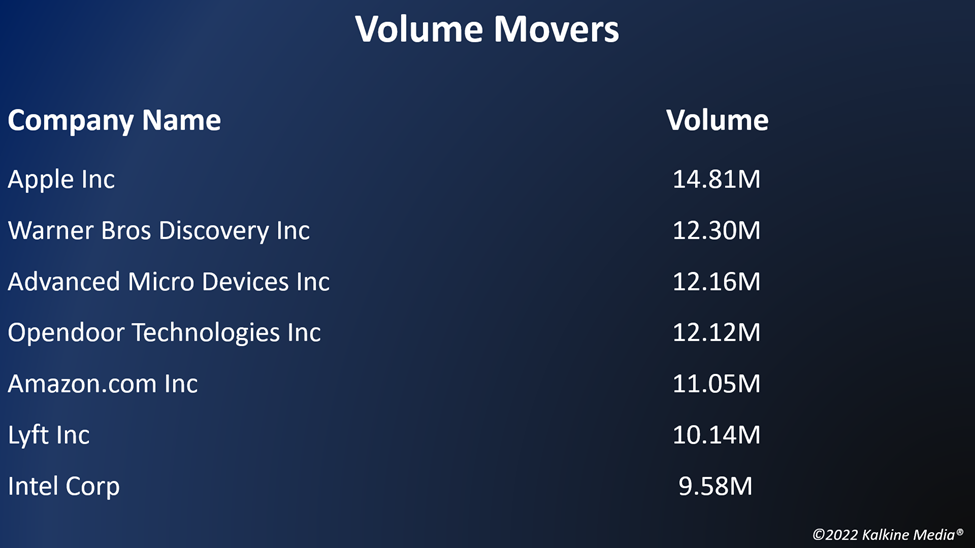

In the consumer discretionary sector, Amazon.com, Inc. (AMZN) decreased by 1.24 per cent, Tesla, Inc. (TSLA) ticked down 6.63 per cent, and Alibaba Group Holding Limited (BABA) declined 4.99 per cent. JD.com, Inc. (JD) and Starbucks Corporation (SBUX) plummeted by 2.27 per cent and 1.32 per cent, respectively.

In technology stocks, NVIDIA Corporation (NVDA) plunged 1.18 per cent, ASML Holding N.V. (ASML) fell 1.89 per cent, and Advanced Micro Devices, Inc. (AMD) tumbled 1.54 per cent. AMTD Digital Inc. (HKD) and Applied Materials, Inc. (AMAT) slipped 9.85 per cent and 1.30 per cent, respectively.

In the energy sector, Exxon Mobil Corporation (XOM) gained 1.42 per cent, Chevron Corporation (CVX) surged 1.57 per cent, and Shell plc (SHEL) rose 1.55 per cent. ConocoPhillips (COP) and Equinor ASA (EQNR) jumped 3.30 per cent and 1.83 per cent, respectively.

In the crypto space, Bitcoin (BTC) and Ethereum (ETH) added 1.86 per cent and 5.26 per cent, respectively, in the last 24 hours. The global crypto market cap increased by 2.65 per cent to US$1.08 trillion at 4:06 pm ET on August 5.

Futures & Commodities

Gold futures were down 0.87 per cent to US$1,791.15 per ounce. Silver decreased by 1.36 per cent to US$19.848 per ounce, while copper rose 2.12 per cent to US$3.5553.

Brent oil futures increased by 0.17 per cent to US$94.28 per barrel and WTI crude was down 1.18 per cent to US$88.38.

Bond Market

The 30-year Treasury bond yields were up 3.64 per cent to 3.069, while the 10-year bond yields rose 5.71 per cent to 2.829.

US Dollar Futures Index increased by 0.82% to US$106.433.