Benchmark US indices closed in the green on Thursday, Dec 23, lifted by basic materials and industrial stocks amid a buoyant trading session as Christmas and New Year holidays approach.

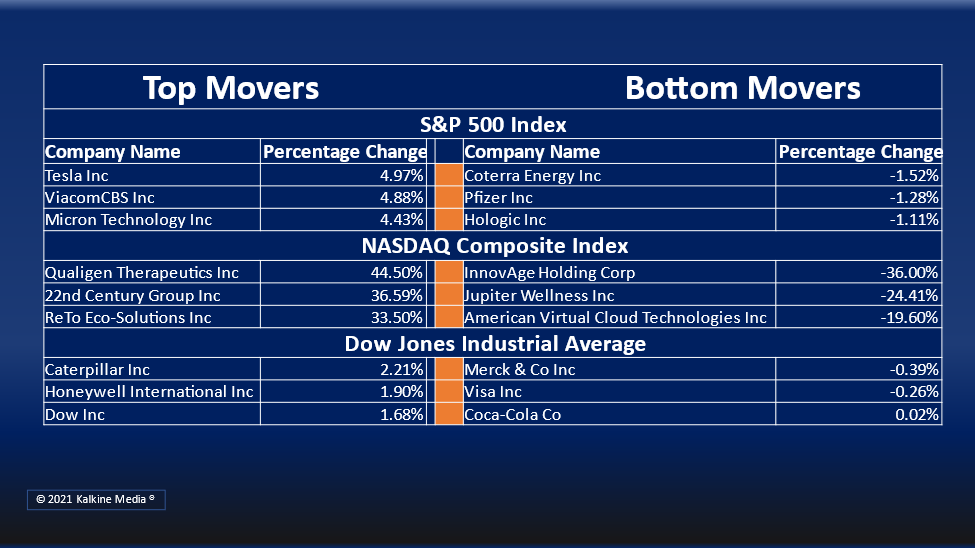

The S&P 500 climbed 0.62% to 4,725.79. The Dow Jones rose 0.55% to 35,950.56. The NASDAQ Composite was up 0.85% to 15,653.37, and the small-cap Russell 2000 gained 1.09% to 2,246.22.

The Commerce Department said on Thursday that consumer spending rose by 0.6% in November from the prior month. The personal-consumption expenditures (PCE) index surged 4.7% year-on-year in November. The index excludes food and energy. The inflation data did not affect traders’ morale.

Meanwhile, the Labor Department said the unemployment benefit claims remained the same at 205,000 on a seasonally adjusted basis in the week ended Dec 18.

Ten of the 11 segments of the S&P 500 index remained in the positive territory. Industrial, consumer discretionary, and basic materials sectors were the top gainers. Real estate, utility, and consumer staples stocks were the bottom movers.

In the healthcare sector, Novavax, Inc. (NVAX) stock fell 3% in intraday trading after initial gains. The company announced encouraging data from its late-stage Covid-19 vaccine trial.

Merck & Company, Inc. (MRK) stock fell 0.56% after FDA’s emergency use authorization for its Covid-19 pill, the second pharma company to receive approval for the oral drug after Pfizer Inc (PFE).

E-commerce firm JD.com, Inc. (JD) fell over 6% after media company Tencent Holdings Ltd. (TCEHY) offloaded US$16.4 billion worth of shares. The Tencent stock jumped around 6% on the news.

In the industrial sector, United Parcel Services Inc. (UPS) stock jumped 1.94%, Honeywell International Inc. (HON) rose 2.02%, and Union Pacific Corporation (UNP) climbed 1.42%. Raytheon Technologies Corporation (RTX) surged 1.18% and Caterpillar Inc. (CAT) rose 2.31%.

In the consumer discretionary sector, Amazon.com (AMZN) stock grew 0.12%, Nike Inc. (NKE) increased by 0.31%, and McDonalds Corporation (MCD) rose 0.50%. Lowe’s Companies Inc. (LOW) and Starbucks Corporation (SBUX) climbed 0.31% and 0.64%, respectively.

In the real estate sector, American Tower Corporation (REIT) (AMT) declined 0.84%, Prologis Inc. (PLD) fell 0.39%, and Crown Castle International Corp. (REIT) (CCI) was down 0.05%. Public Storage (PSA) and Digital Realty Trust Inc. (DLR) decreased by 0.71% and 0.78%, respectively.

Also Read: Why did Crocs (CROX) stock crash on Thursday?

Also Read: Blackstone Products (BLKS) to go public via SPAC – know details

Also Read: Why Nikola (NKLA) stock roared 18% higher today?

Futures & Commodities

Gold futures climbed 0.42% to US$1,809.75 per ounce. Silver futures increased by 0.45% to US$22.922 per ounce, while copper climbed 0.20% to US$4.4000.

Brent oil futures increased by 1.83% to US$76.66 per barrel and WTI crude futures were up 1.47% to US$73.83.

Bond Market

The 30-year Treasury bond yields increased 2.60% to 1.905, while the 10-year bond yields were up 2.37% to 1.493.

US Dollar Futures Index declined 0.05% at US$96.010.